Uniswap (UNI) broke down from a long-term support level on January 19, but has shown several bullish signs inside a bullish pattern.

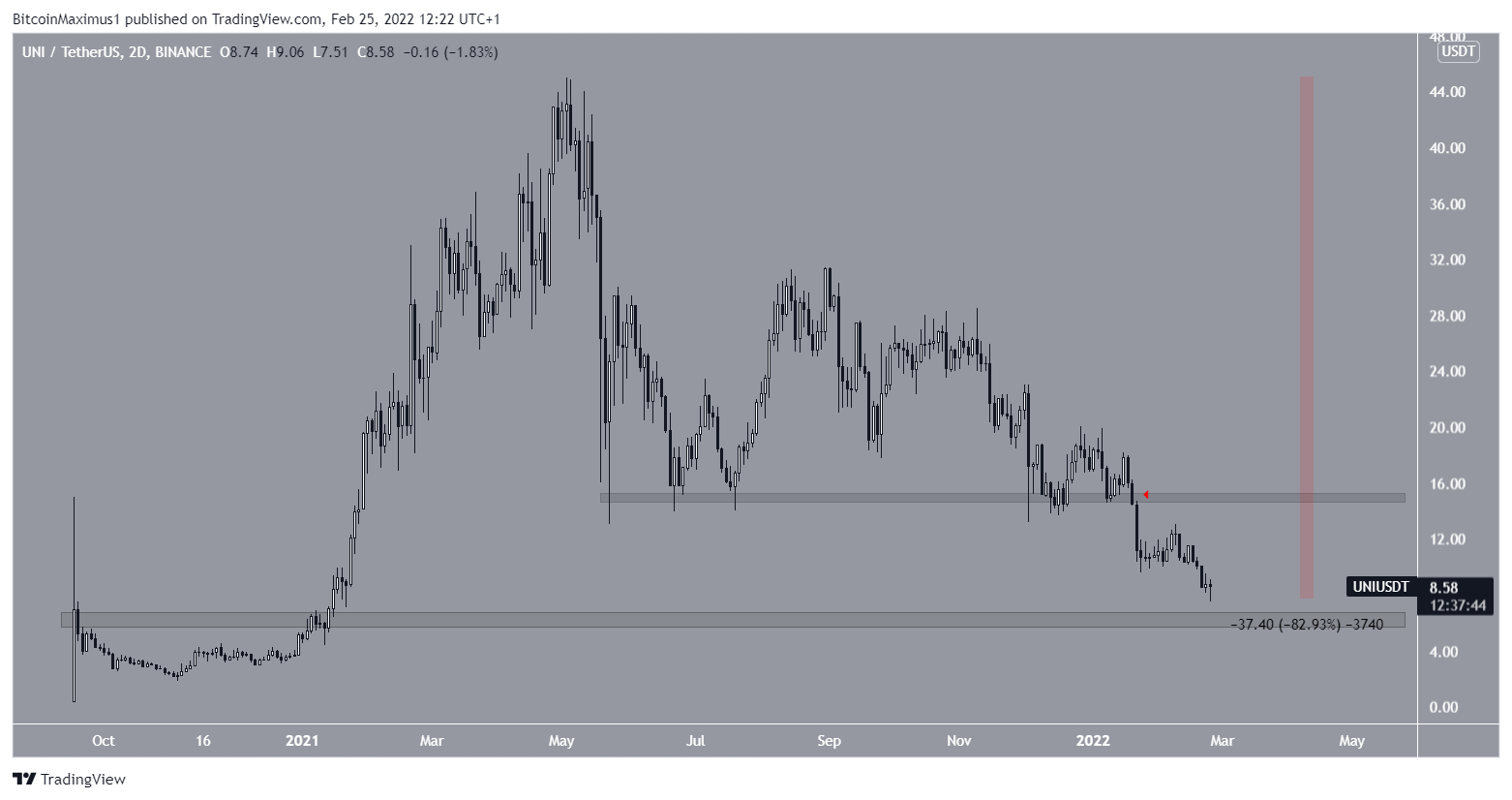

UNI has been decreasing since May 1, when it had just reached an all-time high price of $45. In the period between May and December, it bounced at the $15 horizontal area and attempted to initiate several upward movements.

However, they were all unsuccessful and UNI broke down on Jan. 19, 2021 (red icon).

So far, it has reached a low of $7.51 on Feb. 22, which amounted to a decrease of 83% since the all-time high.

The next closest support area is at $5. Previously, the level had not been reached since Jan. 2021.

UNI creates bullish pattern

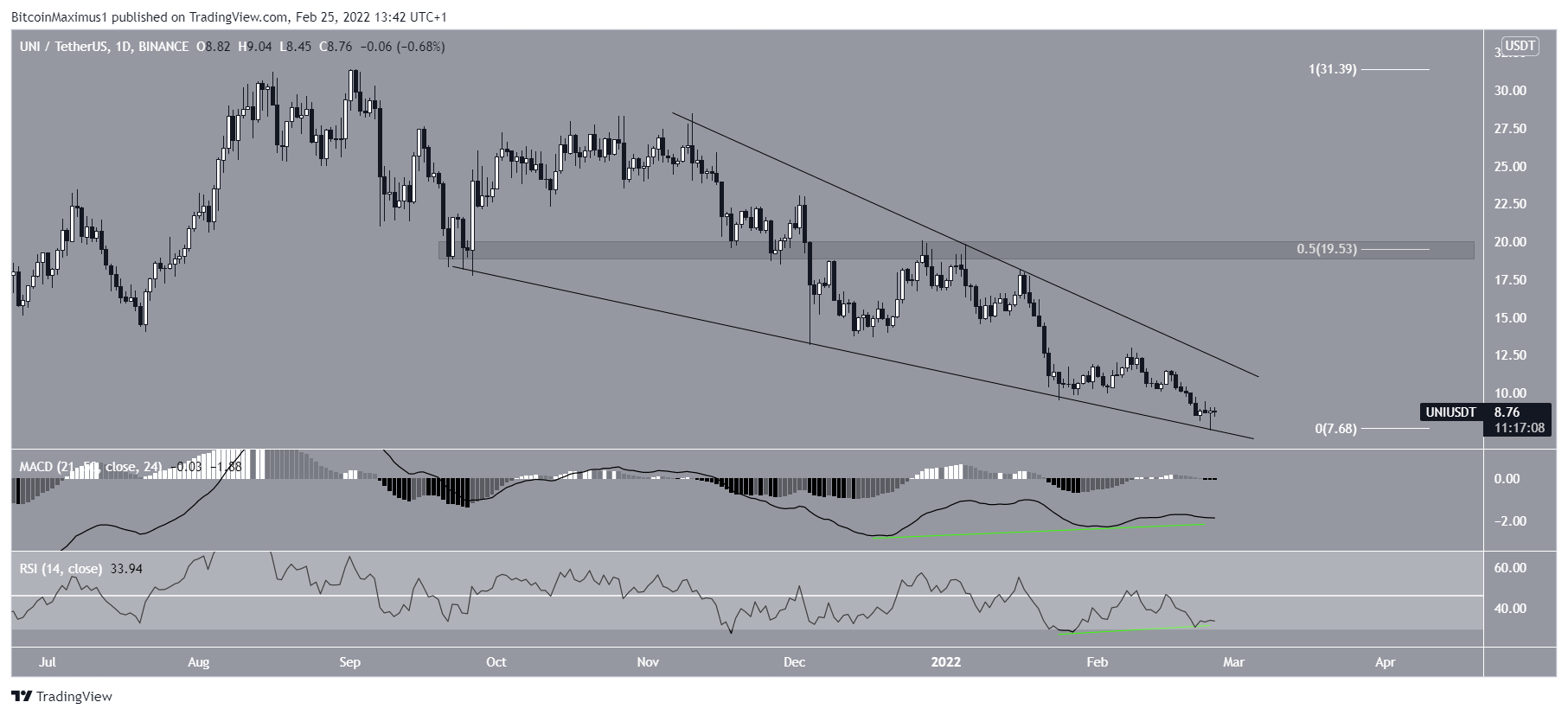

The daily chart is considerably more bullish, since it shows that UNI is trading inside a descending wedge. The descending wedge is considered a bullish pattern, meaning that a breakout from it would be the most likely scenario.

In addition to this, both the MACD and RSI have generated very significant bullish divergences (green lines). Such divergences very often precede bullish trend reversals. Therefore, when combined with the bullish wedge, this suggests that an UNI breakout is the most likely scenario.

If one occurs, the closest resistance area would be at $19.50. This is the 0.5 Fib retracement resistance level and a horizontal resistance area.

Wave count analysis

Cryptocurrency trader@TheTradingHubb stated that UNI is mired in a corrective pattern, which means that a long-term upward movement is likely to follow.

It is possible that the downward movement since the all-time high is an A-B-C corrective structure, in which waves A:C have close to a 1:0.618 ratio. The sub-wave count is given in black.

Wave C has developed into an ending diagonal, which is noted by the shape of the descending wedge. Such patterns are often succeeded by a sharp breakout and upward movement.

Therefore, it supports the readings and the price action from the daily time-frame.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

What do you think about this subject? Write to us and tell us!