Uniswap, the most popular decentralized exchange and one of the top-five DeFi applications by total value locked (TVL) recently had its native cryptocurrency, UNI, pass all-time high prices.

UNI was initially distributed via airdrop to all users who made a transaction on the platform before Sept. 1, 2020.

Since then, the decentralized exchange (DEX) has absolutely taken off and captivated the cryptocurrency and DeFi community at large.

DeFi Applications Experiencing Exponential Growth

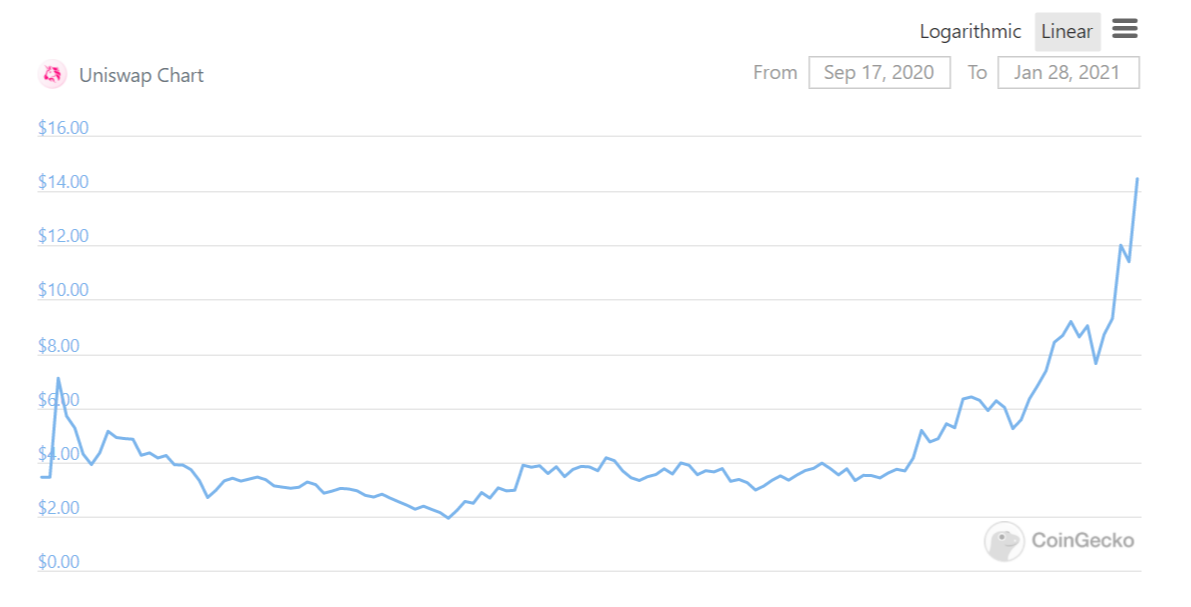

UNI closed its first week on the market trading for $5.25 each but slipped back to the $1.68 level two months later. Since then UNI has quickly climbed back and has recently swelled to over $14.

When looking back slightly further on CoinGecko, we can see that UNI has increased by a whopping 136.6 percent in the last two weeks and 265 percent in the last month.

This increase coincides with the general increase of interest and value in the DeFi industry. TVL across all DeFi applications and platforms currently stands at $24.9 billion.

What Makes Uniswap Different?

As the current preeminent decentralized cryptocurrency exchange, Uniswap is receiving massive cash inflows. Since it’s a fully decentralized exchange, it’s never been easier for projects to get their cryptocurrency listed and tradable, creating a very low barrier of entry for new DeFi projects and users wanting to get involved.

Uniswap also rewards users for providing liquidity, acting as an automated market maker for the cryptocurrency industry at large.

With Uniswap, users can interact with the exchange directly from their digital wallets, never having to give out private information or private keys to any of their cryptocurrencies to gain access. Uniswap has created a system that many crypto experts could only dream of a few years back, and it’s generating incredibly high network fees.

As DeFi continues to become more pervasive to the cryptocurrency community and mainstream institutions at large, Uniswap may continue to act as the main source of decentralized liquidity. This is a much-needed service to a sector focused on taking power away from third parties. With Bitcoin and Ethereum slowly starting to show signs of leveling out after this historic bull run, DeFi projects like Uniswap look like they are just getting started.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.