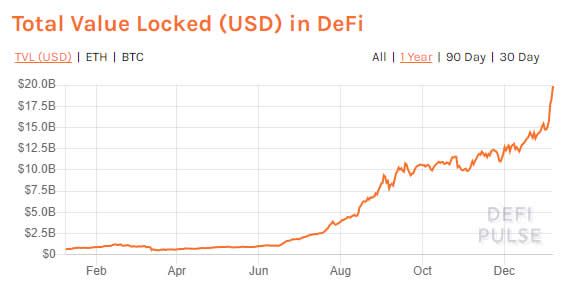

The total value locked (TVL) figure for the decentralized finance ecosystem has reached a record level just shy of $20 billion. However, more and more Ethereum is being withdrawn from the space.

Decentralized finance (DeFi) has hit another milestone in terms of total value locked according to metrics provider DeFi Pulse. On Jan. 6, the figure hit $19.87 billion, an all-time high and an increase of 2,800% since the same time last year.

Many have questioned this method of measuring market sentiment and performance since numbers can be duplicated from the same asset being farmed or wrapped for use on different protocols. However, it’s one of the few DeFi metrics we have and does provide some insight on the overall performance of the fledgling financial ecosystem.

DeFi Positive Feedback Loop

Writing in the latest Defiant newsletter, researcher Owen Fernau labeled the TVL growth a “positive feedback loop,” noting that it should also serve to push the price of ETH higher as has happened in recent weeks;

“TVL’s growth serves as a positive feedback loop: increases in value locked suggest increased utility of Ethereum,”

Ethereum currently constitutes around 35% of the TVL which is measured in USD. Its price surge and other metrics suggest ETH is still undervalued. So while TVL is increasing, it doesn’t necessarily mean that more ETH is being locked in DeFi. In fact, the opposite is occurring.

The amount of ETH locked in DeFi has fallen by 26% since its peak of 9.5 million ETH in October 2020. Today, that figure stands at just below 7 million ETH.

Where is the ETH Going?

There could be a number of reasons for this exodus of ETH. speculation on spot markets could be driving Ethereum holders to trade the asset since its volatility has increased along with the price.

Arbitraging could also be occurring, but this is likely to be done by the whales since smaller trades and swaps would be eaten up in gas fees at the moment.

The amount of the asset locked in the Beacon Chain deposit contract also continues to climb and has now reached 2.27 million ETH, or roughly 2% of the total supply. This is a third of the 6% that is currently locked in DeFi.

At today’s prices, the amount of ETH staked and locked for at least another year is valued at $2.45 billion. According to the ETH 2.0 Launchpad, it’s currently yielding just over 10% for investors.

The numbers are all bullish for Ethereum which is proving its versatility time and time again despite the exorbitant current cost of using it.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.