Uniswap was among the coins that saw their market value slashed by more than $500 million due to the huge sell-off by individual whales and institutional investors during the market crash of May.

Uniswap has come under the radar of several market commentators as one of the world’s leading decentralized finance (DeFi) leading projects which shed $1.42 billion in total value locked (TVL) in May, according to DeFiLlama.

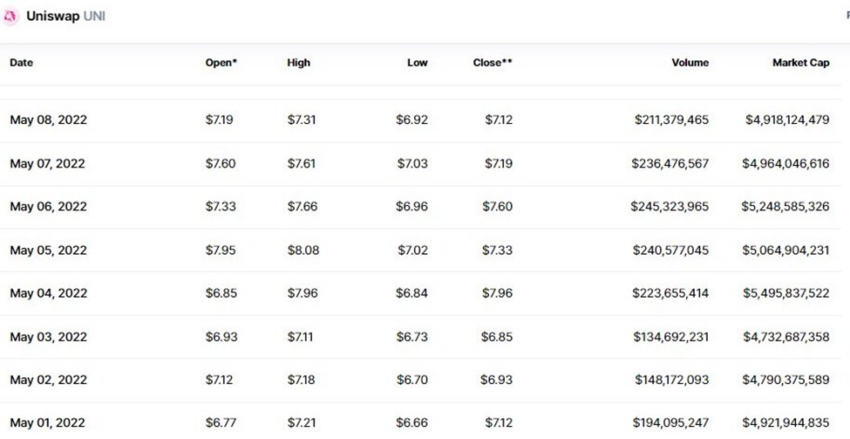

UNI closed May with a market capitalization of approximately $4.09 billion, according to Be[In]Crypto Research.

This was a 16% decline from the market value on the first day of the month. On May 1, UNI saw a trading volume of $194.09 million, which corresponded to a market capitalization of around $4.92 billion.

Why the declining market capitalization?

A massive plunge in the overall market value of digital assets in May can be attributed to the sinking market capitalization of Uniswap.

Many market analysts have credited a slumping stock market which is highly correlated to the crypto market, the uncertainty of the Russia/Ukraine crisis which has led to a rise in commodity prices, and consistent hikes in interest rates by the Fed as factors that led to a huge-sell off by investors.

In May, the number of large transactions involving UNI reached a peak of 185,000 at a price of $7.56 on May 4.

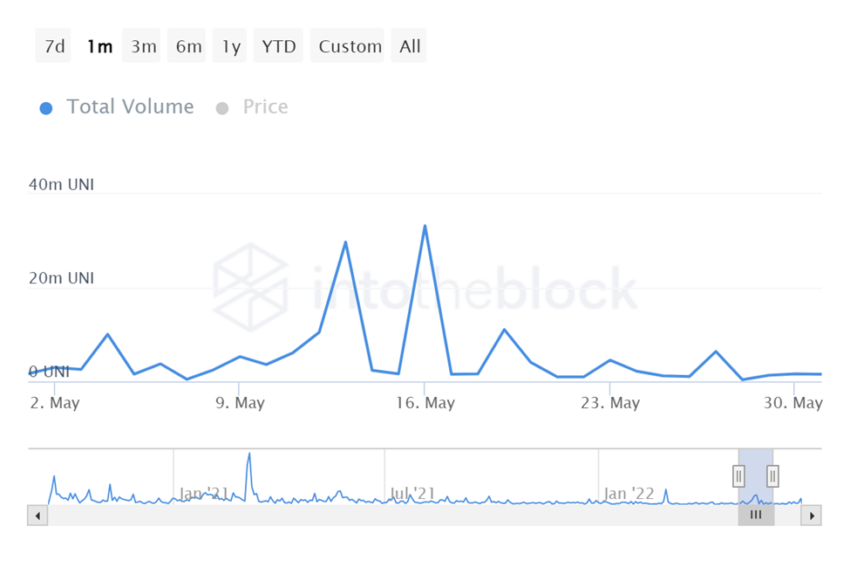

On May 16, the total volume reached a peak of 33.25 million UNI.

The total volume in USD was $168.99 million.

On May 16, UNI opened at $5.45, and this was its intraday-high. The token reached an intraday low of $4.94 and closed at $5.04. The trading volume for the day was $161.92 million, and this corresponded to a market capitalization of $3.76 billion.

This was a 26% dip in UNI’s opening day market value. Due to the price decline, UNI could not recover to reclaim its peak market value throughout the rest of the month.

UNI price reaction

UNI opened on May 1, at $6.77, reached a monthly high of $8.08 on May 5, tested a monthly low of $3.80, and closed the month at a price of $5.70. Overall, this equates to a 15% drop between the opening and closing price of UNI in May.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.