Uniswap (UNI) price is down 17% from its local peak of $6.4 recorded on April 14. After a two-week-long downtrend, on-chain data suggests that UNI could be due for a price rebound. Can the Unsiwap bulls turn the tide?

Uniswap is a decentralized trading protocol popular for facilitating automated decentralized finance (DeFi) token trading. A boom in DeFi trading activity in April saw UNI price test the $6.5 milestone.

But it quickly rejected the $5.3 zone as the bears seized control of the altcoin market toward the end of the month. On-chain data now suggests that the bulls are setting the stage for UNI to start positively in May 2023.

Holders Could Soon Stop Selling

Uniswap(UNI) price was hit with a 17% decline as the altcoin market contracted marginally toward the end of April. However, on-chain data depicts that most recent UNI investors may be unwilling to assume further losses.

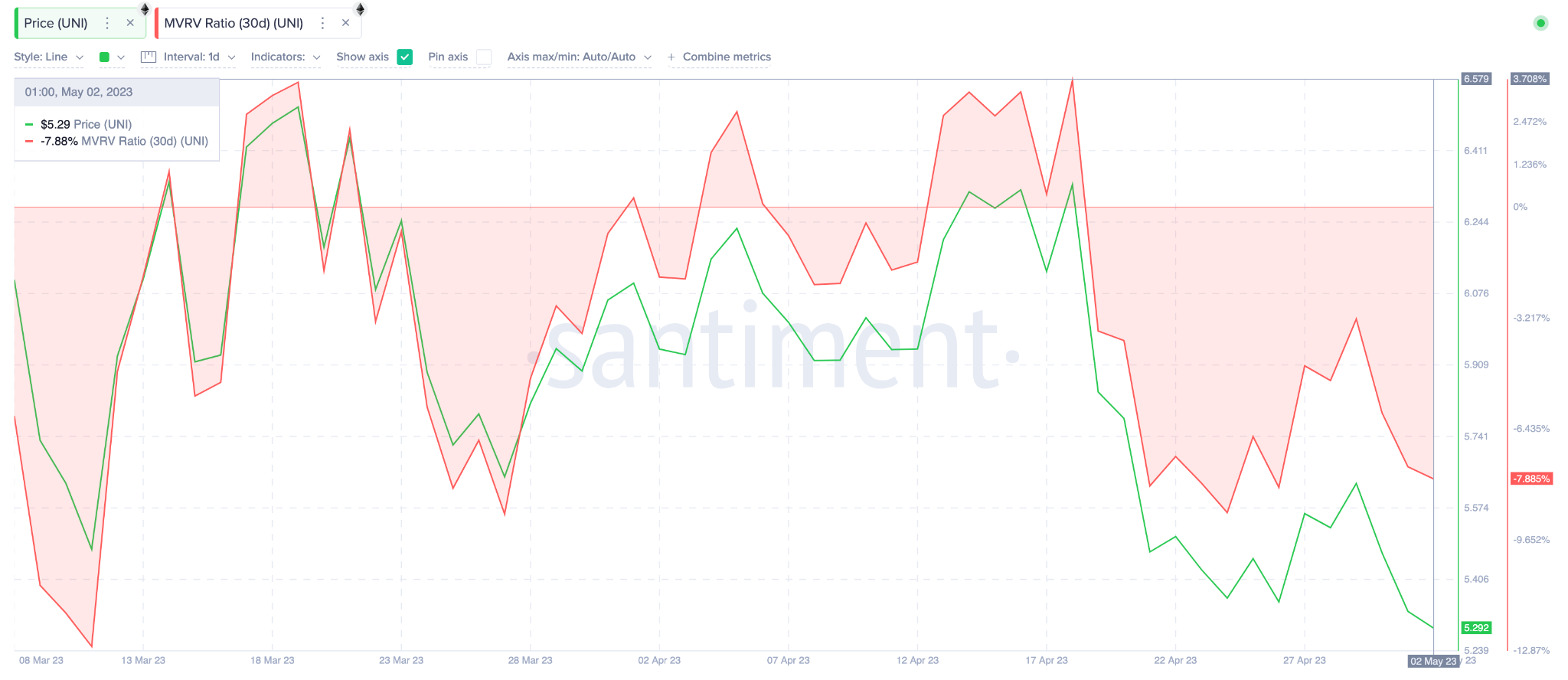

Santiment’s Market Value to Realized Value (MVRV 30d) ratio below shows that most crypto investors that bought UNI in the last 30 days are now holding unrealized losses of more than 7%.

The MVRV metric measure the valuation of a crypto asset in relation to its realized value. When the MVRV ratio is low, as seen above, it suggests that the market is undervalued and signals prospective investors to be on the lookout to buy.

Similarly, it also indicates that the unrealized losses of current holders are now critically high. To avoid booking such high losses, UNI holders will likely stop selling in the coming days. This decline in sell pressure could be enough to trigger a price rebound.

Uniswap is Attracting New Demand

Another crucial contributing factor to the current bullish outlook for Uniswap is the recent increase in the number of new users joining the network. On-chain data shows that Uniswap network growth has steadily increased over the past 10 days.

The chart below shows how it grew from 183 on April 22 to 358 new joiners recorded on May 1.

Simply put, Network Growth measures the number of new wallet addresses created on a blockchain network. A steady rise in network growth indicates that the Uniswap ecosystem is attracting new users.

Hence, the demand for its core services and the underlying UNI token could rise in the coming days.

In conclusion, a bullish combination of the decline in sell-pressure from holders sitting on 7% losses and growth in demand from new entrants could power the next UNI price rebound.

UNI Price Prediction: A Rebound to $6.0 Next?

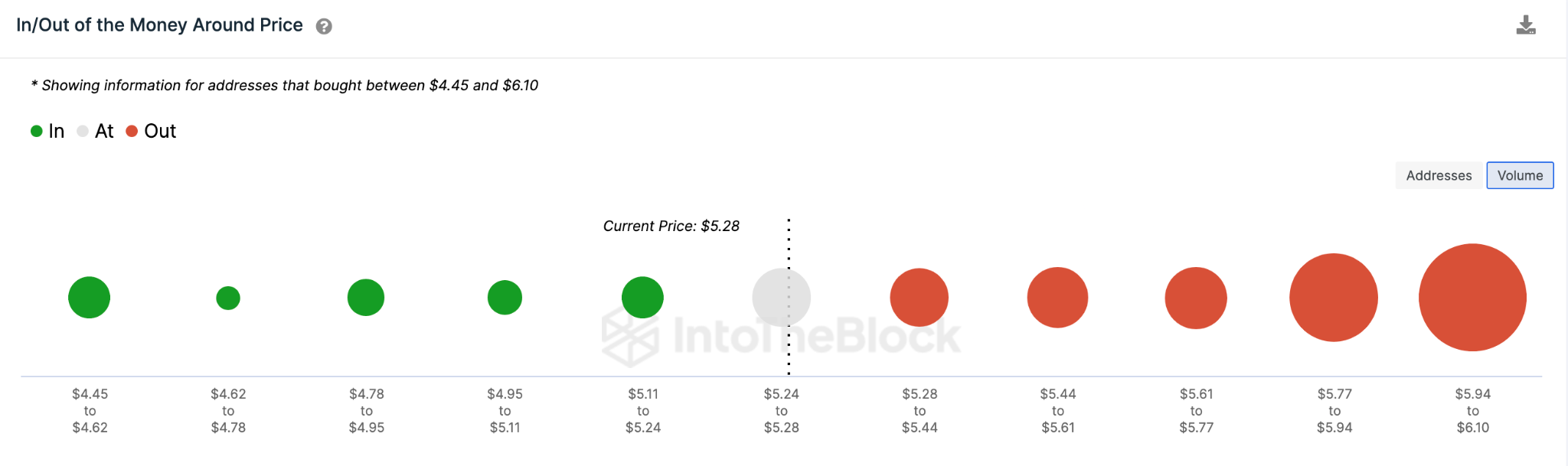

A critical analysis of the In/Out of The Money Price data shows that the UNI price could soon rebound above $6.0 However, the bulls must first scale the potential sell pressure from 9,400 investors that bought 6 million tokens at around $5.38.

But if the bullish scenario plays out as expected, Uniswap holders can anticipate a rally toward $6.03. In that zone, a more significant resistance from 11,500 investors holding 13.7 million tokens could pose a challenge.

Resistance around the $6.0 price could pose a problem for any further price increase as the majority of holders at $5.94 and $6.03 aim to sell their positions.

The bears could force a downswing if the Uniswap price drops below $5.18. Although, the 4,000 investors that bought 1.66 million tokens around that price level will look to prevent the drop.

But if that support level cannot hold, the bears can remain in control until UNI price declines toward $4.87. With smaller clusters of holders further down, bears could effectively push through these small resistance levels until $4.50.