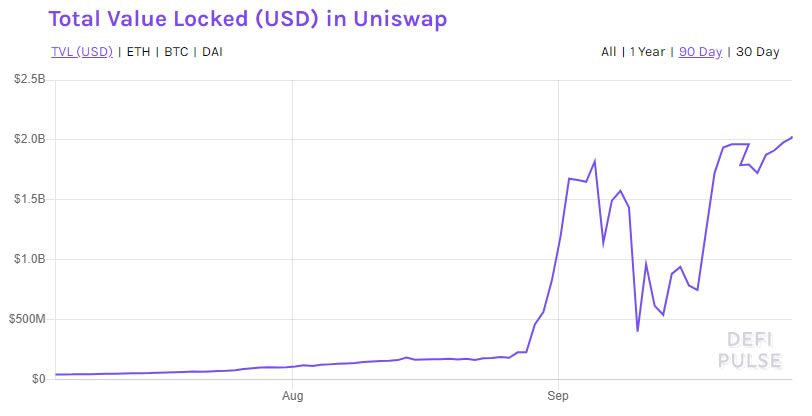

Collateral locked on the Uniswap decentralized exchange has surpassed $2 billion, making it the first decentralized finance (DeFi) platform to reach this milestone.

The crypto bears have been held at bay over the weekend, providing some relief for the cryptocurrency markets, while the total value locked across all DeFi protocols is close to its all-time high at $11 billion.

The TVL chart continues its steep ascent despite crypto markets cooling off over the past month. Uniswap has retaken the top spot, becoming the first to climb over the $2 billion mark.

The platform itself is reporting that liquidity is slightly higher, around $2.24 billion, with a daily volume of $276 million.

80% Locked in Liquidity Pools

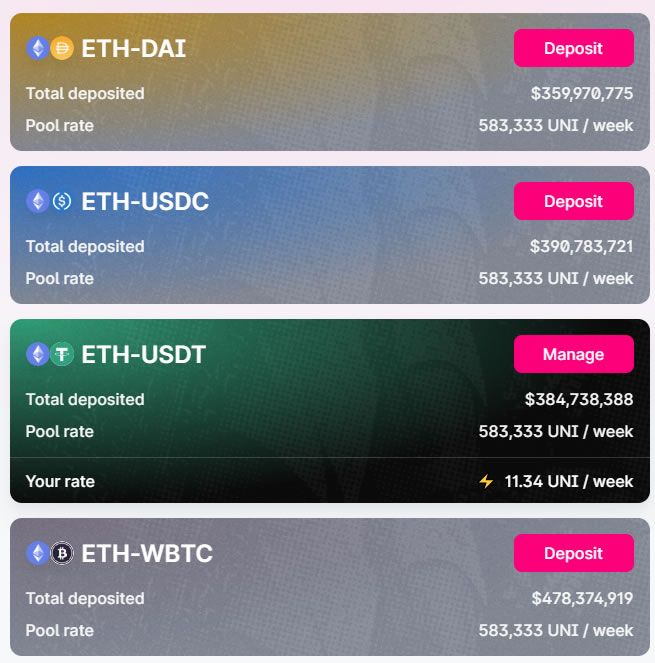

The vast majority of that liquidity is locked across the four liquidity pools that are earning UNI. Around 80% of the total amount on the protocol is split between the four pools with the ETH/WBTC pool being the most popular, holding around 30% of the total. The remaining three pools are split almost evenly earning a share of the 83,333 UNI dished out daily:

UNI Price Update

UNI prices have remained relatively flat over the weekend, dropping below $5 and trading in the $4.75 range at the time of press. On the positive side, UNI has held on to most of its gains since inception, unlike its rival SushiSwap which has lost around 80% of its value. There was a rather scathing report by Glassnode last week which inferred that Uniswap governance is centralized and that one of the largest holders of the token, which can be used for voting, is Binance. It added that around 40% of the supply is allocated to the team and investors which has eroded its decentralization.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored