Rising interest rates have made certain traditional investment assets attractive, hence UK investors are moving away from high-risk investments such as crypto.

During the phase of high-interest rates, borrowing starts becoming expensive for consumers and businesses. Whereas depositing with banks or investing in government bonds might provide attractive yields.

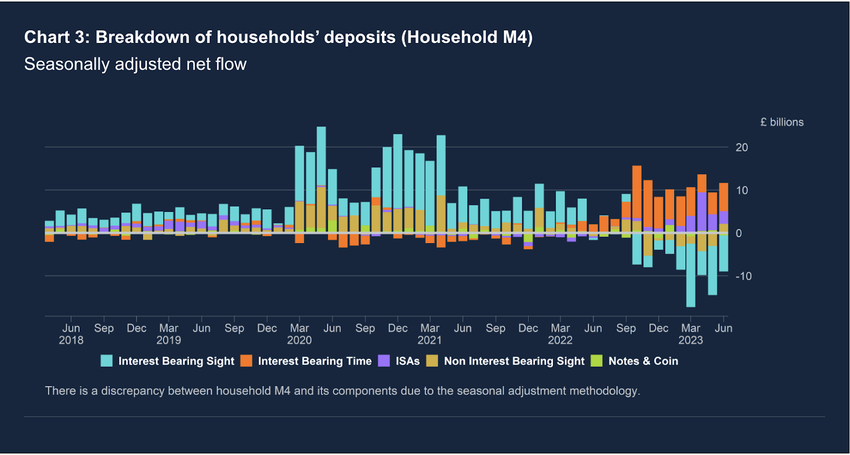

UK Household Investors Turn Towards Interest-Bearing Time Deposits

In June, UK household investors’ inflows into interest-bearing time deposits stood at £6.6 billion (around $8.4 billion). The inflows are larger than May’s inflows of £5.1 billion (around $6.8 billion).

The screenshot below shows that the inflows into the interest-bearing time deposits account gradually increased in the second half of 2022.

When UK investors deposit into interest-bearing time deposit accounts, they must lock up the funds for a specific time. If the investors decide to withdraw before the maturity date, they would have to pay a penalty.

Read more about 10 platforms that provide best interest rate on stablecoins here.

As the households’ funds remain locked up, they cannot invest their money into asset classes such as stocks and crypto.

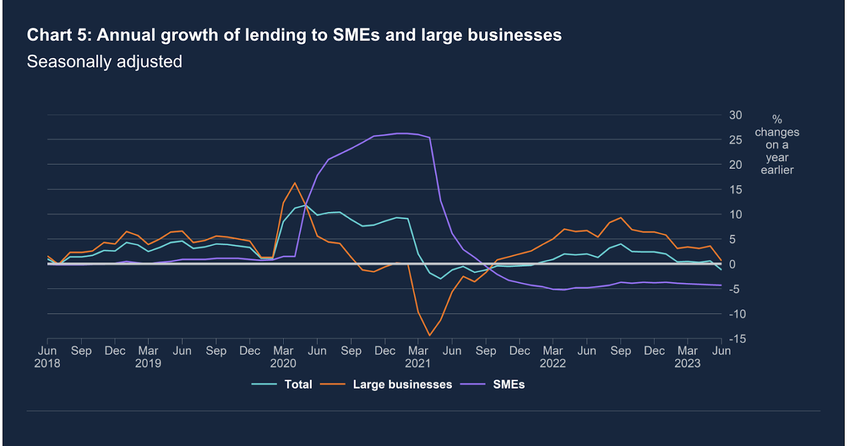

Institutional and Businesses Borrowing Decreases Dramatically

The large interest rate has made borrowing costly for businesses. Bank of England (BoE) revealed that the annual growth rate of borrowing by large businesses dropped to 0.6% in June 2023.

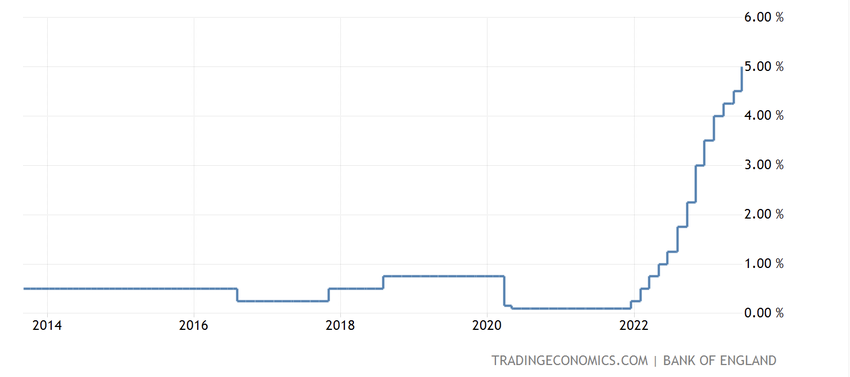

The decrease in borrowing is due to the fact that the BoE interest rate is at its highest in the last 14 years. On June 22, the BoE increased the interest rate for the 13th consecutive time, which is now at 5%.

The central bank has been increasing the interest rate since December 2021 to tame inflation. It is a well-established fact that the war against inflation results in a slowed-down momentum in riskier asset classes such as stocks and crypto.

As a matter of fact, FTSE100, the index of the London Stock Exchange’s top 100 companies based on market capitalization, has broadly remained sideways. As of writing, the FTSE100 is roughly up by 5% since December 2021.

While the stocks are indeed risky investments, investors consider crypto riskier due to volatility and frequent scams. Hence, even if UK investors allocate a certain part of their portfolio to stocks, they might restrain investing in crypto.

It is worth mentioning that over 91% of UK adult consumers are aware of crypto. But the lack of consumer protection and high risk hinder the citizens from investing in the asset class.

However, the country is swiftly proceeding toward regulating the asset class. On June 29, the UK passed a bill recognizing crypto as a regulated financial activity.

Got something to say about UK investors or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.