The United Kingdom government is taking a strict stance against fraud with a consultation paper proposing a blanket ban on cold calling for consumer financial services and products. The possibility of a ban was initiated in May as part of a broader fraud strategy.

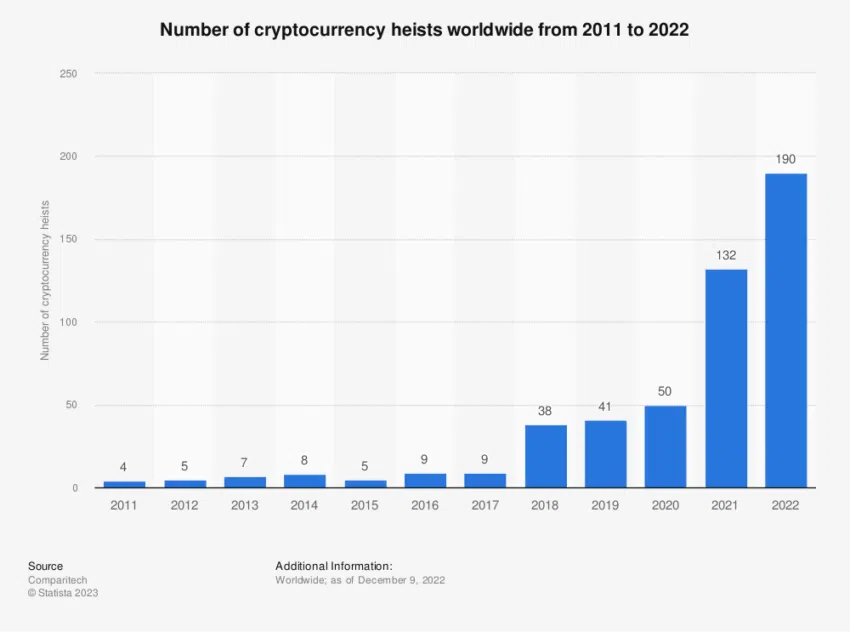

The proposal came in response to a surge of crypto-related scams that have led to losses.

UK Ban on Cold Calling Could Be the Next Crypto Strategy

The consultation paper noted,

“Cold calling for financial services and products has long been the tool of choice for fraudsters seeking to manipulate unsuspecting individuals into scams, especially targeting the most vulnerable.”

Stressing the government’s zero-tolerance approach, it highlights the UK’s broader Fraud Strategy. The government could ban cold calling for all consumer financial services and products, including crypto.

The paper notes that between August and November 2022, over half of all UK landline users received a suspicious call. A significant 80% of these landline owners reported receiving these suspicious calls at least monthly, notes the paper.

Meanwhile, the government has also been keeping a tap on mass texts to promote investment tools.

The Economic Secretary to the Treasury, Andrew Griffith MP, emphasized,

“We can work together to tackle the fraudsters head-on by cutting off their ability to deploy the high-pressure tactics of cold calling. We want the public to know that any unsolicited call marketing financialproducts such as a cryptoasset or insurance is a scam, and not to fall prey to fraudsters.”

The proposal, while broad in scope, is especially watchful of how crypto and related products are mass-marketed through unsolicited communications. It illustrates the devastating impact of such scams through a case that involved a retail investor who, enticed by a cold call, lost £65,000 in crypto investments.

Please take a look at our guide on Friend.Tech here: What is Friend.Tech? A Deep Dive Into The Web3 Social Media App

FCA Compliance for Crypto Businesses

As per the consultation’s outline, several services and products fall under this proposed ban. These include banking or payment services, cryptoassets, mortgages, insurance, and tangible investments like whiskey and wine. However, interactions where a customer has given clear and specific consent for marketing are exempted.

The government’s decision to address this issue comes when the domestic crypto sector is undergoing significant changes. King Charles III granted assent to the Financial Services and Markets Act recently. It provides provisions that enable the regulation of cryptoassets. This act now also paves the way for the Financial Conduct Authority (FCA) and the country’s central bank to treat crypto as a regulated activity.

Notably, the FCA declared last week,

“We are setting out our expectations for cryptoasset businesses in light of the new money laundering legislation introduced last year.”

Starting September 1, 2023, crypto businesses must adhere to the ‘Travel Rule,’ requiring them to collect, verify, and share information about crypto transfers.

But while these efforts are commendable, critics wonder if they’re enough. BeInCrypto had previously reported on the UK government’s strategies to tackle crypto and insurance fraud, which costs the country $9 billion annually.

There are plans to employ 400 specialist staff and technology to detect phone number impersonations and mass-text methods. But should the government emphasize more on enhancing financial awareness among its citizens?

The consultation, comprising 19 probing questions, will remain open for eight weeks. It will reportedly conclude on September 27.