Starting from November 15, 2024, the UAE will exempt cryptocurrency transactions and conversions from Value Added Tax (VAT), applicable to both individuals and businesses.

While other nations remain cautious in establishing clear cryptocurrency regulations, the UAE has adopted an open and proactive approach.

How Have Cryptocurrency Regulations in the UAE Changed?

Prior to the tax exemption policy, the UAE had imposed a 5% VAT on cryptocurrency transactions, similar to other commercial transactions. However, taxing cryptocurrencies posed challenges due to their decentralized and anonymous nature.

Previous tax regulations created barriers for businesses and individuals entering the crypto market. The new tax exemption policy aims to foster growth and attract investment in this sector.

The Federal Tax Authority (FTA) of the United Arab Emirates issued revised VAT regulations on October 2, stating that cryptocurrency-related transactions, including transfers and conversions, will no longer be subject to VAT in the UAE.

“UAE ( Dubai) just eliminated all taxes on crypto transactions. The US needs to follow if they want to be competitive,” Crypto trader Borovik commented

Dubai is emerging as a global hub for cryptocurrency and blockchain technology. With a progressive regulatory framework, the city has attracted numerous companies and projects in the crypto space.

Read more: Complete Guide to Filing Cryptocurrency Taxes in 2024

How Will Virtual Asset Companies Benefit from the VAT Exemption?

Interestingly, the UAE has already applied VAT exemptions for investment fund management, asset transfer, and virtual asset conversion since January 1, 2018. This means individuals or businesses that have paid VAT on cryptocurrency purchases or sales since 2018 could be eligible for refunds from the government.

However, this retroactive process may involve making certain voluntary disclosures to the FTA. This means that old transaction records will be reviewed, and some businesses could face penalties if fraud is discovered.

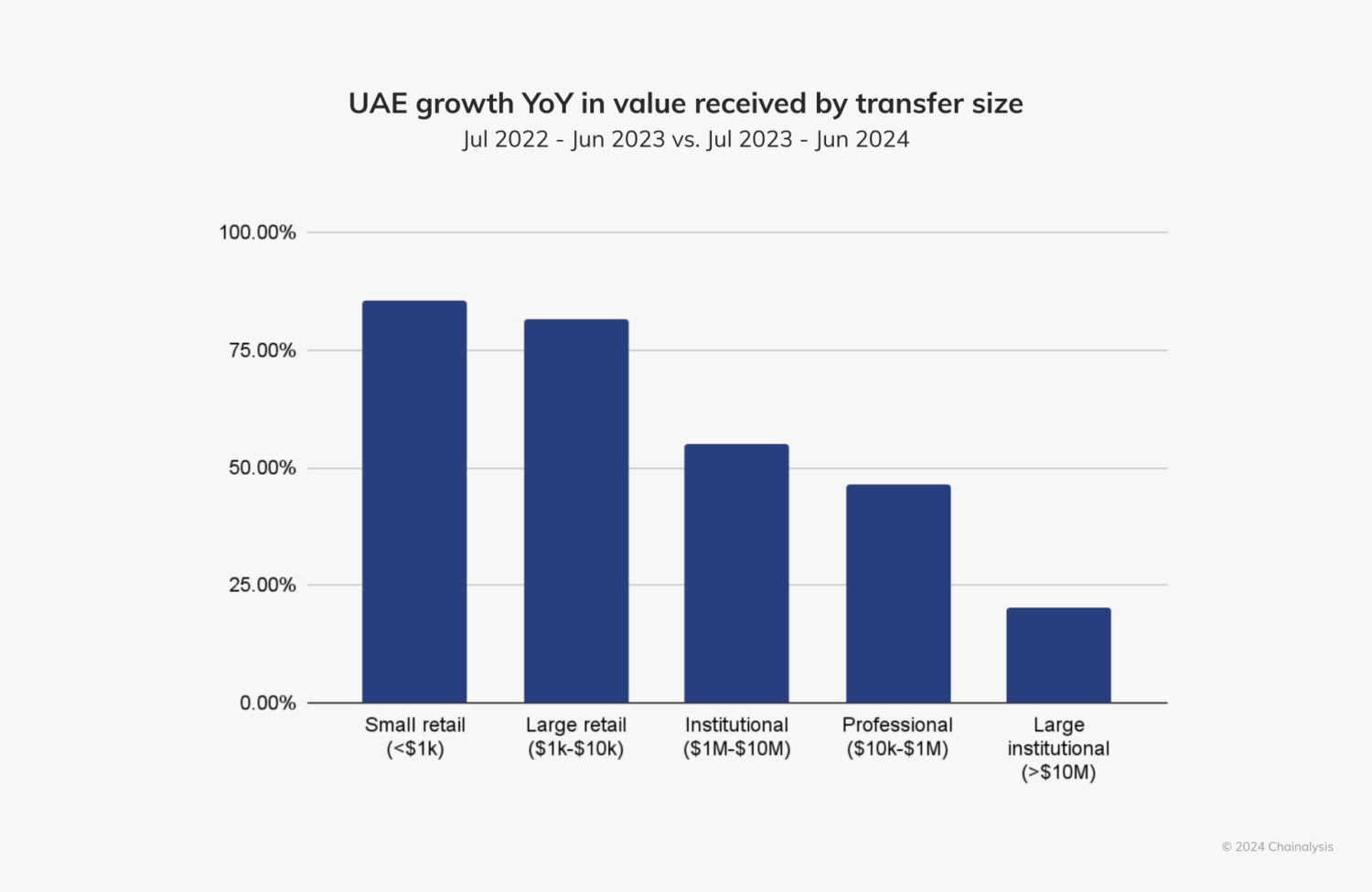

According to Chainalysis, from July 2023 to June 2024, the UAE received over $30 billion in cryptocurrency, placing the country in the global top 40 for crypto inflows and making it the third-largest crypto economy in the MENA (Middle East & North Africa) region.

The Chainalysis report also highlights that the UAE is developing a diverse and growing cryptocurrency ecosystem. The total value of DeFi services, including DEXs, in the UAE has increased by 74% compared to last year, rising from $2.3 billion to $3.4 billion. DEXs alone saw an 87% increase, from an estimated $6 billion to $11.3 billion.

Read more: Top 11 Public Companies Investing in Cryptocurrency

With the new tax exemption policy, the UAE is poised to become a preferred destination for venture capitalists and blockchain businesses in the coming year. However, crypto legal expert Irina Heaver believes that some challenges still remain for crypto businesses.

“It’s important to note that there is absolutely no connection between the recent VAT exemptions on crypto exchange transactions and the ease of establishing banking relationships for crypto businesses. These are completely unrelated topics. The exemption of VAT on exchange transactions does not influence the banking landscape at all. In reality, banking remains challenging for crypto-related businesses in the UAE, as it does globally,” Irina Heaver told BeInCrypto.