The consumer price index in the United States, the primary indicator for inflation, was measured at 8.2% in Sept., according to the latest report from the U.S. Bureau of Labor Statistics.

While this figure represents a slight drop from 8.3% in Aug., but not as low as the 8.1% some had expected, it shows that inflation is still running rampant.

This means that the Federal Reserve will almost certainly continue to aggressively raise interest rates at its next policy meeting in Nov.

Markets reacted negatively, with the S&P 500 Future dropping 2%. U.S. government bond yields spiked, and two-year Treasury yields soared 0.15 percentage points.

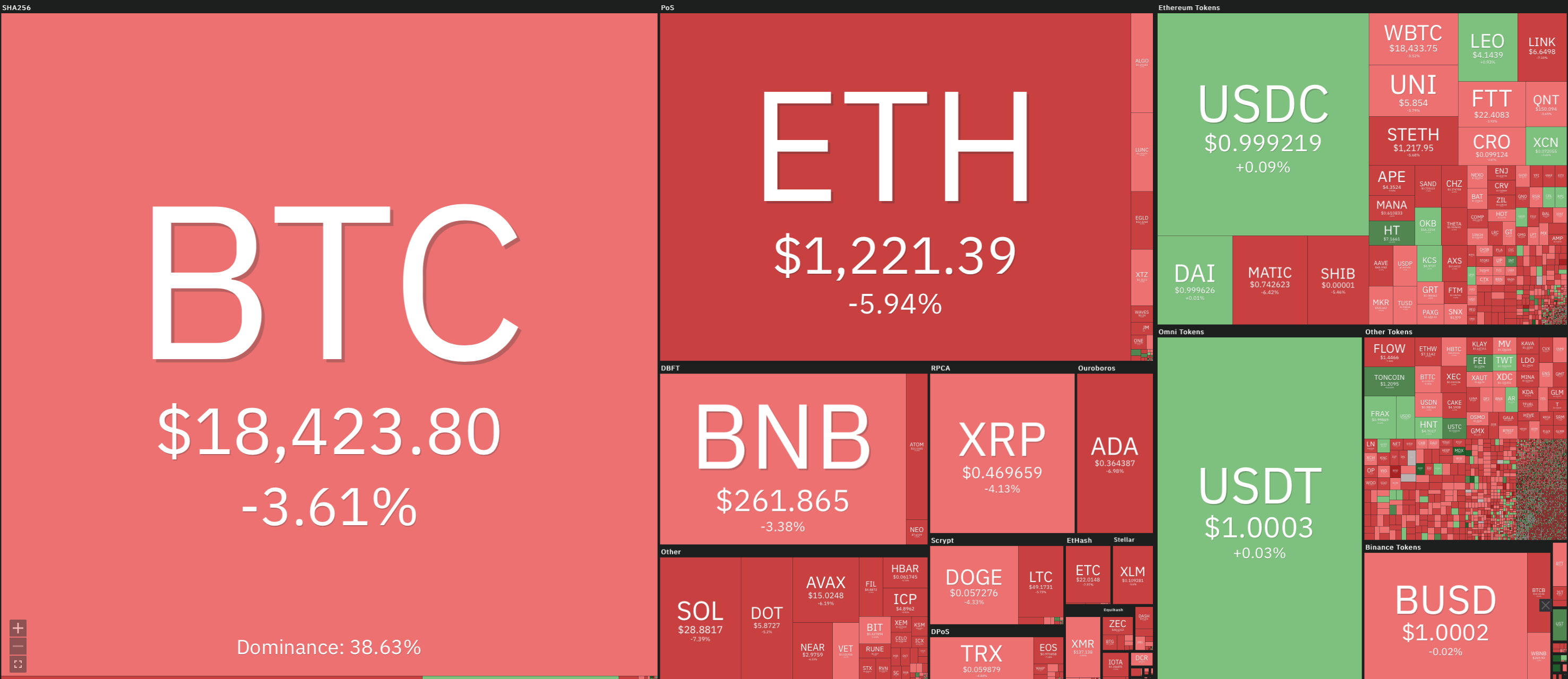

Meanwhile, crypto markets also responded poorly, with Bitcoin price falling nearly 4% within an hour of the announcement, while Ethereum price dropped over 6%.

Still, this figure falls within expectations, as the Bitcoin price typically falls roughly 4% when CPI comes in higher than expected, according to QCP Capital.

Bitcoin price reacts negatively

Just prior to the report BTC price began an upward movement and increased by 1.95% in a matter of five minutes, reaching a high of $19,030.

However, right after the report a sharp downward movement began (red icon), in which the price fell by 3.25%. This led to a low of $18,190. All in all, Bitcoin had a volatility of roughly 5% in both directions.

While the short-term movement as a result of the slightly higher than expected inflation is chaotic, the longer-term price movement is still following the same pattern.

Bitcoin price seems to be in the process of completing the fifth and final wave of an ending diagonal. If correct, the price will sweep the yearly lows of $17,622 (white), before completing its correction.

PPI Data Suggests Inflation Remains High

Data from the Producer Price Index (PPI) was published yesterday showed that the rate of PPI inflation was at 8.5% through Sept., rising 0.4% from Aug. after two months of decline.

According to Gabriel Santos of JPMorgan Asset Management, the marginal increase demonstrated that the economy is still in the early days of its inflationary deceleration.

“I think the data this morning just emphasizes that we’re still seeing the early days of a deceleration process in inflation with very mixed news,” she told CNBC on Wednesday.

Adding, “There is some good news. There is some deceleration in goods prices, some improvement in supply chain issues, mixed news around commodities, more recently with a slight rise in energy prices once again, and then some still bad news in inflationary pressures in services… so we’re still very much in the early days.”

An Unsatisfactory Guessing Game

While the PPI may offer some clues, some commentators believe that everyone, including the Fed, is in the dark about what the CPI numbers may hold.

On the same program, Stephanie Link, Chief Investment Strategist for Hightower, said: “They [the Fed] don’t have much credibility. They were behind the curve. They should have been raising rates a year ago.”

As Link sees it “we’re kind of peakish” indicating that the top may have been reached but that ultimately the economy is still at “huge, huge levels” of inflation.

Additional reporting by Nicholas Pongratz

Technical analysis by Valdrin Tahiri