Kevin Hassett, a former Coinbase advisor who holds over $1 million in COIN stock, leads the Federal Reserve Chair race with a 56% nomination probability on prediction markets.

As Trump’s criticism of Jerome Powell grows, final interviews are underway through Treasury Secretary Scott Bessent.

Hassett Emerges as Frontrunner Amid Volatile Prediction Markets

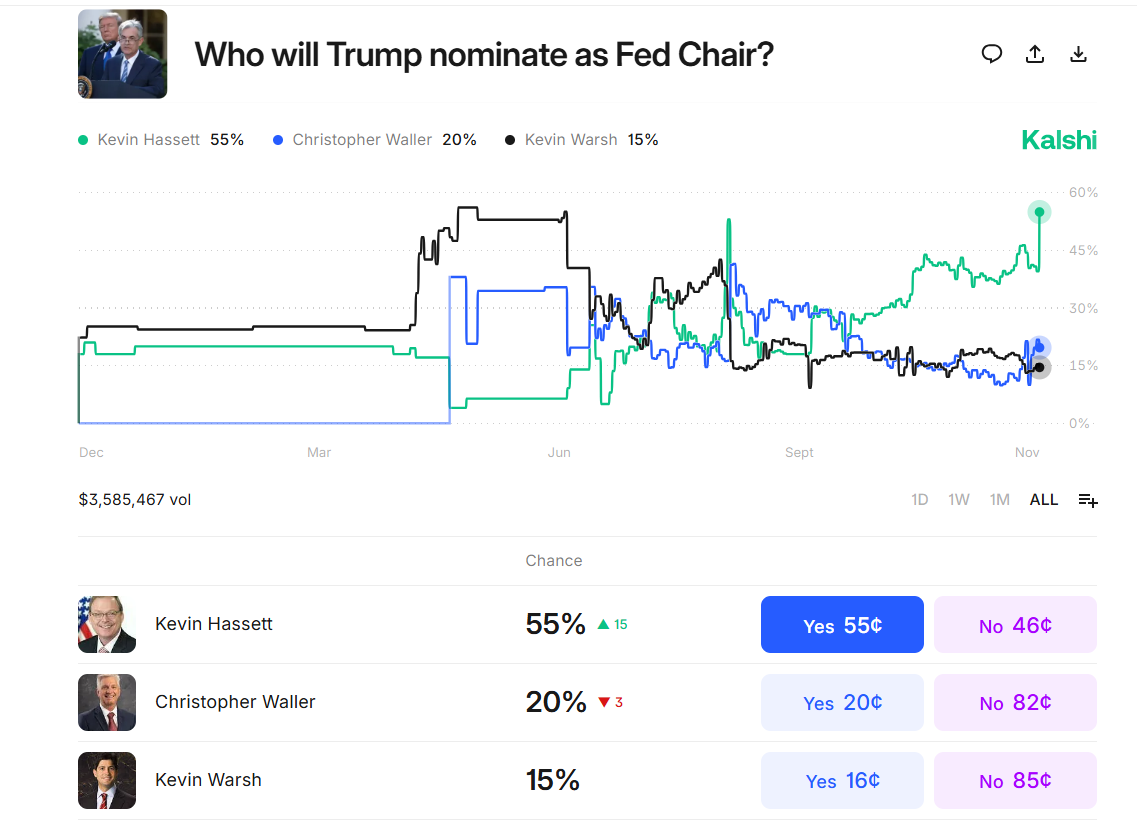

Kalshi prediction markets currently give Kevin Hassett a 55% chance of nomination for the role of Federal Reserve Chair. This represents a 15% increase in the last 24 hours, placing him well above Christopher Waller (20%) and Kevin Warsh (15%).

As the former chair of the Council of Economic Advisers, Hassett is known for advocating rate cuts and maintaining direct ties to the crypto industry.

Coinbase officially announced its Global Advisory Council in late November 2025, confirming Hassett’s position.

The Council helps guide the company’s engagement with global regulators, illustrating the growing relationship between crypto firms and policymakers.

As a Distinguished Visiting Fellow at the Hoover Institution, Hassett has promoted a more accommodative monetary policy through 2024 and 2025. Therefore, his strong pro-rate cut approach sets him apart from the hawkish stance under current Fed Chair Jerome Powell.

However, Hassett’s experience as a Coinbase advisor and his substantial holdings of COIN stock create a direct link to the crypto sector.

This raises both concerns about potential conflicts of interest and hopes for a shift in the Fed’s approach to digital assets.

Meanwhile, President Trump has amplified his public criticism of Jerome Powell while the search for a new Fed chair continues. In a recent Oval Office session, Trump shared his frustrations with Powell’s leadership.

Final interviews for the new Chair are ongoing, led by Treasury Secretary Scott Bessent. Trump hinted at having a preferred candidate but has kept details private, reportedly to gauge how markets respond to speculation.

Jerome Powell’s current term runs until May 2026, giving Trump limited time for change. While the team notes that Trump’s choices can be unpredictable, speculation continues to mount ahead of an expected announcement before Christmas 2025.

Implications for Crypto Policy and Market Dynamics

If appointed, Hassett could bring an unprecedented level of crypto support to the Federal Reserve. His role as a Coinbase advisor and investor places him in a unique position among contenders.

These connections could impact policy on digital asset regulation, central bank digital currencies (CBDCs), and integration of crypto into traditional finance (TradFi).

“If Kevin Hassett becomes Fed Chair, the implications for crypto are strongly bullish. 1. Aggressive “dove” who has publicly criticized current rates for being too high and advocated for deeper, faster cuts. 2. Led the White House digital asset working group to shape pro-crypto regulation. 3. Served on Coinbase’s advisory board and owns a large stake in COIN,” said Juan Leon, Senior Investment Strategist at Bitwise.

The market broadly expects that a dovish and crypto-experienced Chair could boost institutional acceptance and regulatory transparency.

Some critics worry that Hassett’s crypto holdings could create conflicts of interest in policies affecting digital assets.

The Fed holds significant influence over banking and regulations for cryptocurrency exchanges and stablecoin issuers. Therefore, scrutiny will be high if a Chair with personal investments in the industry takes office.

The contrast between Hassett and contender Christopher Waller signals two different paths for monetary policy and crypto regulation. Waller represents policy stability and caution regarding technology, while Hassett’s candidacy points to more support for innovation and cryptocurrency growth.

The decision will shape not only interest rates, but also the Fed’s stance on new technologies. As the December announcement nears, both financial and crypto markets are alert for changes in US monetary policy and digital asset regulation.