Tron (TRX) currently trades at $0.12, its highest level in the past 30 days. The altcoin’s value has risen by almost 10% in the last month.

Tron’s price surge is due to the spike in demand for the altcoin during the period under review.

Tron’s Rally is Backed By Demand

An on-chain assessment of TRX’s performance revealed that its recent price rally is backed by demand from market participants.

For example, its Relative Strength Index (RSI) is 66.25 at the time of writing and in an uptrend. This metric measures TRX’s overbought and oversold market conditions.

It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due to a price correction. In contrast, values below 30 indicate that the asset is oversold and may witness a rebound.

At 66.25, TRX’s RSI signals that most market participants prefer accumulating more coins than selling their holdings.

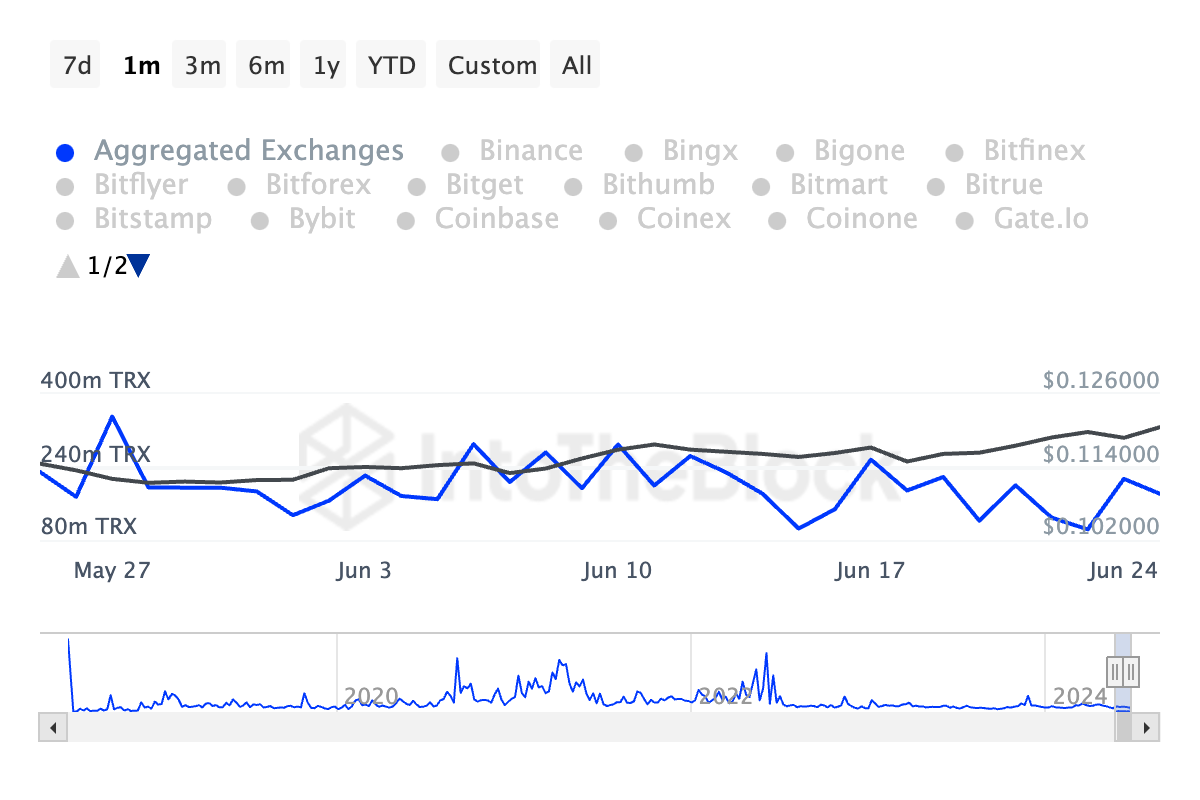

However, some traders have taken advantage of the recent price rally to profit from distributing some of their TRX holdings. The altcoin’s exchange inflow volume has risen 4% in the past 30 days.

Read more: Tron (TRX) Price Prediction 2024/2025/2030

This metric measures the total amount of an asset being transferred into cryptocurrency exchanges over a specific period. When it rises, it often indicates that more holders are transferring their assets to exchanges with the intention of selling.

As of this writing, 181.81 million TRX valued at $22 million sit across cryptocurrency exchanges.

TRX Price Prediction: Profit-Taking Activity Puts Coin at Risk

With sustained buying pressure in its market, TRX is currently trailed by significant bullish sentiments. This is confirmed by the position of the dots that make up the coin’s Parabolic Stop and Reverse (SAR) indicator. As of this writing, these dots lie under TRX’s price.

The indicator tracks an asset’s price trends and identifies potential reversal points. When its dots rest below an asset’s price, the market is said to be in an uptrend. It indicates that the asset’s price has been climbing and may continue to do so.

If this trend continues, TRX may leave the $0.12 price level to trade at $0.13.

However, if the ongoing profit-taking activity gains momentum, this can put downward pressure on TRX’s price, invalidating the above projection. It can cause the coin’s price to trade at $0.11.