Coinbase customers can earn 1.5% APY (Annual Percentage Yield) by holding USDC coins. But, traditional banks offer better yields than Coinbase without regulatory concerns.

Coinbase, one of the largest crypto exchanges in the United States, announced that their customers could earn 1.5% APY on their USDC holding. Earlier, only the MakerDao community could benefit from the reward program, but on Tuesday, Coinbase announced to expand of the scheme to its entire customer base.

Customers from the United States, United Kingdom, and European Union can avail of this benefit on their Coinbase USDC holdings. They plan to launch the USDC reward program to the rest of the world over the coming weeks.

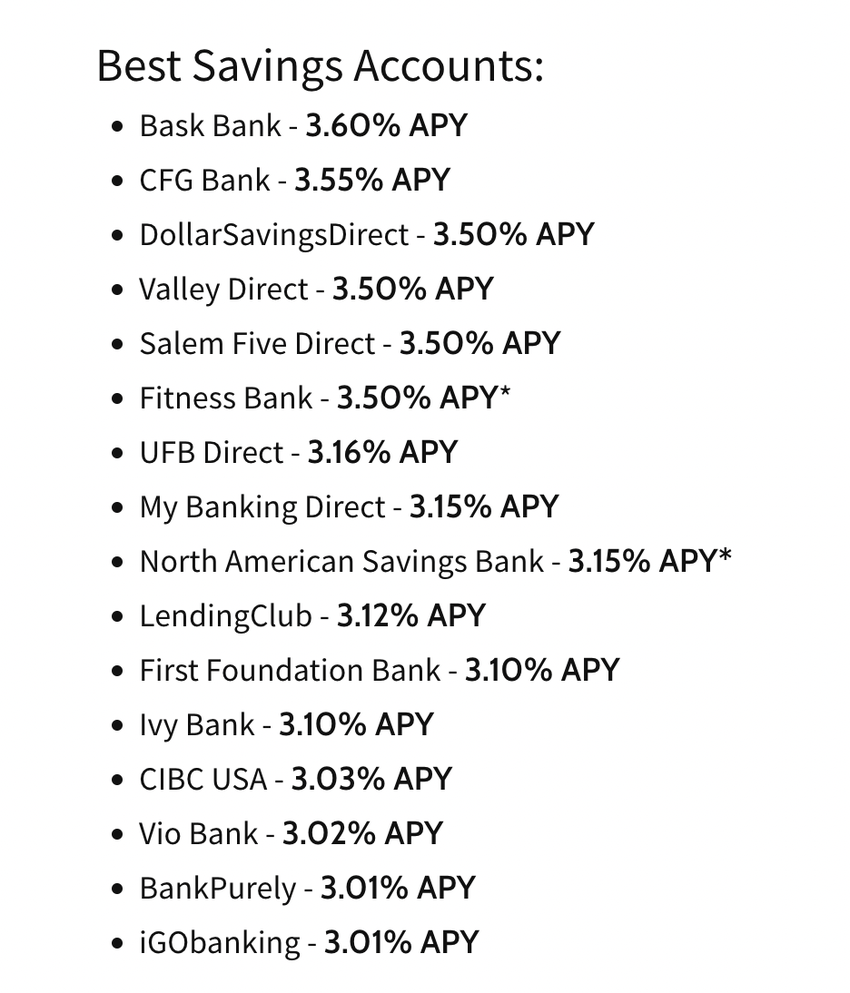

Traditional banks offer double the yield

Generally, most traditional banks offer more yield than the Coinbase exchange. According to research by Investopedia, Bask Bank provides the highest yield of 3.60%. Bask Bank is a division of Texas Capital Bank. The study has 16 banks that offer double the yield of Coinbase USDC.

When a customer deposits his money in a traditional bank, there are no regulatory concerns and no fear of de-pegging, as it happened with UST. The Twitter community has heavily criticized the low yield offered by Coinbase USDC. They have questioned why they should hold USDC at 1.5% APY when the inflation rate is over 8%.

Stablecoin yield offered by other exchanges.

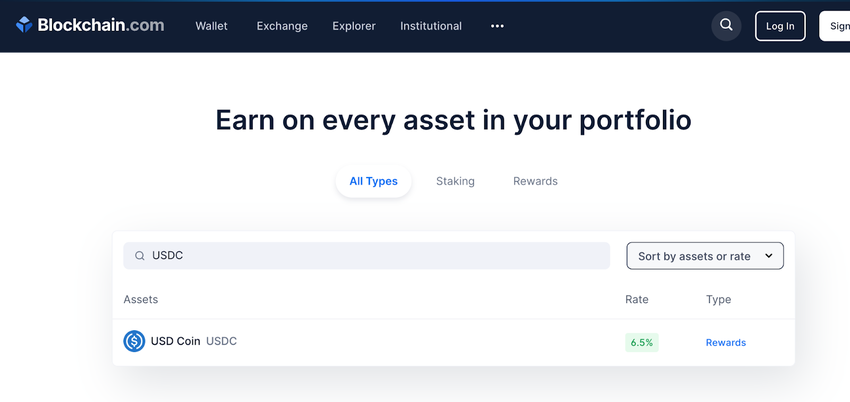

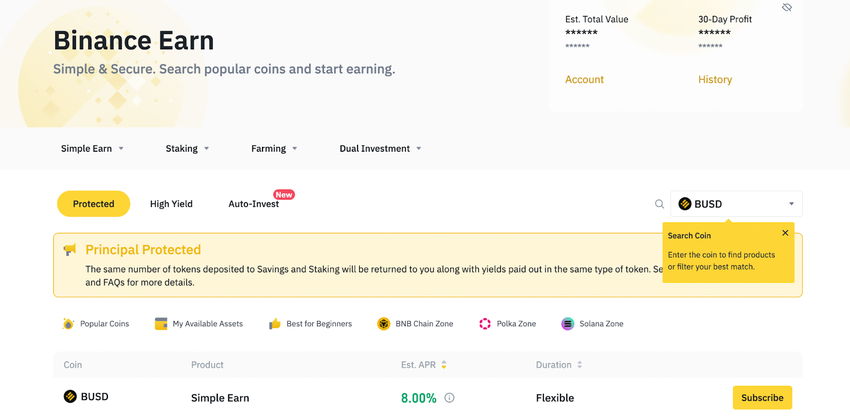

Earlier in 2021, the exchanges were offering attractive yields on stablecoin holding. But with the bear market and the collapse of some lending protocols, the yields have decreased significantly. However, some crypto exchanges still offer a yield of over 5% in stablecoin holdings. The community chooses instead to hold USDC in other exchanges.

The crypto exchange blockchain.com offers 6.5% rewards on USDC. Binance offers an Annual percentage yield of 8% on BUSD. FTX offers an 8% yield up to $10,000.

In crypto, the APY is the rate of return made on an investment. Unlike the APR, which only considers simple interest, the APY includes compound interest. Compound interest is the amount earned on the interest and the principal investment. However, an APR of 8% is still more profitable than an APY of 1.5%.

Coinbase CPO, Surojit Chatterji steps down

Apart from the backlash on the low yield on Coinbase USDC, an announcement by Chief Product Officer at Coinbase is making headlines. Surojit Chatterji announced today on LinkedIn that he is stepping down from his role. Coinbase announced in an SEC filing that it is mutually agreed that Mr. Chatterji will step down effective Nov. 30. They are reorganizing the product, design, and engineering teams.

Surojit Chatterji will continue to serve the CEO, Brian Armstrong, and the executive team as an advisor through at least Feb. 3, 2023.

Got something to say about Coinbase or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here