Trading veteran Peter L. Brandt has shared a bold forecast for leading altcoin, Ethereum (ETH). In a post on X, Brandt notes that the altcoin’s price will plummet to $1651, a low it last traded at in October 2023.

At press time, ETH trades at $2,627. A drop to $1651 would mean a 36% fall from its current value.

Ethereum To Drop to Ten-Month Low as Analyst Calls Doom

According to Brandt, ETH had traded within a rectangle pattern since April. This figure, also known as a horizontal channel, is formed when an asset’s price consolidates within a range for a period.

The upper line of this channel forms resistance, while the lower line forms support. In ETH’s case, the coin faced resistance at $4,000 and found support around $ 2,814 when it traded within the rectangle.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

The coin’s consolidation phase ended on August 4, when it dropped below the rectangle pattern’s lower line. After an asset breaks out of a consolidation pattern, it typically retests the breakout level to determine if it will act as support or resistance. According to Brandt, at ETH’s current price, the altcoin is now retesting this breakout level to assess whether the price will hold or fail.

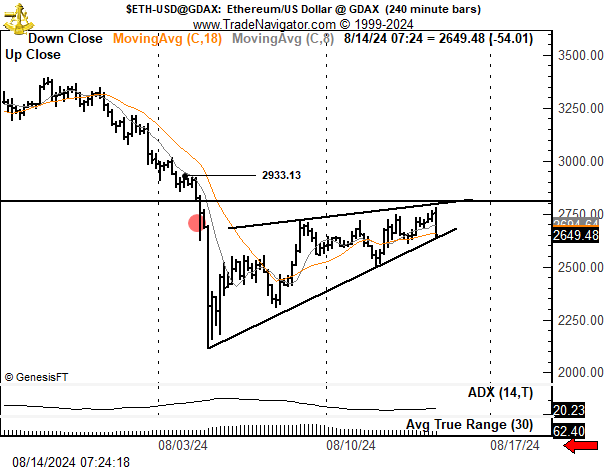

The market veteran also identifies a rising wedge pattern on an intraday chart. This pattern forms when an asset’s price consistently makes higher highs and higher lows, but the gap between them narrows, creating a wedge shape. Typically considered a bearish signal, this pattern suggests a potential downside reversal.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Rising Wedge. Source: X/Twitter

The implication is that the coin cannot breach its breakout level, and its price will trend further downward. Based on this, Brandt notes that he has taken a short position with a target of $1,651. This position offers a 3:1 risk-to-reward ratio.

However, recognizing the need for caution, he said that he would set a stop loss at $2,961, and if ETH’s price trades above this level, he would exit the trade.