Best Crypto Staking Platforms to Watch in 2025

Written & Edited by

Dmitriy Maiorov

Editorial note: Some links in this article are affiliate links. We may earn a commission if you take action, at no extra cost to you. Our recommendations remain independent and unbiased.

👉 Learn more in our Advertiser Disclosure

Crypto staking is a popular way to earn passive income. The idea behind it is simple: instead of holding assets in a wallet, users lock their crypto in a smart contract for a set period to support a blockchain’s operations. For doing so, they earn rewards.

To make life a little easier for you, we have created our top picks of best crypto staking platforms. Here is a list of parameters by which we selected project:

- Geographical availability

- Supported cryptocurrencies

- Interest rate

- Lock-up period

While compiling this article, we have also identified the following key features of projects included in our material:

- Support for several cryptocurrencies for staking

- Various APYs

- Flexible and fixed staking options

- Daily/weekly reward distributions

- No lock-up period (or flexible terms)

12 results found

Summary of the Best Crypto Staking Platforms

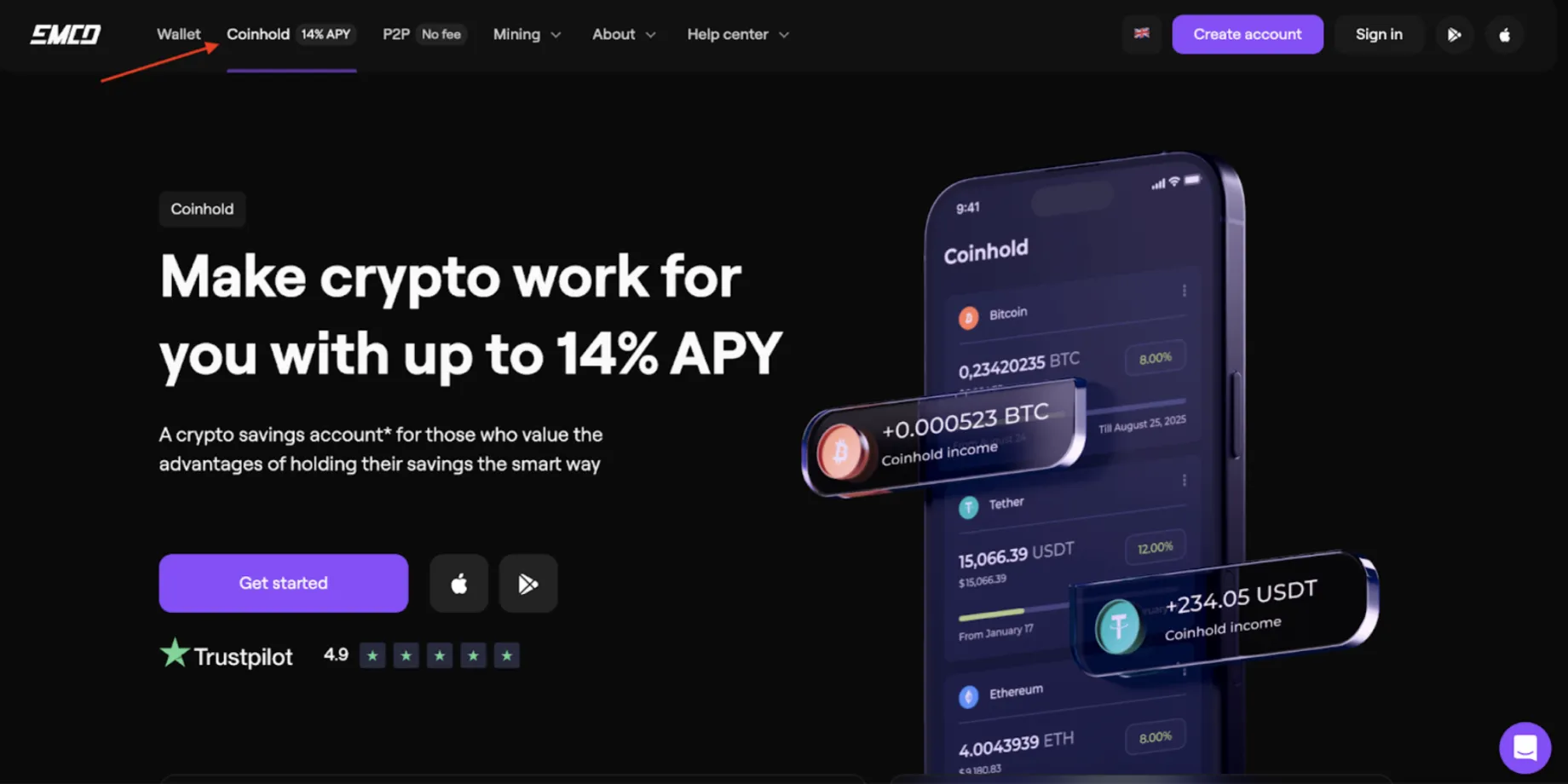

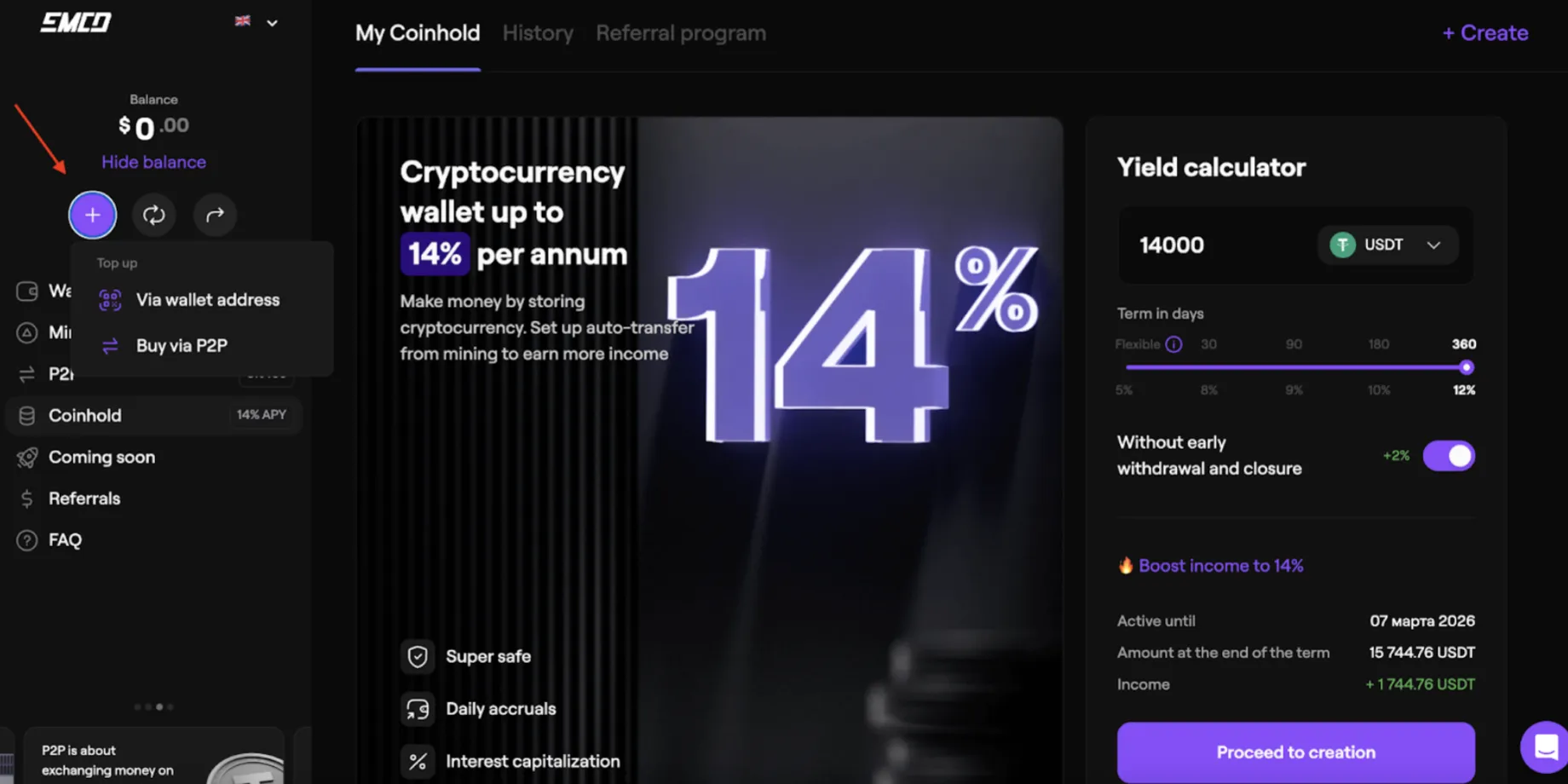

| up to 14% APY | Worldwide | from 30 to 360 days | 4 | Explore EMCD | |

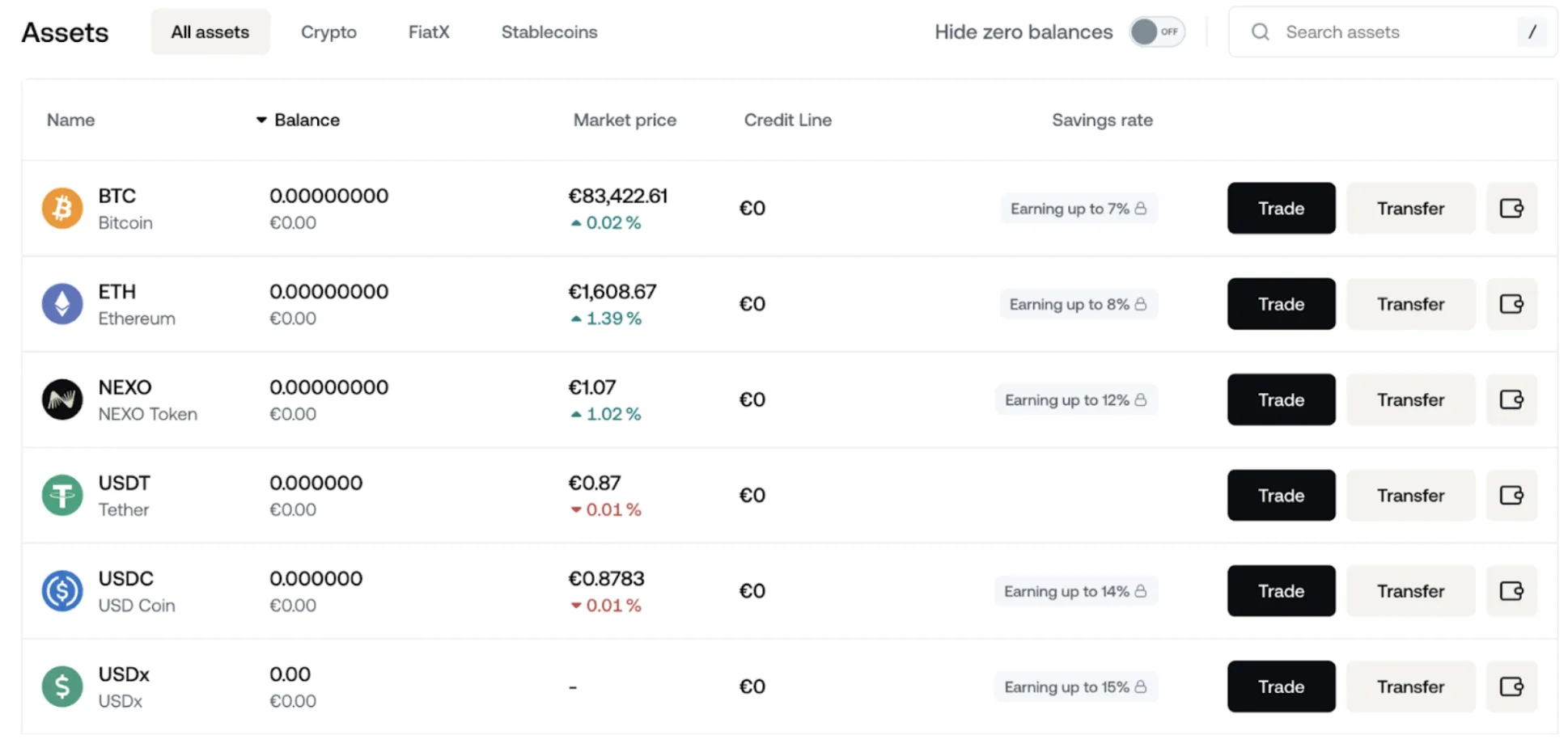

| up to 16% | Worldwide (except for US) | No | 38 | Explore Nexo | |

| 3.07% APY | Worldwide, except for US | No | 1 | Explore Tonstakers | |

| up to 17.6% | 140+ | No | 19 | Explore Uphold | |

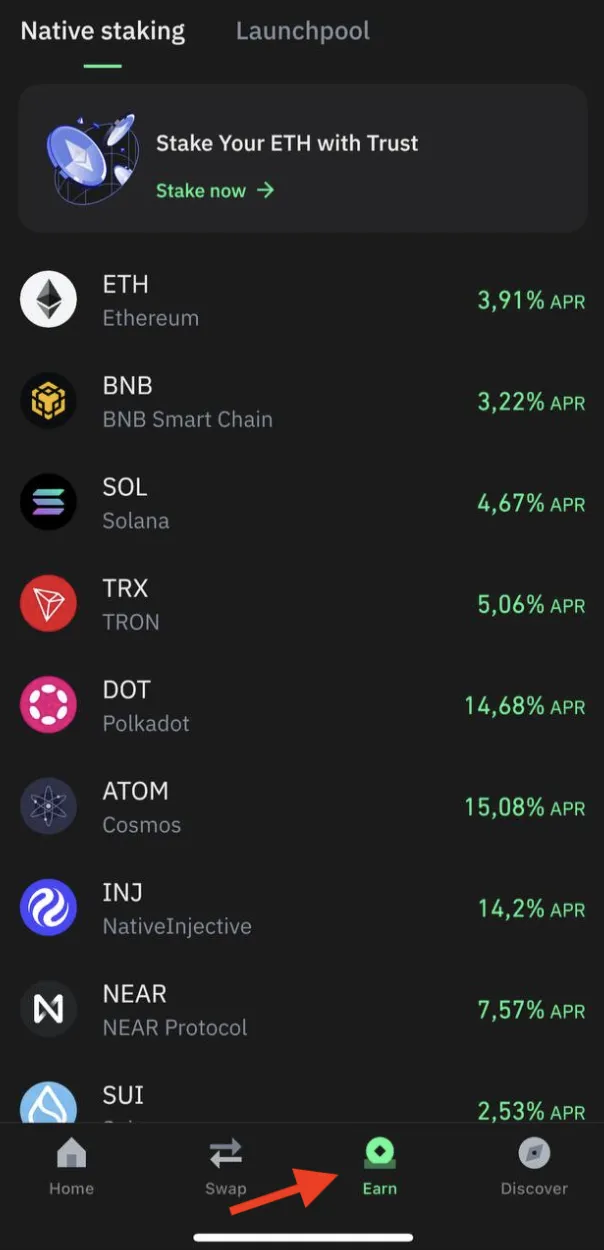

| up to 23.52% | Worldwide | Depends on the asset | 24+ | Explore Trust Wallet | |

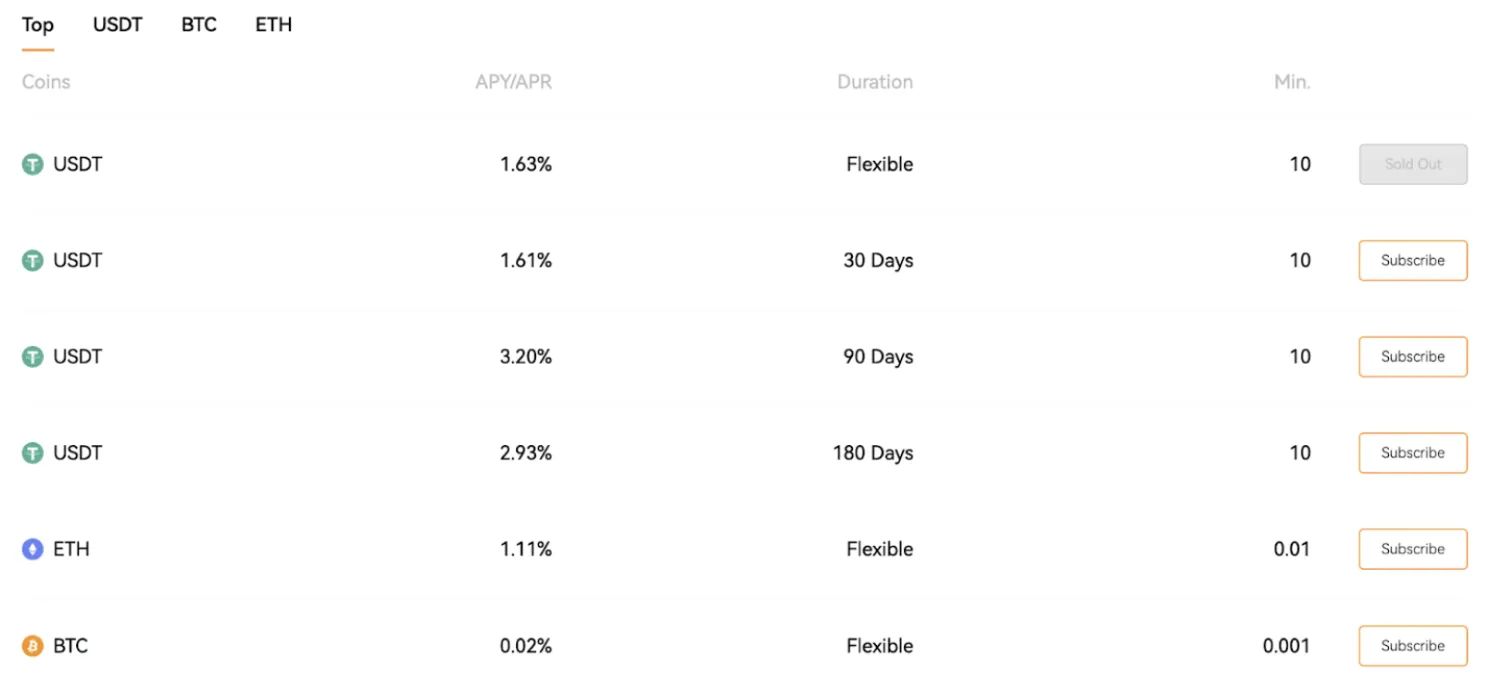

| up to 3.20% | 151 | from 30 to 180 days | 3 | Explore BloFin | |

| up to 11.5% | 198 | 30 days | 1 | Explore dYdX | |

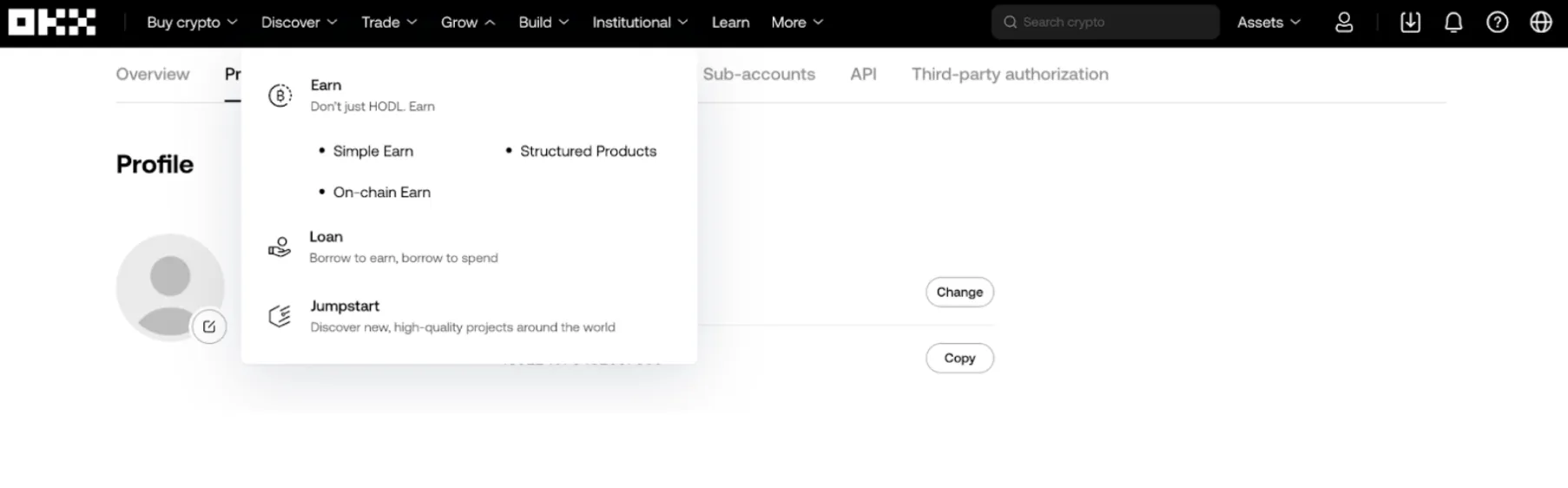

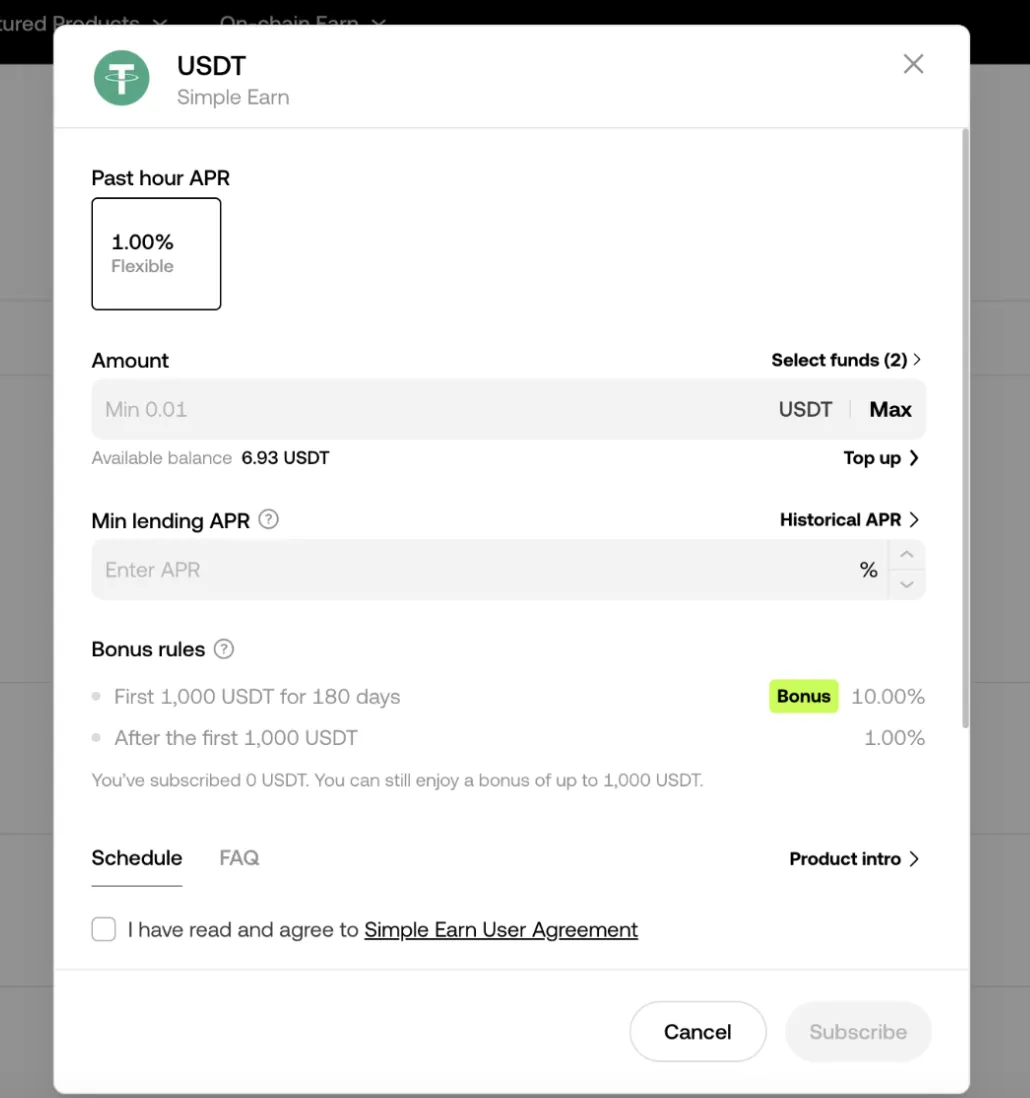

| up to 21,14% | Worldwide | Depends on asset | 38 | Explore OKX | |

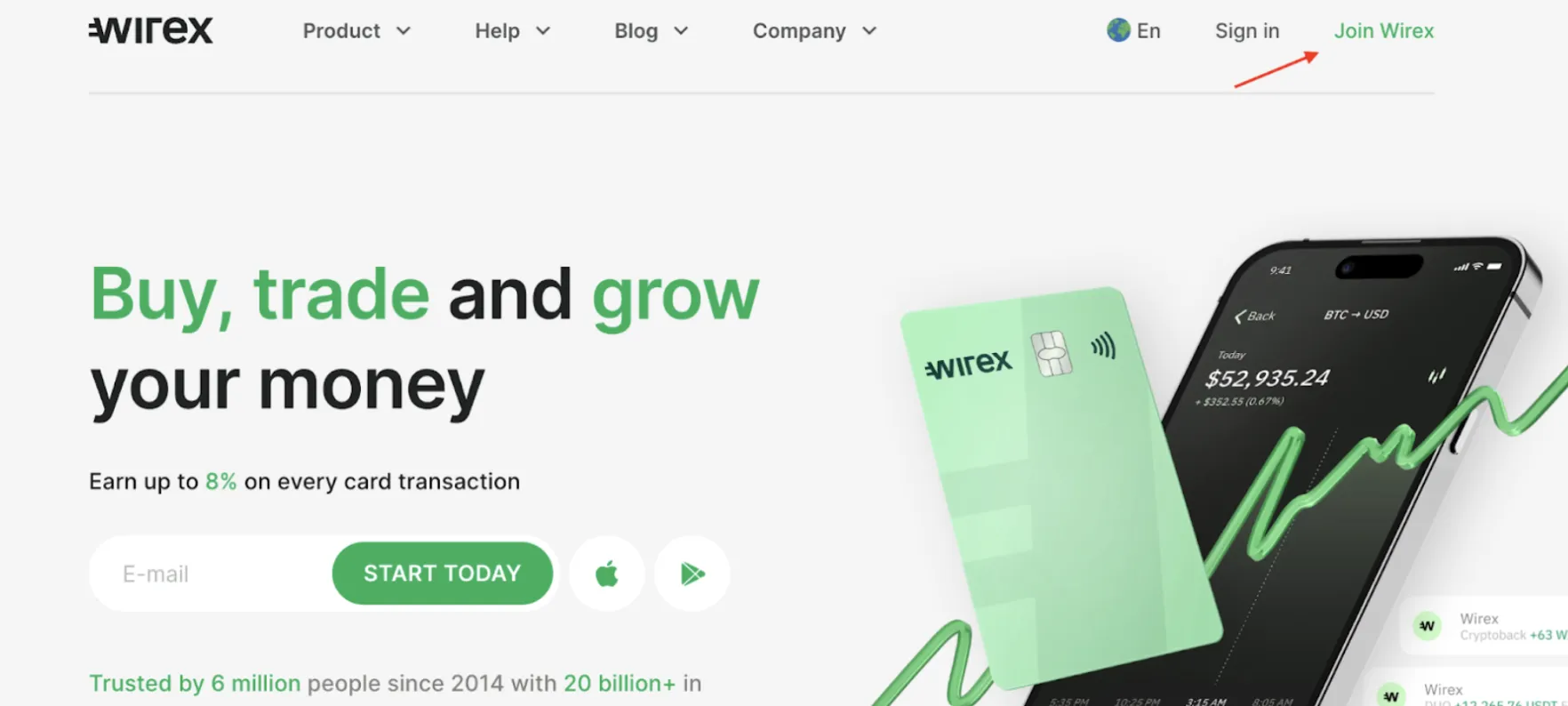

| up to 400% APR for Wirex DUO and up to 16% AER for X-Accounts | Worldwide | from 12 hours to 7 days; no for X-Accounts | 130+ | Explore Wirex | |

| up to 12% | Worldwide (except for US) | Depends on asset | 136 | Explore Coinbase | |

| from 1% up to 100+% | Worldwide (except for US, Russia) | Depends on asset | 60+ | Explore Binance | |

| up to 20% APR | Europe | No | 58+ | Explore YouHodler |

What is crypto staking?

Crypto staking is one of the options for passive income. Here's how it works: users lock their coins for a specific period. In return, they become validators who help verify transactions and maintain the network's operations. Validators check transactions within the blockchain and support its functionality. To lock their cryptocurrency in staking, they receive rewards.

In essence, when you stake, you lock your assets in the blockchain, thereby supporting its operations, and in return, you earn profits.

Some networks use staking as a consensus mechanism. With it, they build a well-functioning ecosystem. Among such networks are Ethereum, Solana, Cosmos, and Sui. They operate on the Proof-of-Stake (PoS) model.

How to Choose the Best Cryptocurrency Staking Sites

There are many staking sites in the crypto industry, so choosing the best one might seem difficult. To help you with that, we have compiled a list of aspects you should consider when selecting a platform for earning passive income through staking:

- Supported assets for staking: Make sure the site or platform supports the cryptocurrencies you want to stake.

- APY: This is the Annual Percentage Rate, or how much money you can get by staking the chosen asset. Some platforms offer higher returns, while others provide lower numbers.

- Security: This one is always of the highest priority. Check if the site or platform employs all the latest security measures, such as two-factor authentication (2FA), encryption, cold storage holding, etc.

- Fees: Commissions that some platforms charge sometimes can be the deciding factor. Compare fees that different sites offer and only then make a final decision. Without this, you could easily miss a more profitable option.

- Liquidity: Some platforms may offer fixed terms for staking, while others allow you to exit your position anytime. If liquidity is important, look for platforms with more flexible conditions.

- Reputation: Get acquainted with other users’ reviews regarding the platform you put your eyes on.

How to Maximize Your Staking Rewards

There are several strategies you can consider to maximize your staking rewards. Let’s explore them.

Choose assets with highest APY

APYs change from one platform to another. They also depend on the staking asset. Compare all the available offers in the market and choose the one with the most appropriate conditions for you. But remember that extremely high returns are usually associated with certain risks. Do a thorough research before investing.

Reinvest profits

Instead of withdrawing all your earnings immediately, consider reinvesting them into staking again. This will help you increase the budget working for you and maximize your profits through compounding.

If you stake $1,000 in Ethereum with a 6% APY, your balance will grow by $60 after one year. If you reinvest those $60 into staking, your earnings in the second year will be calculated not on $1,000 but on $1,060, thereby increasing your profit for the following year.

Diversify

Diversification is a strategy for spreading assets across different cryptocurrencies or staking platforms to reduce risks. This allows you to minimize losses if one of the assets or pools underperforms.

Instead of staking all your funds in a single cryptocurrency, you can distribute them like here:

- 40% in ETH for stable returns.

- 30% in DOT for higher yields.

- 30% in SOL for diversification and potential growth.

Leverage Liquid Staking

This strategy allows you to stake cryptocurrency and borrow funds to increase your position. In other words, it combines liquid staking with leverage. Platforms like Margex, as mentioned earlier, offer this feature.

Here’s how leverage liquid staking works:

- You stake your cryptocurrency and receive liquid staking tokens, which can be used to borrow funds or for restaking.

- Using borrowed funds increases your staking position and earns more rewards.

Use Long-Term Staking Products

Many platforms offer long-term staking products that provide higher yields by locking funds for a specific period. For example, you can choose staking for 6 or 12 months, which allows you to earn higher interest, but you won’t be able to withdraw your funds before the term ends.

Conclusion

Crypto staking is one of the most popular and effective ways to earn passive income. Users can receive rewards for supporting blockchain networks by locking their assets. Many staking platforms are available, and when choosing one, it’s important to consider factors such as supported assets, APY, security, fees, and liquidity. Also, check the platform’s reputation and determine if it’s trustworthy.

To maximize your earnings from crypto staking, you can employ several strategies. For example, reinvest your profits, diversify your portfolio, leverage liquid staking and explore long-term staking products offered by some platforms. However, it is always important to remember that higher returns often come with higher risks, so conducting thorough research before investing is essential.

Frequently Asked Questions

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.