This article will take a look at five cryptocurrencies in the decentralized finance (DeFi) sector.

These DeFi tokens have interesting developments lined up for the month of June, which could also have a positive effect on their price.Aave (AAVE)

The Aave protocol is a decentralized, open source liquidity protocol. It allows users to participate as either borrowers or depositors. Depositors provide market liquidity while earning a passive income, while borrowers are able to borrow assets. The protocol also offers interesting features such as the flash loan. This allows an entity to borrow assets, without providing any collateral. However, the borrowed liquidity has to be returned within one block transaction. It is mainly designed for developers, since its execution requires considerable technical knowledge. As for its security, the protocol stores funds on a non-custodial smart contract that is present on the Ethereum (ETH) blockchain. The native token is AAVE, which is used to vote on improvement protocols. The global DeFi investment summit will be held on June 2 to June 3. One of the speakers will be Stani Kulechov, the founder and CEO of Aave. AAVE has been decreasing since reaching an all-time high price of $668, on May 18. However, it has bounced above the $300 support area and potentially completed its correction.

Coti Network (COTI)

COTI is a DeFi platform whose main goal is to assist organizations in creating their own payment systems. In addition, it allows them to digitize their own currencies. It is a directed acyclic graph (DAG) cryptocurrency, meaning that it does not require blocks and miners in order to utilize blockchain technology. COTI utilizes Trustchain, a consensus algorithm that is based on machine learning. It significantly reduces costs, while at the same time increasing processing speed. It does this by grouping transactions in different chains based on their trust scores. There are numerous advantages gained from Trustchain, such as:- Allowing users to embed one-click payment requests into their websites for effortless checkout.

- Using trust scores for faster confirmation times in its proof of trust consensus mechanism.

- Decentralized on-chain smart contracts that are verified by full nodes, before being confirmed.

MANTRA DAO (OM)

MANTRA DAO is a DeFi platform which is community-governed. Its three main areas of focus are: Lending, Staking, and Governance. Its native token is OM. The ecosystem is governed by OM token holders, which have full voting rights. It also employs a reputation mechanism called Karma. It is similar to credit scores, meaning that it rewards users who contribute positively to the MANTRA DAO ecosystem. MANTRA DAO also uses Riochain, a public blockchain that is extremely scalable and secure. It uses a hybrid model that allows for interoperability between different blockchains. The OM price has been moving downwards since March 15. It reached a new all-time low price of $0.142, on May 19. It is now facing resistance at $0.24.

Beam (BEAM)

BEAM is a confidential DeFi cryptocurrency platform that specializes in privacy, allowing anonymous and safe transactions. It uses a combination of two protocols: Mimblewimble and LelantusMW. It does this through the implementation of Beam Shaders and the Beam virtual machine. They work together in order to create smart contracts, whose terms cannot be changed, after creation. Therefore, BEAM allows the exchange of assets and creation of contracts between two parties. It does so without needing a trusted third party. Since its launch in January 2019, BEAM has released four versions. Each has offered a significant improvement over their predecessor. The 6.0 hard fork for BEAM will launch on June 5. It will provide updates to both shaders and confidential assets. BEAM has been decreasing since April 11. In a span of 42 days, it lost 78% of its value, culminating with a low of $0.456 on May 23. Currently, it is trading inside a range between $0.525 and $0.96.

Serum (SRM)

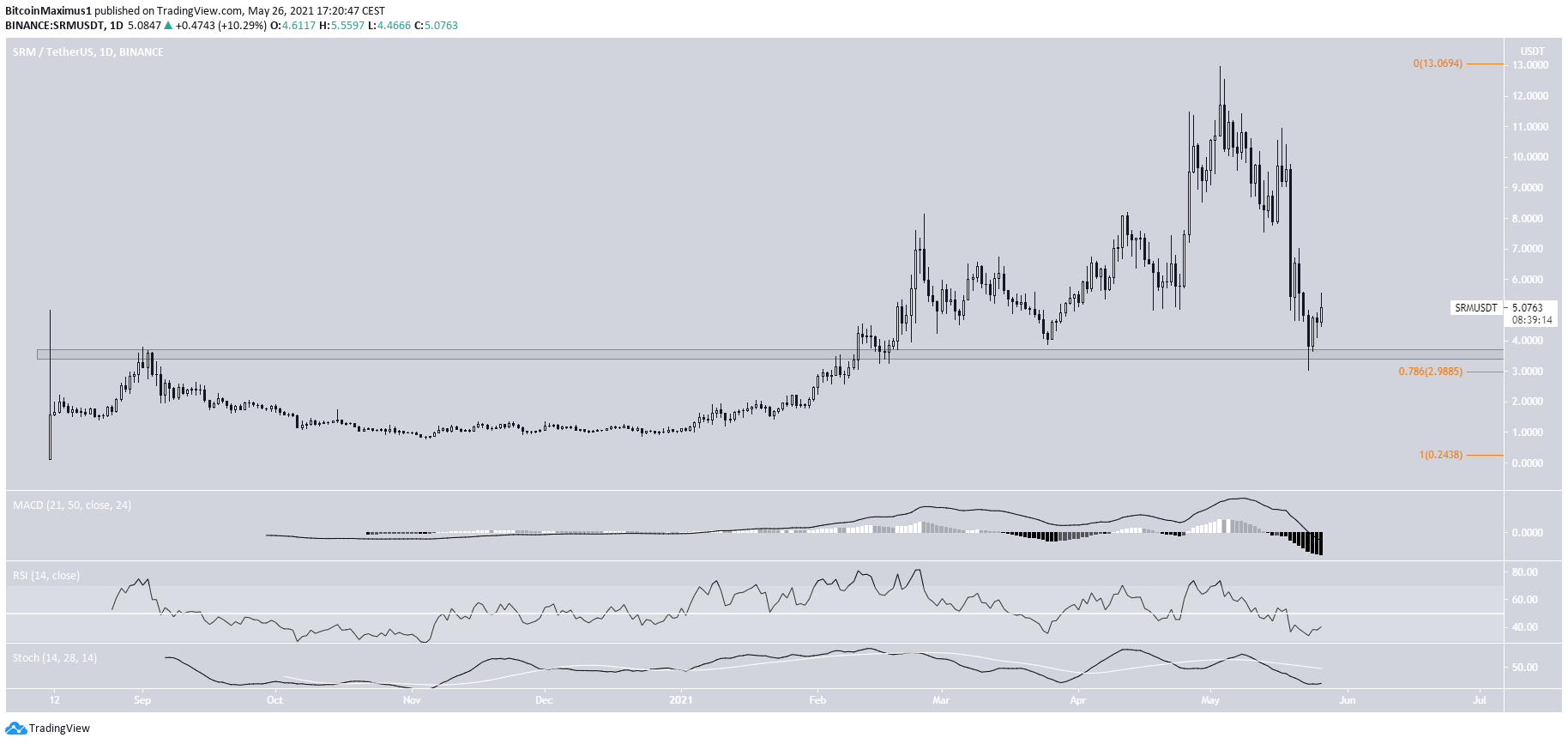

Serum is a decentralized exchange and ecosystem. It aims to bring unparalleled speed with very low transaction costs to the DeFi sector. It is built on the Solana (SOL) network. Serum can reach up to 50,000 transactions per second. Its native token is SRM. SRM allows users to exchange assets between different blockchains. Despite having a maximum supply of ten billion, 90% of the tokens are locked up in the long-term. 10% were unlocked the first year, while the rest will be unlocked throughout a seven-year period. The current circulating supply is estimated to be 50 million. SRM has been moving downwards since May 3, when it reached an all-time high price of $12.98. The decrease was sharp. It caused a validation of the previous resistance area of $3.50 and the 0.786 Fib retracement support level. Despite the lack of clear bullish reversal signs, it is possible that the token has completed its correction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored