The odds appear to be shifting in favor of Telegram-linked Toncoin (TON), whose value has risen by almost 10% in the past 24 hours.

The altcoin has outperformed other cryptocurrencies during that period, thanks to Pavel Durov’s first public statement since his arrest on August 24.

Pavel Durov’s First Statement

Telegram CEO Pavel Durov expressed gratitude for the support he received following his recent arrest in France, where he was questioned by police for four days. He revealed that authorities suggested he could be held personally responsible for illegal activities on Telegram due to a lack of response from the platform.

Durov highlighted that Telegram has a designated representative in the EU to handle such requests and that French authorities had various means to reach him. He criticized the approach of holding CEOs accountable for third-party actions on their platforms, calling it a misguided application of outdated laws.

“Building technology is hard enough as it is,” Durov stated, adding that the potential for personal liability would deter innovation.

Durov emphasized the challenge of balancing privacy and security, noting that Telegram has always sought to engage with regulators while adhering to its mission of protecting users’ rights, particularly in authoritarian regimes. He mentioned past instances where the platform chose to exit markets like Russia and Iran over privacy concerns.

Addressing Telegram’s recent surge in users, which reached 950 million, Durov acknowledged the growing pains and the increased potential for abuse. He assured users that Telegram is actively working to improve its moderation and safety efforts, promising to share more details soon.

“We are driven by the intention to bring good and defend the basic rights of people,” Durov affirmed while expressing optimism that these events would lead to a stronger and safer platform.

TON Sees Demand Uptick

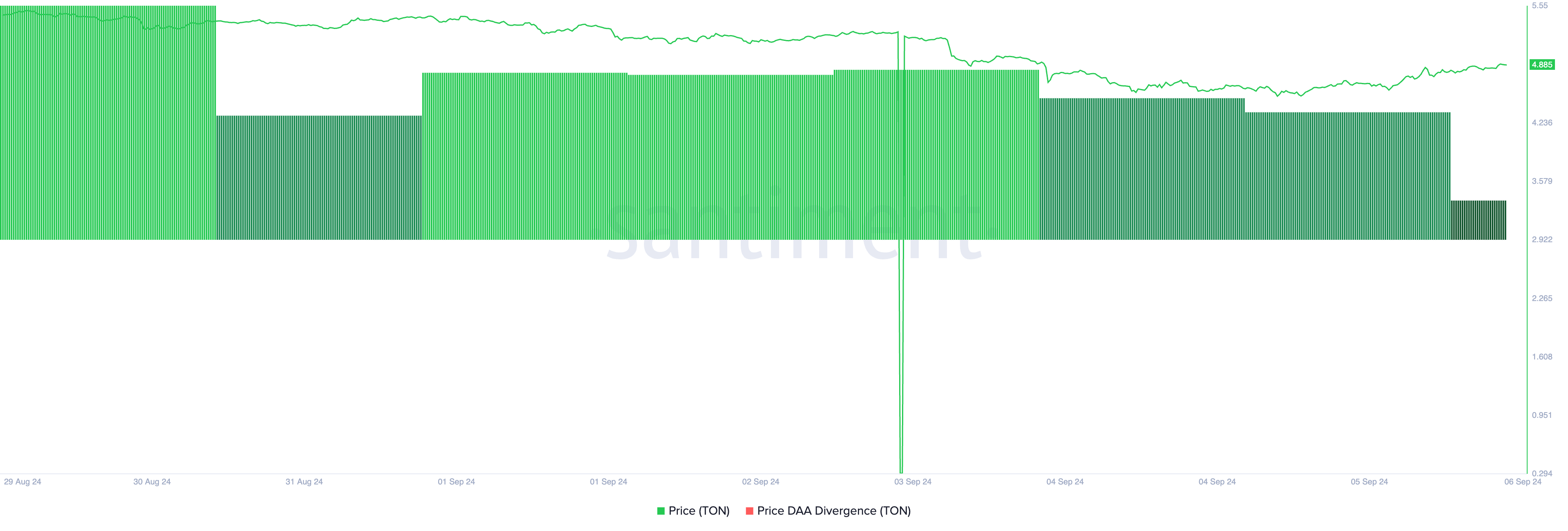

The positive sentiment around this statement has led to a spike in Toncoin’s value. TON is the top gainer in the market, with a 7% price uptick in the past 24 hours. The price surge is backed by significant demand, as evidenced by its positive price daily active address (DAA) divergence.

When an asset’s price DAA divergence is positive during an uptrend, it is a bullish signal indicating that the price surge is supported by a demand enough to sustain the rally.

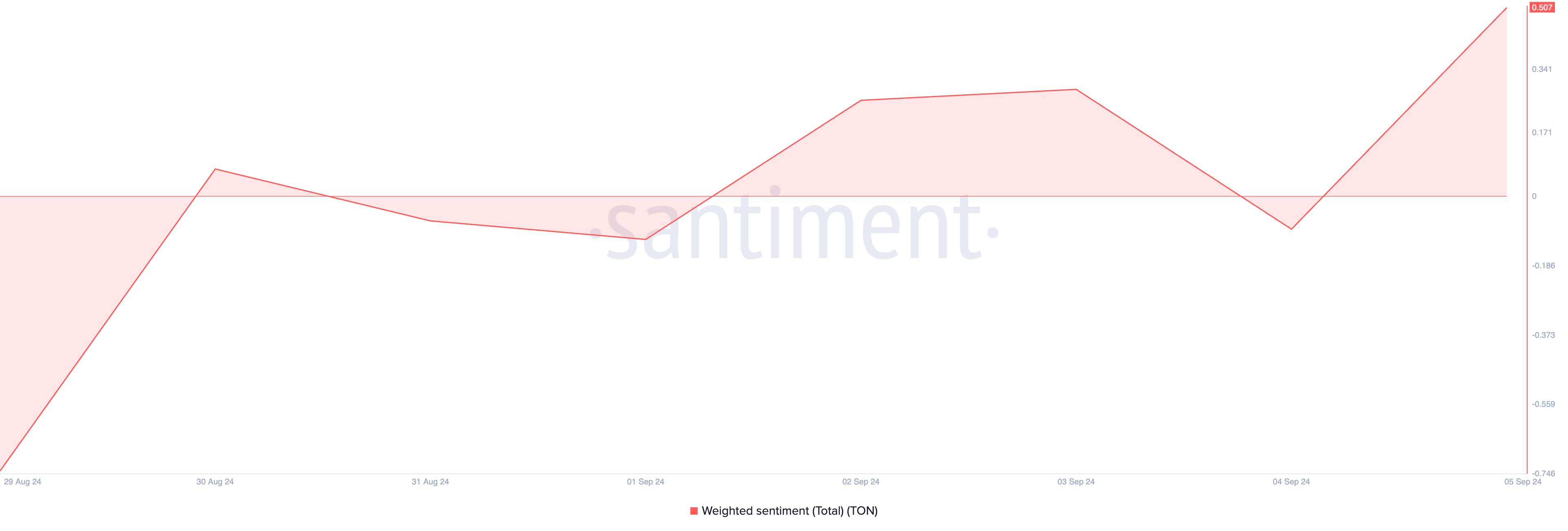

Moreover, the market sentiment toward TON has shifted from negative to positive over the past two days, as evidenced by the altcoin’s positive weighted sentiment.

This metric, which tracks the market’s mood regarding an asset, is 0.50 as of this writing. It indicates that positive emotions fuel most social media discussions about TON.

Read more: What Are Telegram Bot Coins?

Additionally, the bullish bias is also present in TON’s derivatives market with an uptick in trading volume and open interest.

Data from Coinglass shows that trading volume has spiked by 8% to $630 million during the review period. Likewise, its open interest, which tracks the total number of unsettled futures or options contracts, has risen by 8.17%. When this climbs, it suggests that more traders are entering the market and opening new positions.

Toncoin Price Prediction: Further Upside

Toncoin’s performance on the 12-hour chart hints at the possibility of an extended rally.

First, readings from its Moving Average Convergence/Divergence (MACD) show its MACD line (blue) poised to cross above its signal line (orange). When this happens, it indicates a potential shift in the market trend from bearish to bullish. It suggests that the asset’s momentum is trending upward, and traders often interpret this as a buy signal.

Also, the Chaikin Money Flow (CMF), which tracks how money flows into and out of the market, attempts to cross above the zero line. When an asset’s CMF crosses above zero, it indicates that buying pressure is starting to outweigh selling pressure. Therefore, it suggests that buyers are gaining control of the market.

If this buying pressure is sustained, TON’s price could rally toward $5.32. Breaking past this critical area of resistance could increase the chances for another upward move to $5.96.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Still, traders must watch out for the recent low at $4.51. Losing this level of support could trigger a 40% price correction for Toncoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.