Telegram-linked Toncoin (TON) continues to experience heavy selloffs even a week after the arrest of Pavel Durov, CEO of the messaging platform. An analyst has identified a bearish head-and-shoulders pattern, which suggests that the altcoin could be at risk of further devaluation.

However, despite these challenges, whale holders of TON remain undeterred, continuing to “buy the dip” and accumulate more of the token amidst its recent difficulties.

Toncoin Bulls Must Defend Support to Prevent Price Fall

In a recent post on X, crypto analyst and trader AlienOvichO shared a technical analysis highlighting the formation of a head and shoulders pattern on TON’s one-day chart.

The head-and-shoulders pattern is a key indicator of a potential trend reversal, consisting of three peaks: the shoulder, head, and another shoulder, with a neckline acting as a support level. According to AlienOvichO, if TON breaks below this neckline, which currently forms support at $4.78, it could lead to further declines in its value.

Currently trading at $5.24, TON would need to drop an additional 9% for this bearish scenario to unfold.

While initiating a clear uptrend may be challenging, the analyst noted that TON bulls must strive to force sideways movement if they intend to prevent the bearish scenario from playing out.

“TON Bulls have some works to do to deny this bearish structure from taking place so the best way to avoid it would be a sideways rang in the coming weeks before a higehr attempt,” AlienOvichO stated.

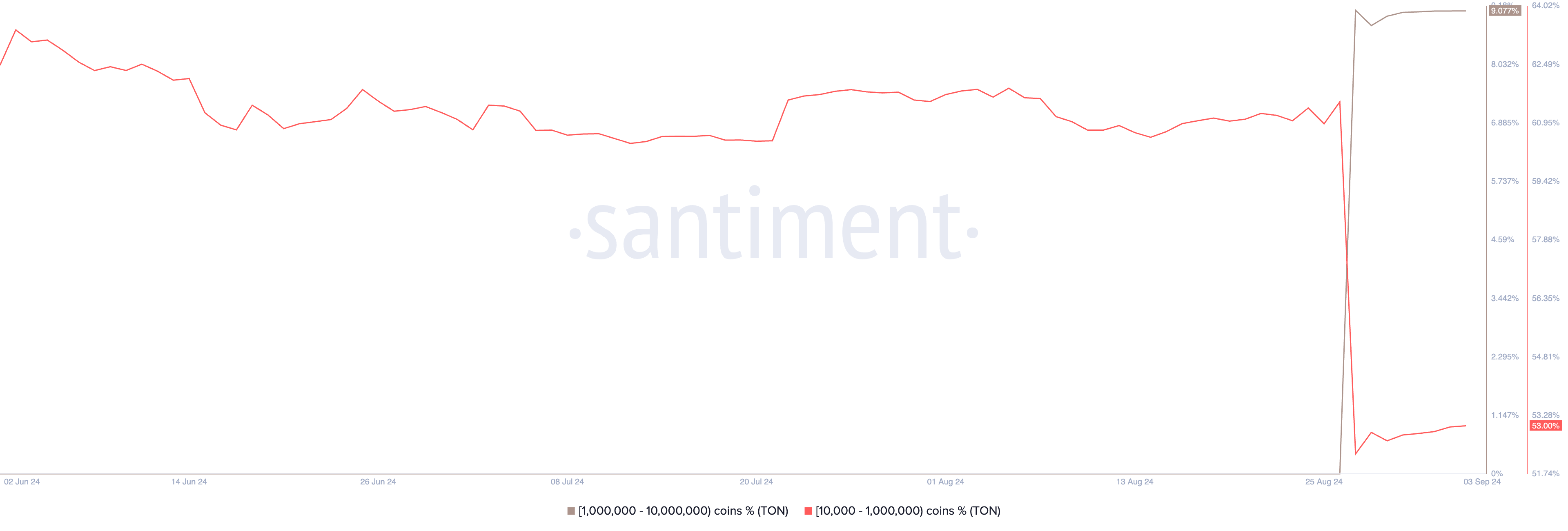

Interestingly, TON whales have seen the recent price drop as a buying opportunity. According to Santiment’s data, these large holders have increased their TON holdings since Durov’s arrest. The whale cohort holding between 1 million and 10 million TON tokens now controls 9.07% of the total circulation of the altcoin.

Read more: What Are Telegram Bot Coins?

However, since Durov’s arrest, smaller wallets, particularly those holding between 10,000 and 1 million TON, have reduced their holdings. This shift suggests that while larger investor are accumulating, smaller holders may be losing confidence amidst the ongoing uncertainty surrounding Toncoin.

TON Price Prediction: Token Eyes $3.76

TON’s technical indicators align with AlienOvichO’s bearish outlook. The Chaikin Money Flow (CMF) is below zero at -0.10, indicating liquidity outflow and increased selling pressure.

Additionally, the dots of TON’s Parabolic Stop and Reverse (SAR) indicator rest above its price. An asset’s Parabolic SAR indicator measures its trend direction and identifies potential reversal points. When its dot rests above the price, the market is in a downtrend, and the price decline might continue.

If TON breaks below the $4.78 support level, its next price target is $4.73. Should the bulls fail to defend this price level, TON’s price may fall further to $3.76, a low it last traded at in March.

Read more: 6 Best Toncoin (TON) Wallets in 2024

However, if the market trend shifts from bearish to bullish, and the whale accumulation triggers a market-wide demand for TON, its price may rally to $5.49.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.