After a slow October for many altcoins, traders are now turning to tokens that may pump as market sentiment improves. With growing optimism around rate cuts and stronger liquidity across crypto, November could mark a rebound month for the broader market.

Among them are three hidden gem altcoins that have quietly built strong setups despite weak October performances. Each shows early signs of accumulation, breakout potential, and renewed buying interest; signals that could drive solid gains through November 2025.

Chainlink (LINK)

Among the three hidden gem altcoins, Chainlink (LINK) stands out as one of the stronger recovery candidates for November. The RWA oracle network had a weak October, falling over 15%, but its structure and whale activity now hint that it could be one of the few tokens that may pump soon.

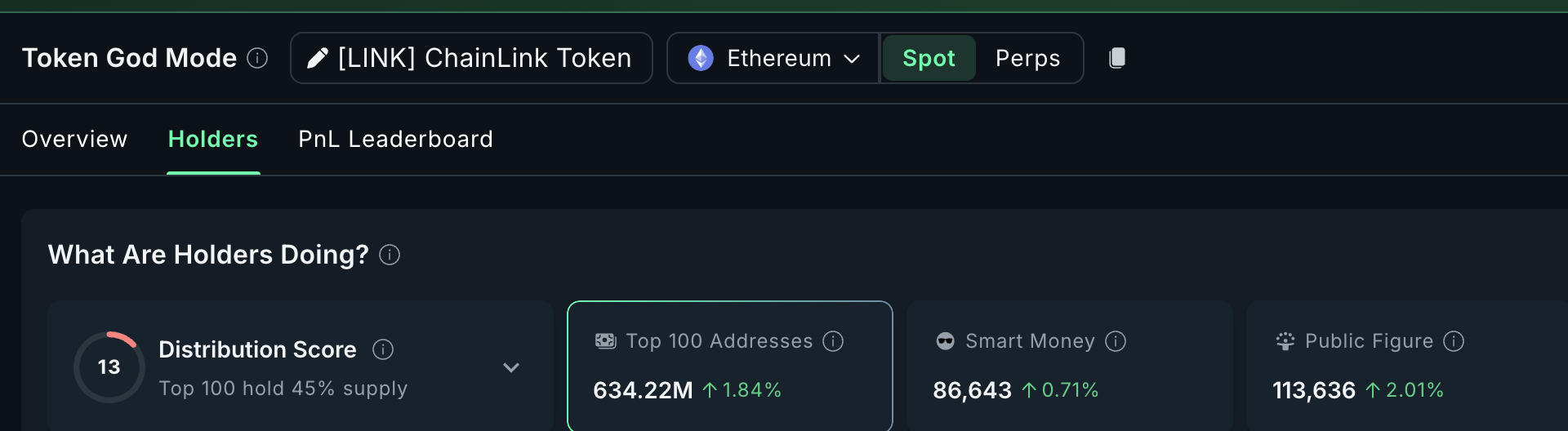

On-chain data shows that the top 100 addresses, or mega whales, increased their holdings by 1.84% in the past week, bringing their combined balance to 634.22 million LINK. This means whales added roughly 11.46 million LINK, worth around $205 million.

Smart money and public figure wallets also grew their positions slightly.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ray Youssef, founder and CEO of NoOnes, supports this view.

“Whale accumulation after the post-October crash is a textbook signal of smart-money positioning ahead of further expected RWA expansion. The structural breakout above $18.70 and a series of higher lows suggest a possible bullish setup for LINK entering November,” Youssef told BeInCrypto.

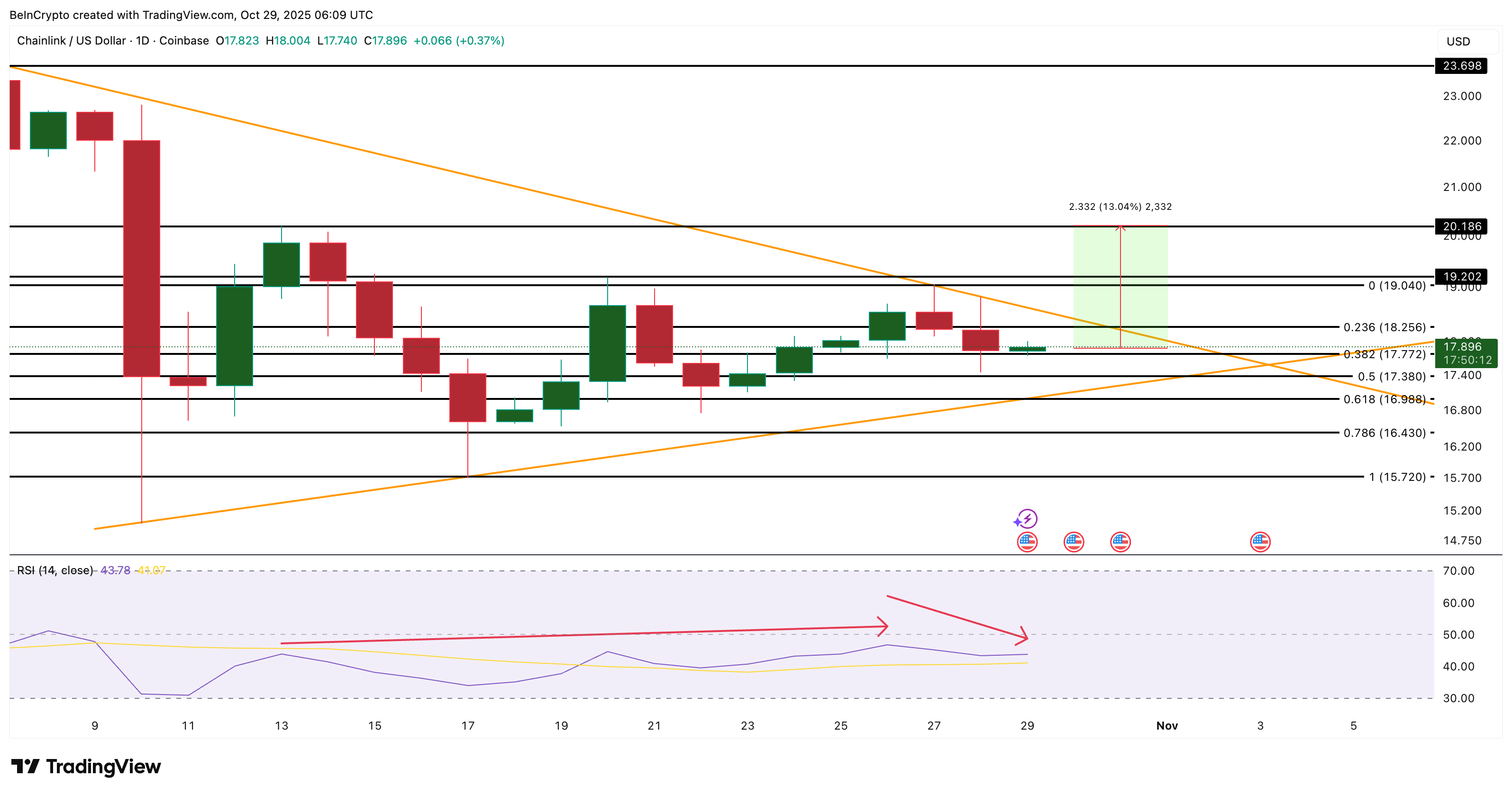

Technically, LINK trades inside a symmetrical triangle, validating the higher-low setup Youssef emphasized earlier. This pattern shows continued indecision between buyers and sellers. The lower trendline has only two touchpoints, which means if strong selling appears, the invalidation scenario could gain strength, breaking the pattern to the downside.

However, if LINK closes above $18.25 and confirms a breakout, the price could push toward $20.18, and eventually $23.69, marking a 13%–30% upside move.

The Relative Strength Index (RSI), which measures buying and selling momentum, earlier showed a hidden bearish divergence (price made a lower high while RSI made a higher high), pointing to potential weakness. But the latest RSI recovery suggests that divergence is easing, a sign that whale accumulation might be restoring confidence.

If the market weakens, $17.38 and $16.98 are key supports. Losing them could expose $15.72, confirming the bearish invalidation.

Litecoin (LTC)

Litecoin’s ETF story has taken center stage this week. The newly launched Canary Litecoin ETF (LTCC) crossed $1.1 million in organic volume within just two hours of debut, setting a record pace for a crypto-backed ETF.

Yet, despite this strong institutional debut, LTC’s price is down 2.7% in the last 24 hours and nearly 8.5% over the past month, showing that much of the optimism may already be priced in.

Even then, renewed on-chain buying suggests that the next leg of this hidden gem altcoin could make it one of the tokens that may pump in November.

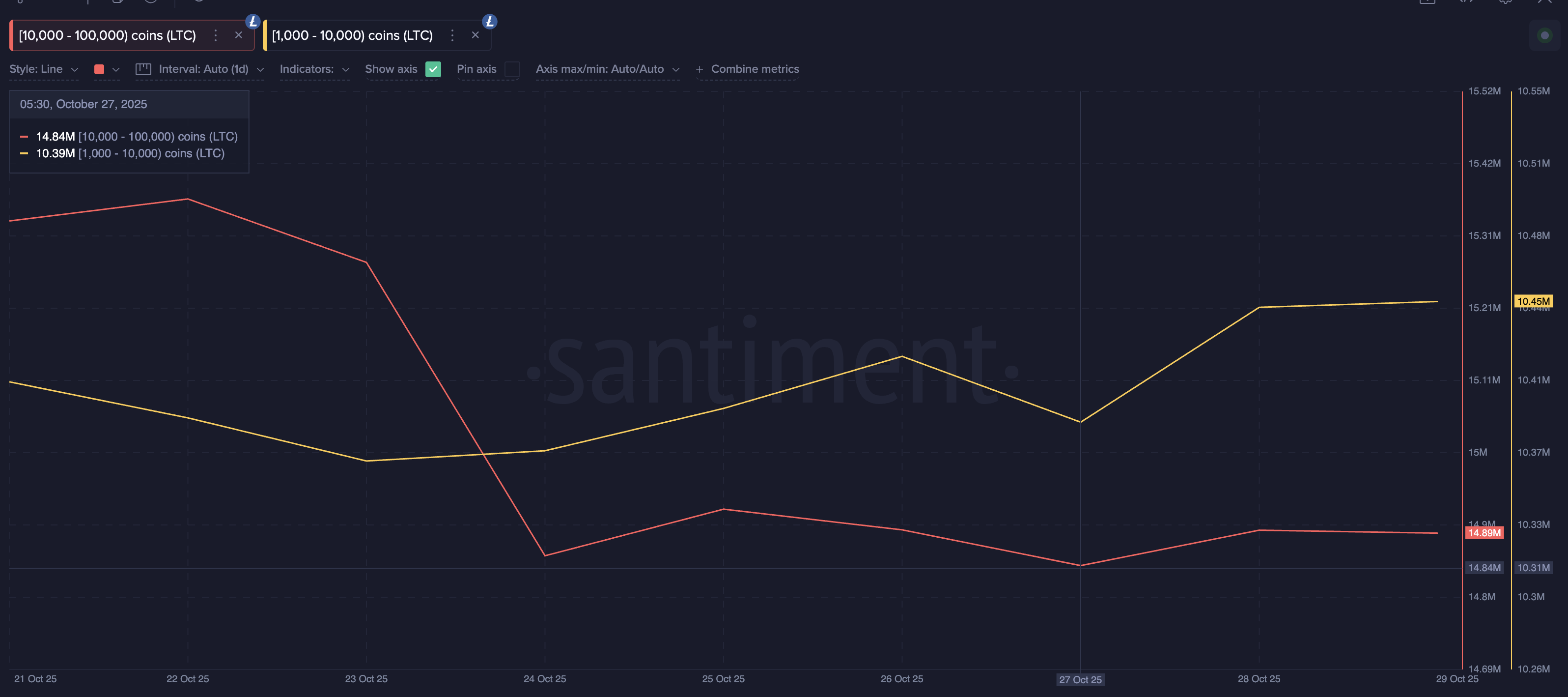

Over the past 48 hours, two key investor cohorts, “sharks” holding 10,000–100,000 LTC and “dolphins” holding 1,000–10,000 LTC, have both added to their holdings. Combined, both groups accumulated nearly 110,000 LTC, valued at about $10.7 million in total at the current LTC price. This steady inflow shows renewed confidence from mid- to large-scale holders, possibly in anticipation of a post-ETF rally.

Per the chart, LTC trades within an ascending triangle, with Fibonacci levels supporting its structure. The first resistance sits near $98.65, and a breakout above that could pave the way to $106.97- roughly a 10% move.

If buyers manage to sustain above this level, $135.98 becomes the next major upside target. This target aligns with the ETF-driven momentum and broader market sentiment heading into November.

However, the setup is not without risk. A daily close below $94.86 would weaken the bullish case. And losing $93.51 could expose deeper supports at $89.35 or even $79.27.

Uniswap (UNI)

Uniswap (UNI) could be one of the few tokens that may pump in November. Despite being down over 17% in October, the DeFi platform’s native token (UNI) is showing early signs of recovery, ending the past week in green.

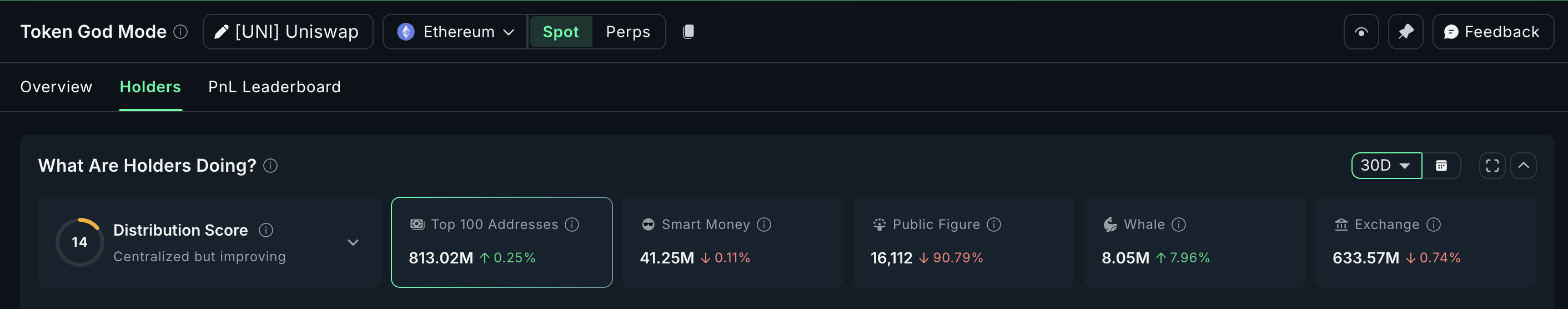

Additionally, during the 30-day window, two large investor groups have quietly increased their exposure. Whale wallets, holding between 100,000 and 1 million UNI, expanded their holdings by 7.96%, now at 8.05 million UNI. Meanwhile, mega whales, representing the top 100 addresses, added 0.25%, bringing their total stash to 813.02 million UNI.

Together, these groups accumulated about 2.62 million UNI, worth roughly $16.6 million at the current price. This steady pickup during a down month signals growing confidence that Uniswap’s price structure could soon turn bullish.

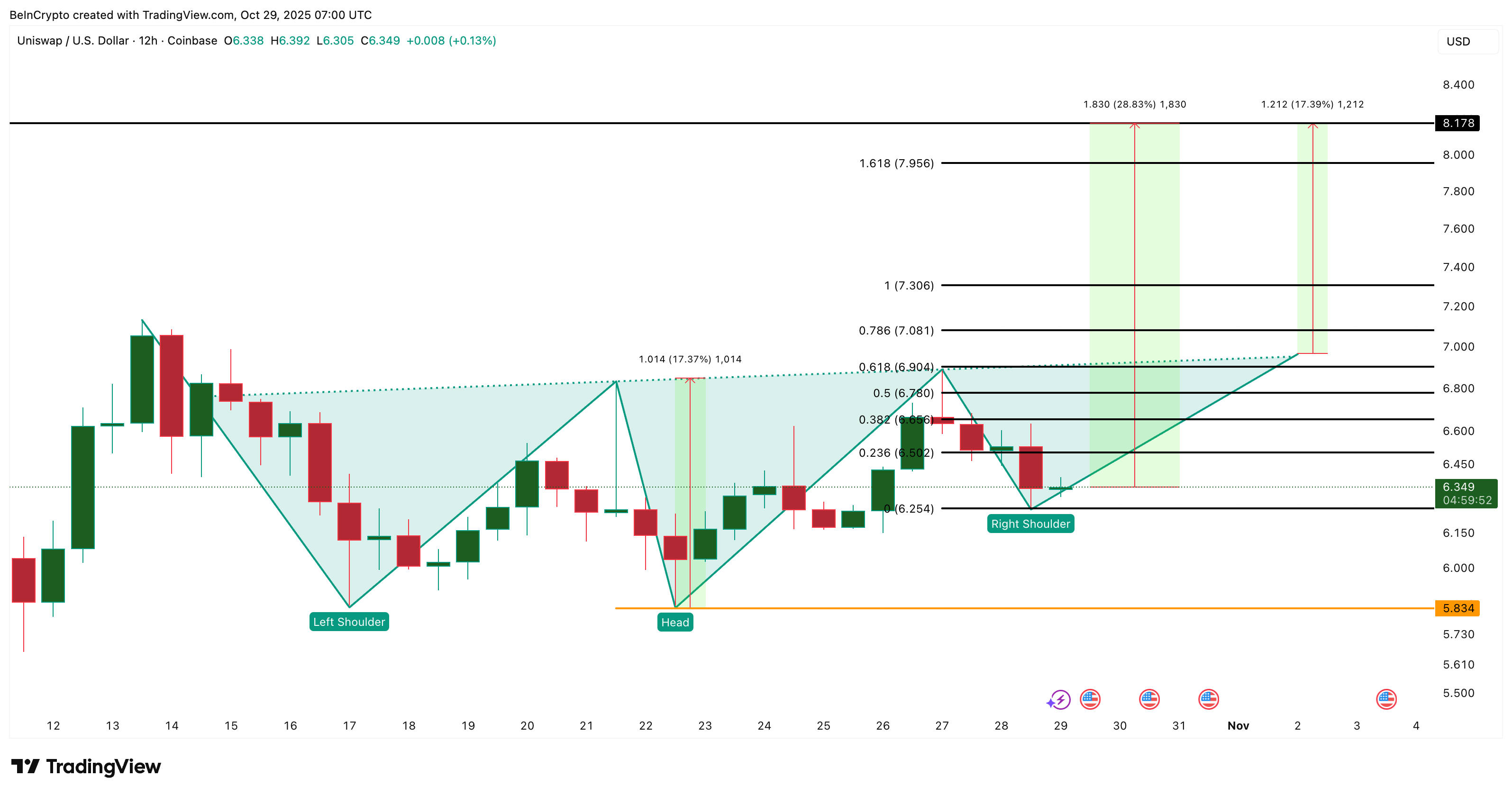

On the technical side, UNI’s 12-hour chart shows a developing inverse head and shoulders pattern, which often hints at a shift from bearish to bullish momentum. The neckline sits near $6.90, and a clean candle close above that could confirm a breakout, paving the way toward $8.17 – a projected upside of nearly 29% from current levels.

Before reaching that zone, minor resistances at $7.08 and $7.30 could test buyers’ strength. However, the bullish thesis would weaken if UNI dips below $6.25. And a clear move under $5.83, the base of the formation, would invalidate the pattern entirely.