The cryptocurrency community is abuzz following recent allegations surrounding the listing practices of prominent centralized exchanges (CEXs), notably Binance and Coinbase.

What began with a post by Simon Dedic, CEO of Moonrock Capital, has sparked widespread debate on how much power CEXs wield in determining the fate of new projects and tokens. Amid this controversy, industry leaders and community members are weighing in, exposing the growing divide between centralized and decentralized exchanges.

Allegations of High Demands for CEX Listings

In a post on X (formerly Twitter), Dedic shared details of a conversation he had with a “Tier 1” project that reportedly spent over a year in due diligence with Binance. According to Dedic, Binance eventually requested 15% of the project’s total token supply in exchange for a listing offer.

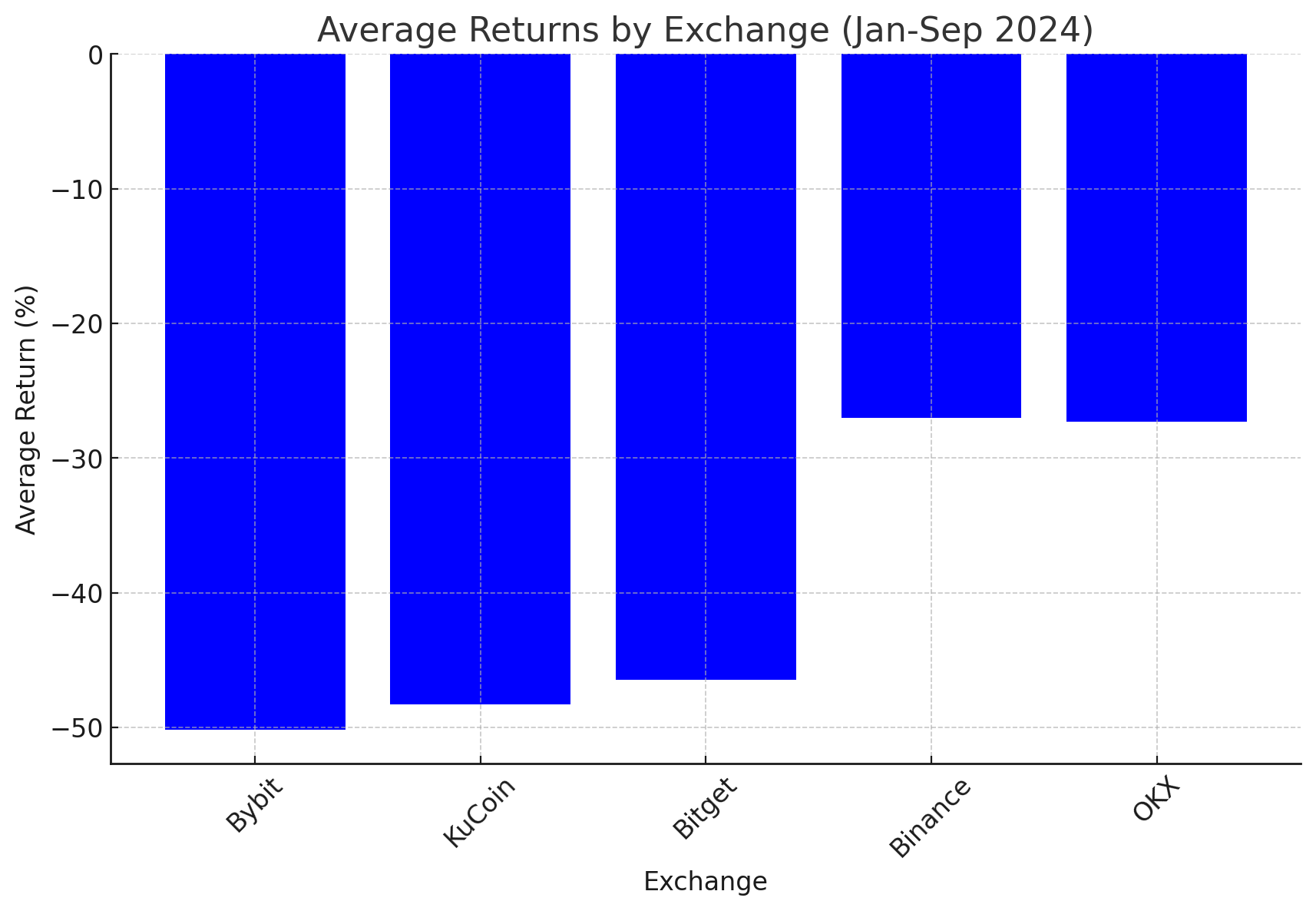

He estimated the cost for the listing could range from $50 million to $100 million, describing such demands as “unaffordable” for projects and a key reason for “bleeding charts” — a term referring to price declines following CEX listings.

In response, Andre Cronje, founder of Fantom, disputed Dedic’s claims about Binance. He disclosed that Coinbase, not Binance, had previously demanded substantial fees for listing (probably Fantom’s FTM token) with amounts ranging from $30 million to $300 million over time.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

Cronje’s stance highlights the growing concern over how listing demands might create barriers for projects aiming to gain visibility on major exchanges. Coinbase CEO Brian Armstrong soon addressed the controversy, aiming to set the record straight. Armstrong stated on X, “Asset listings on Coinbase are free,” while promoting decentralized exchanges (DEXs) as a viable alternative.

Armstrong’s post was backed by a Coinbase blog post explaining the Asset Hub, designed to streamline the listing process. Coinbase’s Asset Hub also ensures transparency and fairness, supposedly at no cost to token issuers.

Justin Sun Speaks Amid Growing Community Frustration

Adding to the debate, TRON founder Justin Sun weighed in, sharing his experiences with both exchanges. Sun stated that while Binance did not charge TRON any listing fees, Coinbase required an $80 million deposit in TRX and a $250 million BTC deposit in Coinbase Custody.

Sun also suggested that such demands are excessive, adding another layer to the debate on whether listing fees are justified for projects of different sizes. The controversy has sparked a wave of community reactions, many voicing disillusionment with CEX practices.

“Kinda makes me not want to buy anything listed on Binance again. Knowing that they paid tens of millions to get on there, so they could get the most exit liquidity they could is a signal that maybe it is not worth that much. Real platforms don’t need to launch on Binance,” said Tuomas Holmberg, founder and CEO of Collector Crypt.

Tenset CEO and co-founder of Tenset Security Mat Millbury echoed the sentiment, criticizing the adverse effects of Binance listings on token prices. Some see the issue as an indication of excessive power wielded by CEXs over new projects.

“Exchanges hold too much power,” Animoca Brands’ Mo Ezeldin commented, suggesting that listing fees and token demands create an unhealthy cycle that ultimately harms projects and drains positive momentum.

Meanwhile, Mavryck Network founder Alex Davis voiced support for DEXs, arguing they could provide a more sustainable model for the future.

“All this drama surrounding CEXs simply highlights the need for (order book) DEXs and further transparency. Make the rules for listings clear, and list appropriately. The point of crypto was to disintermediate from 3rd parties, not create new ones raking in their own fees,” Davis expressed.

Binance Leadership Defends Policies

Binance’s former CEO Changpeng Zhao (CZ) also responded to the backlash, urging the industry to move away from “quote attacks.” CZ asserted that Bitcoin, the most prominent digital asset, never paid listing fees, advising projects to focus on their development rather than exchange listings. Justin Sun echoed the sentiment.

Similarly, Binance’s co-founder Yi He added that Binance’s listing processes are transparent and based on project merit. She encouraged the public to “do your own research” (DYOR) and dismissed the allegations as “gossip,” explaining that high token allocations for airdrops or promotions do not guarantee listings.

As accusations and rebuttals circulate, the role of decentralized exchanges (DEXs) is coming into sharper focus. Unlike CEXs, DEXs allow projects to list directly without intermediary demands or large token allocations, potentially offering a path toward more equitable access.

Read more: What Are Decentralized Exchanges and Why Should You Try Them?

While centralized exchanges offer liquidity, reach, and visibility, many in the community argue that their influence over project success may be overreaching. The ongoing debate highlights a need for change, whether through increased transparency from CEXs, the adoption of decentralized alternatives, or an industry-wide shift toward fairer practices.