The Solana (SOL) price crashed to a new yearly low in Nov. 2021. There are no bullish reversal signs in place. So what happened?

Last week was mired in negative Solana news. On Nov. 17, Binance announced that it was temporarily suspending deposits of USDT and USDC on the Solana network.

While the deposits eventually resumed on Binance, the same did not occur on BitMex, Bybit, or OKX, the latter of which delisted the stablecoins. This happened to reduce the fallout from the FTX exposure.

On Nov. 18, the Stablecoin issuer Tether decided to swap $1 billion USDT on Solana for ERC-20 tokens, used in the Ethereum blockchain. The news came after the FTX collapse since Solana had close ties to the now-bankrupt exchange. The total value locked in the Solana network is down by 70% since the FTX collapse.

The next day, Metaplex, a decentralized protocol for creating digital assets on the Solana blockchain, announced that it was laying off numerous staff members.

Despite this negative news, the co-founder of Solana brushed aside concerns about these losses, stating that the treasury has 30 more months of runway.

Solana Breaks Down From Crucial Support

The long-term technical analysis picture could look more attractive. The price of SOL broke down from the long-term support area with an average price of $29 during the week of Nov. 14 – 21.

This was the next step in a downward movement that has been ongoing since the all-time high. A similar drop was seen in the rest of the cryptocurrency market.

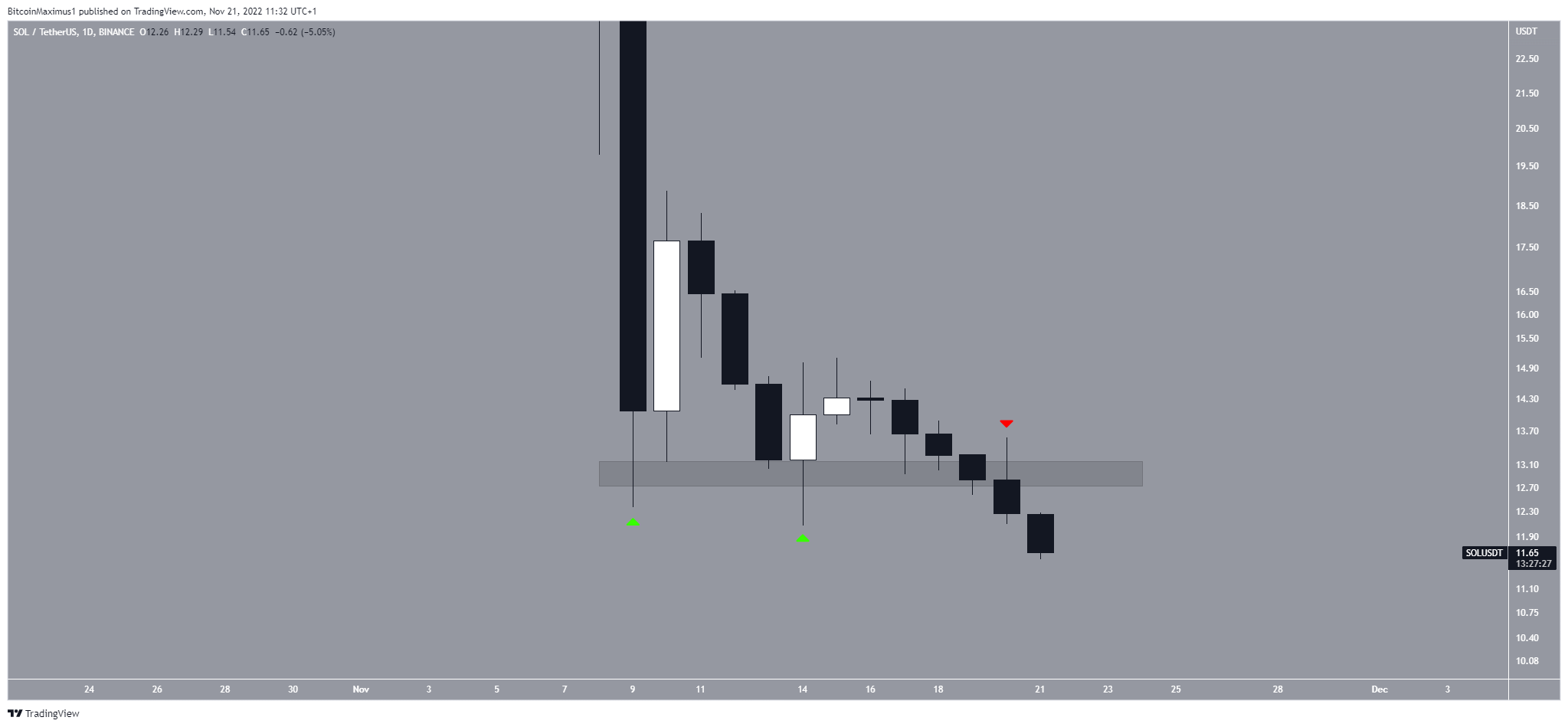

The SOL token reached a low of $11.54 in Nov. 2021. Therefore, Solana has not bounced at all over the past 24 hours.

The breakdown also caused the weekly RSI to break down from its bearish divergence trend line (green). This is a bearish development that often leads to lower prices.

If the decrease continues, the closest support area will be at $4.40. Measuring from the current price, it would amount to a decline of 62.40%.

The short-term daily chart supports this hypothesis. While the Solana price bounced at the $13 area, creating two lower wicks (green icons), it has since broken down. The $13 area is now likely to act as resistance (red icon).

As a result, it is almost a certainty that the price prediction will be bearish.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.