After experiencing another outage early this month, Solana’s (SOL) price is finally back on track battling key resistance levels.

While the futures market data looks ripe for gains, technical indicators point towards a skewed picture for SOL.

Solana, the 9th-ranked asset by market cap traded close to its $34.00 resistance level oscillating at $33.91 at press time.

While there was some short-term momentum in the coin’s trajectory, presenting 1.57% daily gains, there are quite a few roadblocks that could hinder SOL’s bullish price action.

SOL approaching key resistance mark

After making a local high of $39 on Sept. 13, SOL’s price started its descent from the upper price levels down to the lower $30 to $33 range. The altcoin’s price moved in the tight band between the $30.80 support and the $34.00 resistance mark.

The Oct. 1 outage hindered the coin’s short-term bullishness pulling the price down to $31.70, however, recovery from that mark was charted over the last two days as SOL’s price appreciated by close to 5%.

RSI’s gradual ascent presented a slowly rising buying pressure, but low trade volumes showed that there wasn’t much strength from the retail side.

Futures market shows signs of life

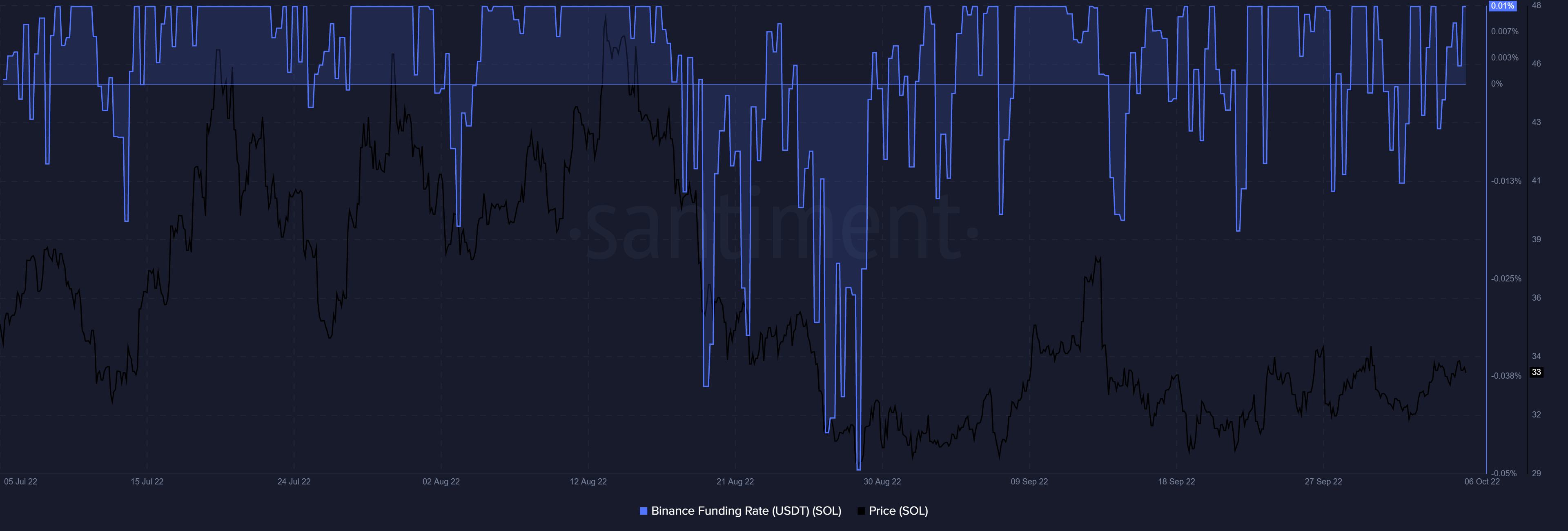

Despite the sluggish overall momentum, SOL’s funding rates on Binance turned positive presenting bullish sentiment on the futures market for the altcoin.

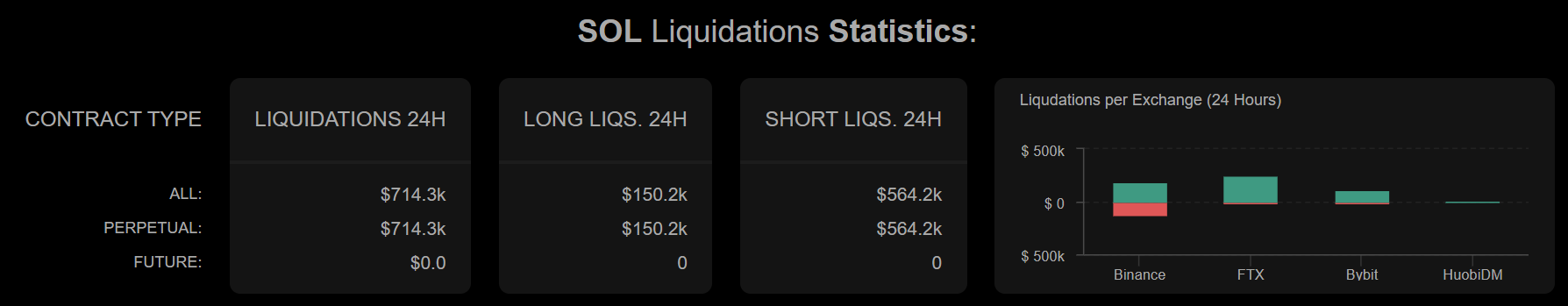

Additionally, SOL’s liquidation statistics showed that short liquidation considerably overtook long liquidation. While $564,200 worth of shorts were liquidated, only $150,200 longs saw liquidations giving an overall bullish tone to the market.

Seemingly, while futures traders were bullish on SOL in the short term, the same couldn’t be said for spot traders.

Fears of price falling to $13

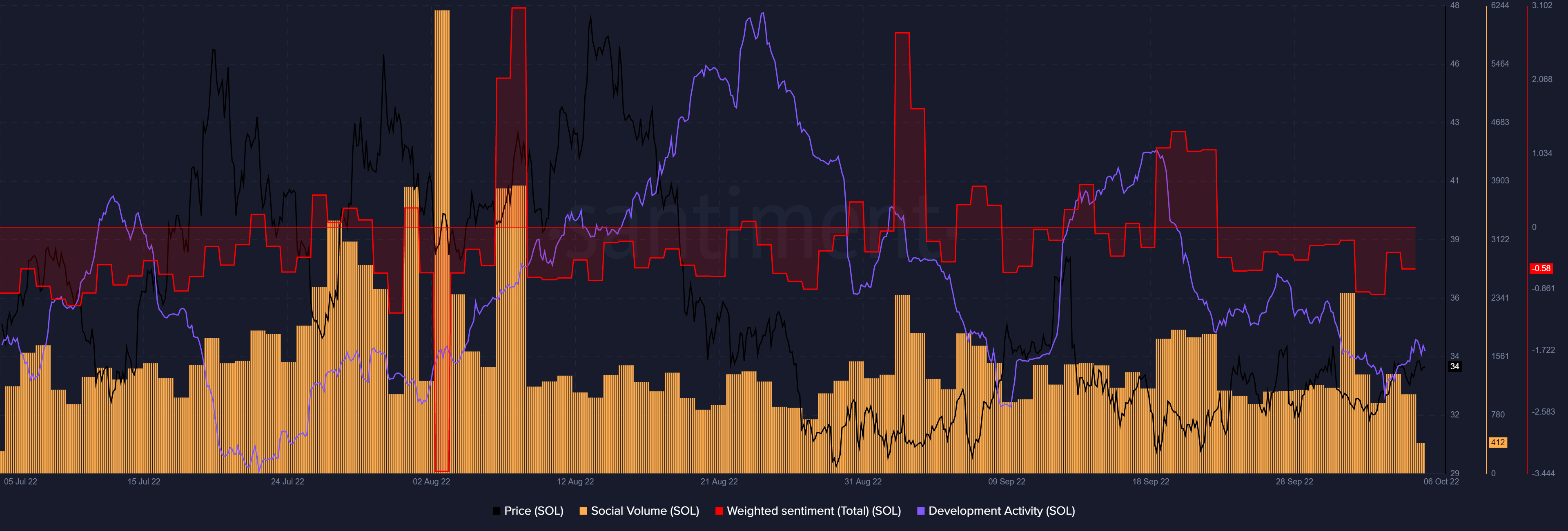

Even though SOL’s short-term technical indicators appeared to be positive, on-chain data from Santiment suggested that social volumes and weighted social sentiment for Solana had dwindled.

Additionally, SOL’s development activity took a hit during mid-Sept. and has been struggling to keep up since.

With no major retail euphoria and struggling development activity the next major support for SOL was at the $11-$13 level from where the altcoin rose in July 2021.

In the near term, if Solana bulls can place price above the $34 zone, some relief can be expected.

Be[in]Crypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.