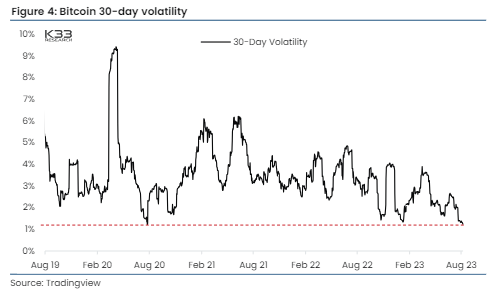

While Bitcoin (BTC) continues its quiet dance around the $29,000 mark, the market keenly observes the much-anticipated catalyst that could launch it to unprecedented highs—Exchange Traded Funds (ETFs). As the 30-day volatility drops to new lows and trading volumes seem to be on a hiatus, the catalyst we’ve been waiting for could very well be around the corner.

Bitcoin’s consistent performance has created a semblance of stability, leading options Implied Volatility metrics to decline. At the same time, a stable market has spurred an uptrend in perpetual Open Interest. Against this backdrop, leverage has been building, signaling a potential surge of volatility in store.

Big Bitcoin Catalyst

Catherine Wood, the CEO of ARK Invest, said, “I think the SEC, if it’s going to approve a Bitcoin ETF, will approve more than one at once.” And this seems imminent with the upcoming ETF decisions.

The US Securities and Exchange Commission (SEC) faces an impending decision on ARK 21Shares’ ETF filing. Previous events have showcased the tremendous influence of ETF momentum on the market, notably during June’s rally post-BlackRock’s ETF filing.

At this point, theories on whether SEC will approve, reject, or simply delay its decision are all speculation. ARK’s application will most likely impact market volatility. However, current indicators suggest a postponement, as the SEC’s focus remains divided, with its eyes also on the Grayscale lawsuit.

Historically, the SEC has leaned towards utilizing the entire span of its 240-day decision window. With ARK 21Shares’ filing verdict scheduled for release between Aug. 11 and Aug. 13, a potential spike in market activity and volatility is on the cards.

And ARK isn’t the sole player in this game. The horizon teems with more ETF deadlines, with Bitwise’s decision slated for Sept. 1 and subsequent decisions following closely on Sept. 2. The market, already in a state of heightened anticipation, may see increased volume and price fluctuations due to these impending verdicts.

If you choose to try and trade your way through these ETF decisions, check out our guide here first: 9 Best Crypto Exchanges for Day Trading in 2023

BTC Waits in Limbo

However, it’s not just the ETFs that have people interested. Bitcoin’s current stability, mirroring its behavior from the summer of 2020 and the incoming halving, provide a perfect environment for accumulation. This calm, though, has its own risks. As leverage builds, so does the chance of potential market liquidations.

For traders and investors, it’s a waiting game. BTC is experiencing sporadic short-lived volatility bursts and market volumes. Despite this, BTC remains in a tight consolidation phase around the $29,000 mark.

Concluding with the insights from an industry expert, David Rubenstein, Carlyle Group Co-Founder and Co-CEO, noted,

“Well, what has happened is people make fun of Bitcoin and other cryptocurrencies, but now the establishment of Larry Fink at BlackRock is saying they are going to have an ETF approved by the government. So you are saying, wait a second, the mighty BlackRock is willing to have an ETF in Bitcoin maybe Bitcoin is going to be around for a while.”

Bitcoin and the entire crypto sector still have an uphill battle ahead of them, but the SEC’s decision on the ETFs and overall regulations will be the biggest influence.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.