The crypto market and its range-bound movement have challenged many traders and their predictions. Still, some analysts were able to perfectly time Bitcoin price this week.

Bitcoin (BTC) price and the global crypto market cap, after the late October gains, continued to move in a tight range last week. For the most part of the last week, BTC price traded in red on the daily chart as it fell from the higher $20,700 to the lower $20,200 range.

With Bitcoin price noting a close to 3.9% pullback from Monday to Thursday, Friday offered some fresh gains to the crypto market. BTC price was up by 1.15% on Nov. 4 as most of the cryptos traded in the green.

Even though the crypto market momentum has been rather unpredictable, some technical analysts have been able to time Bitcoin perfectly. Here are a few instances when renowned traders were able to ace Bitcoin price action.

Crypto Analysts Acing Bitcoin Price Action

Technical analyst Crypto Lark told his 1 million followers on Twitter that Bitcoin monthly MACD is behaving exactly as it did in the last two bear markets. Lark predicted that this could be the “start to a long and slow grind back up,” which is exactly how the crypto market seems to be trending currently.

Another famous analyst, Dylan Le Clair, highlighted that Bitcoin Seller Exhaustion Constant flashed a potential bottom. The last two times the indicator presented such low numbers were in July 2020 and November 2018.

The crypto trader noted that while a move in either direction could be violent, BTC price could be range-bound for quite some time.

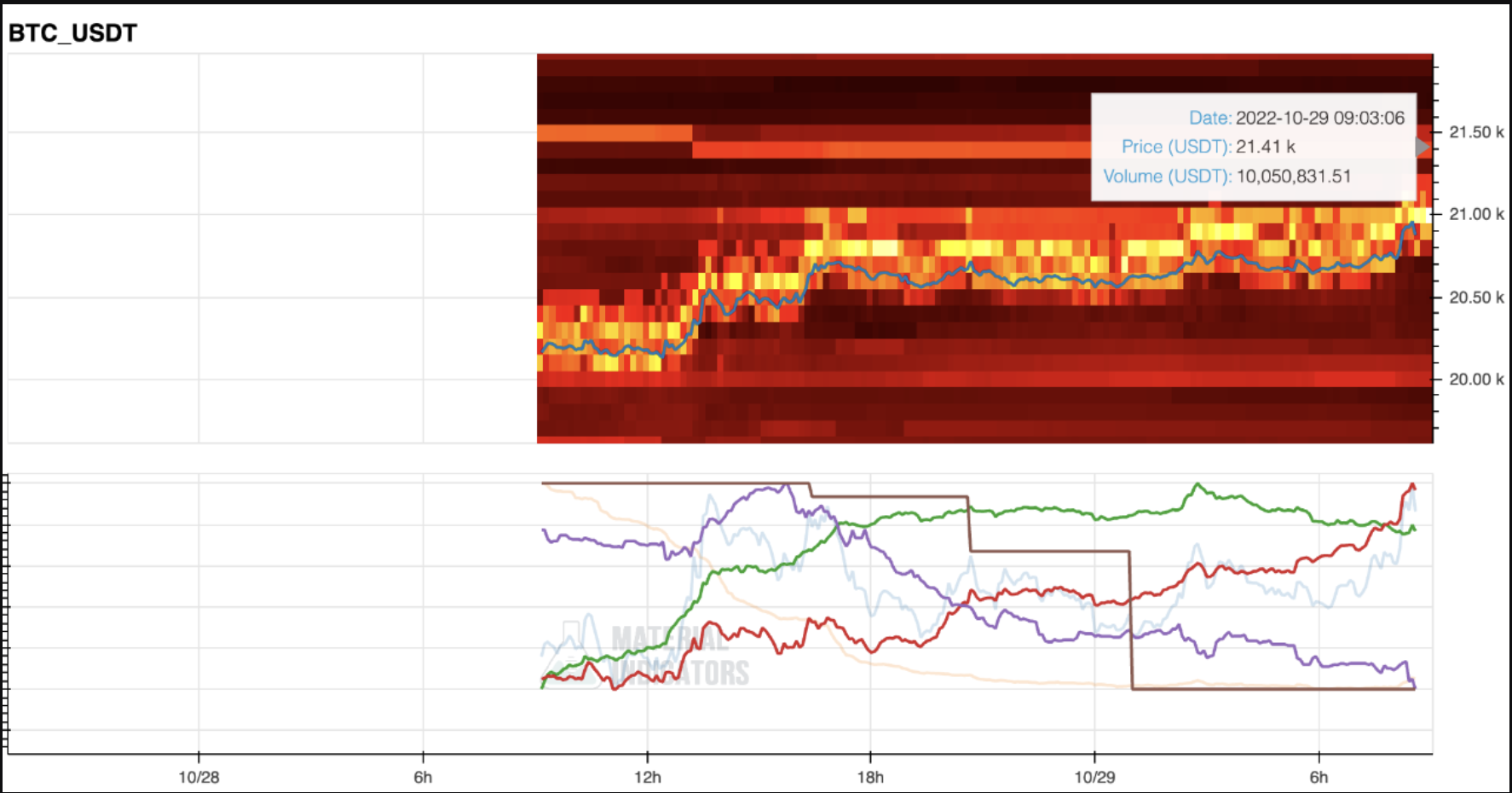

Le Clair highlighted in a Tweet that there is strong support for limit buyers in the $18,000-$19,000 range, while there are plenty of limit sellers in the $20,000-$21,000 range. As a result, Bitcoin price could “pinball in this range for weeks or even months.”

Notably, Bitcoin has, in fact, moved between the aforementioned range over the last 1.5 months.

Likewise, Bitcoin Archive said on Oct. 25 that Bitcoin price could breakout after DXY short-term breadown trend. Interestingly, BTC price saw an important 7% price uptick soon after.

Perfectly Timing the Dump

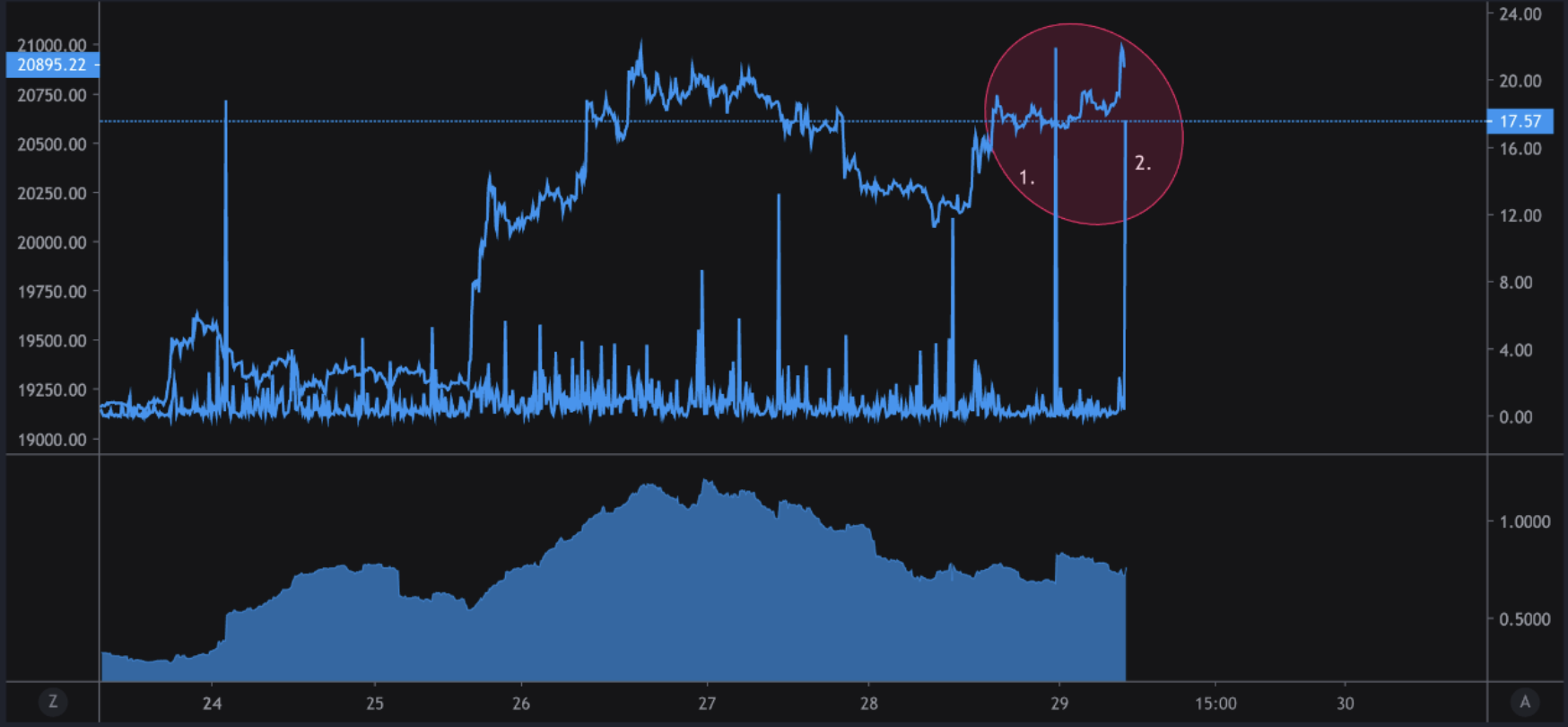

CryptoQuant analyst Onchain Edge said on Oct. 29 that “BTC could dump in the next 12 hours.” Over the following day, Bitcoin price noted a 2.8% pullback.

At the time, the analyst noted the following alerts:

- High BTC inflow into exchanges: Indicative of the number of BTC entering exchanges in a short amount of time. The first was a mean of 21 BTC, and the second was 17 BTC.

- The funding rate was positive with rising open interest and a lot of stables were sent to exchanges (possibly short positions).

- A lot of liquidity on crypto exchanges around the $21,400 range. If Bitcoin price shoots up to that level, it can cause a cascade of liquidations.

Another CryptoQuant analyst suggested on Oct. 31 that Bitcoin whales were making a move. There was a notable activity spike for whales owning 1,000-10,000 BTC, which is the highest activity in the month of October.

The high value indicated higher selling pressure in the spot exchange. As for derivative exchange, since coins could be used to open both long or short positions, a rise in inflows presented higher volatility.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.