BeInCrypto looks at the five biggest altcoin losers in the entire crypto market this week, specifically from April 28 to May 5.

The underperforming cryptos that saw prices falling the most in the entire cryptocurrency market this week are:

- Sui (SUI) price decreased by 71.72%

- Immutable (IMX) price decreased by 16.12%

- Injective (INJ) price decreased by 15.44%

- Render Token (RNDR) price decreased by 15.30%

- MultiversX (EGLD) price decreased by 12.92%

Sui (SUI) Price Leads Underperforming Cryptos

The SUI price has decreased below a short-term descending resistance line since May 4 and is trading very close to the $1.25 horizontal support area. Due to the lack of price history as the project only went live for trading this week, it is difficult to make an estimate as to where the price is heading next.

In any case, if the crypto asset moves above the resistance line, it could increase to the $1.34 resistance area. On the other hand, a breakdown from the $1.25 area can lead to a sharp fall toward the closest support at $0.96.

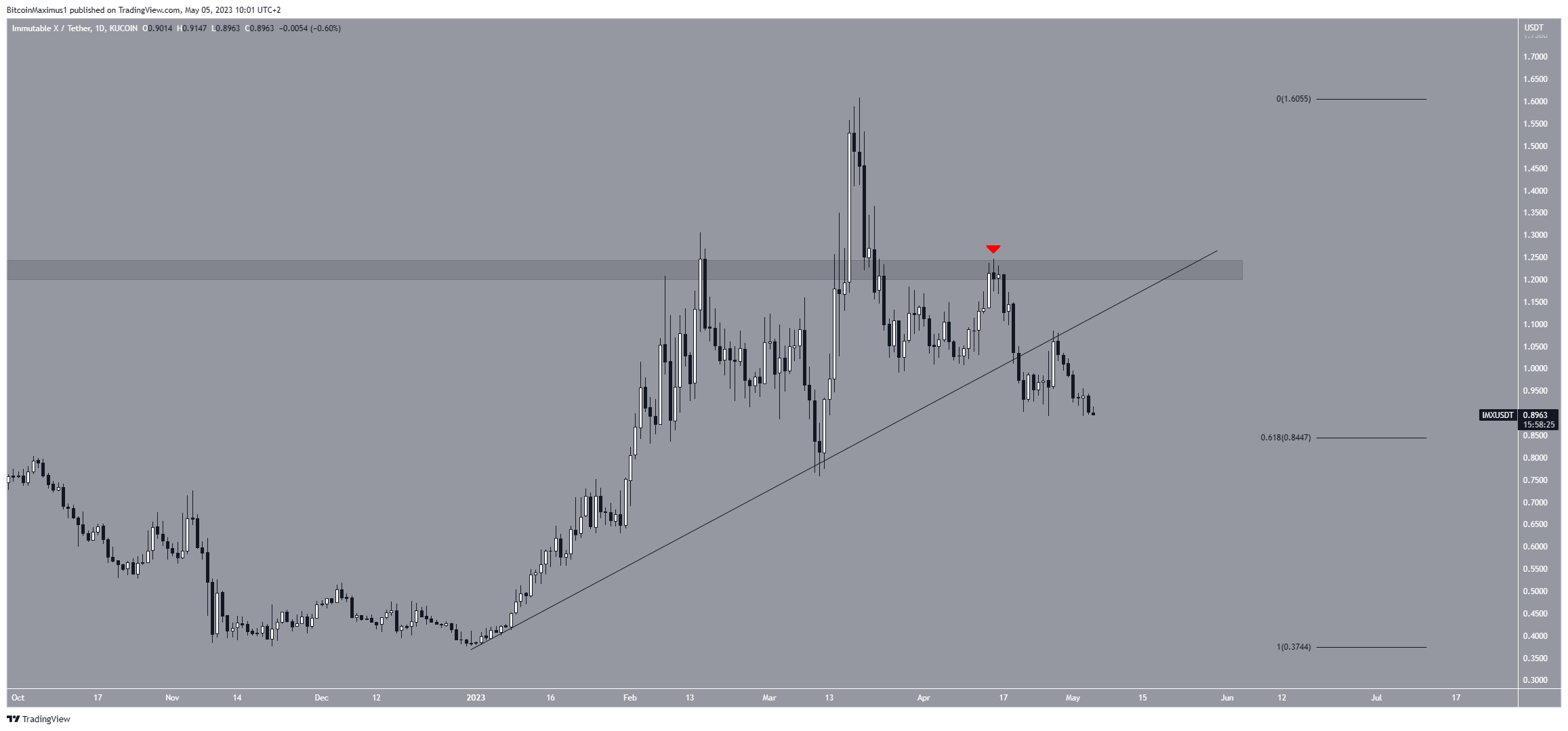

ImmutableX (IMX) Breaks Down After Rejection

The IMX price has fallen since it was rejected by the $1.25 horizontal resistance area (red icon) on April 15. Shortly afterward, it broke down from an ascending support line, suggesting that the previous increase is now complete.

If the downward movement continues, the closest support will be at $0.85, created by the 0.618 Fib retracement support level.

However, an upward movement toward the $1.25 resistance area could transpire if the digital asset regains its footing.

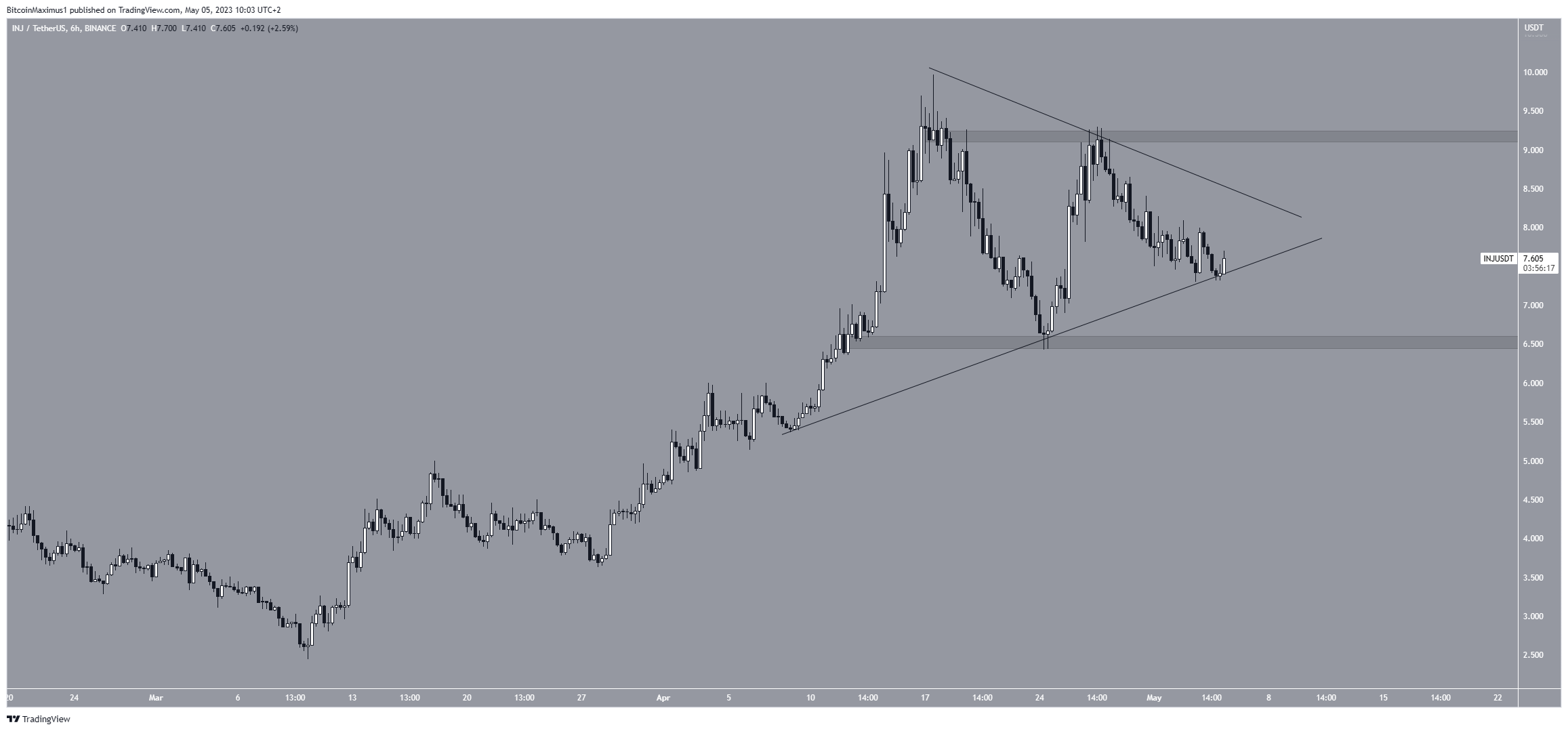

Injective (INJ) Trades in Neutral Pattern

The INJ price has traded inside a symmetrical triangle since Feb. 17. The symmetrical triangle is considered a neutral pattern, meaning that both a breakout and breakdown are possible. Currently, the price trades close to the pattern support line.

If the price breaks down, a fall to the $6.50 horizontal support area could occur. However, an upward movement to $9.20 is expected if a breakout transpires.

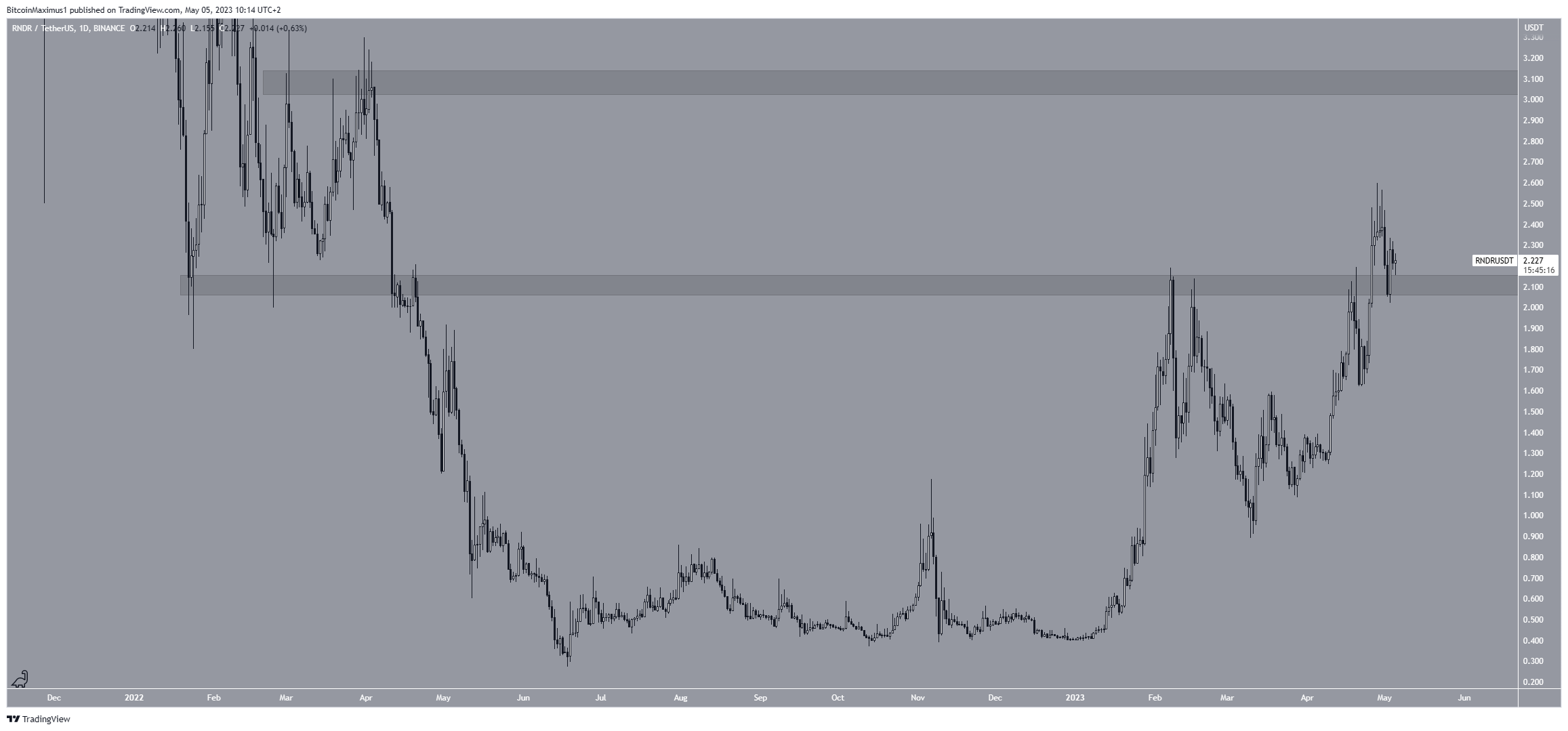

Render Token (RNDR) Bounces at Resistance

The RNDR price broke out from the $2.10 horizontal resistance area on April 26. Afterward, it returned to validate it as support on May 3 (green icon).

If the price begins another upward movement, it can increase to the next resistance at $3.10. However, if a breakdown transpires, a fall to $1.60 will be on the cards.

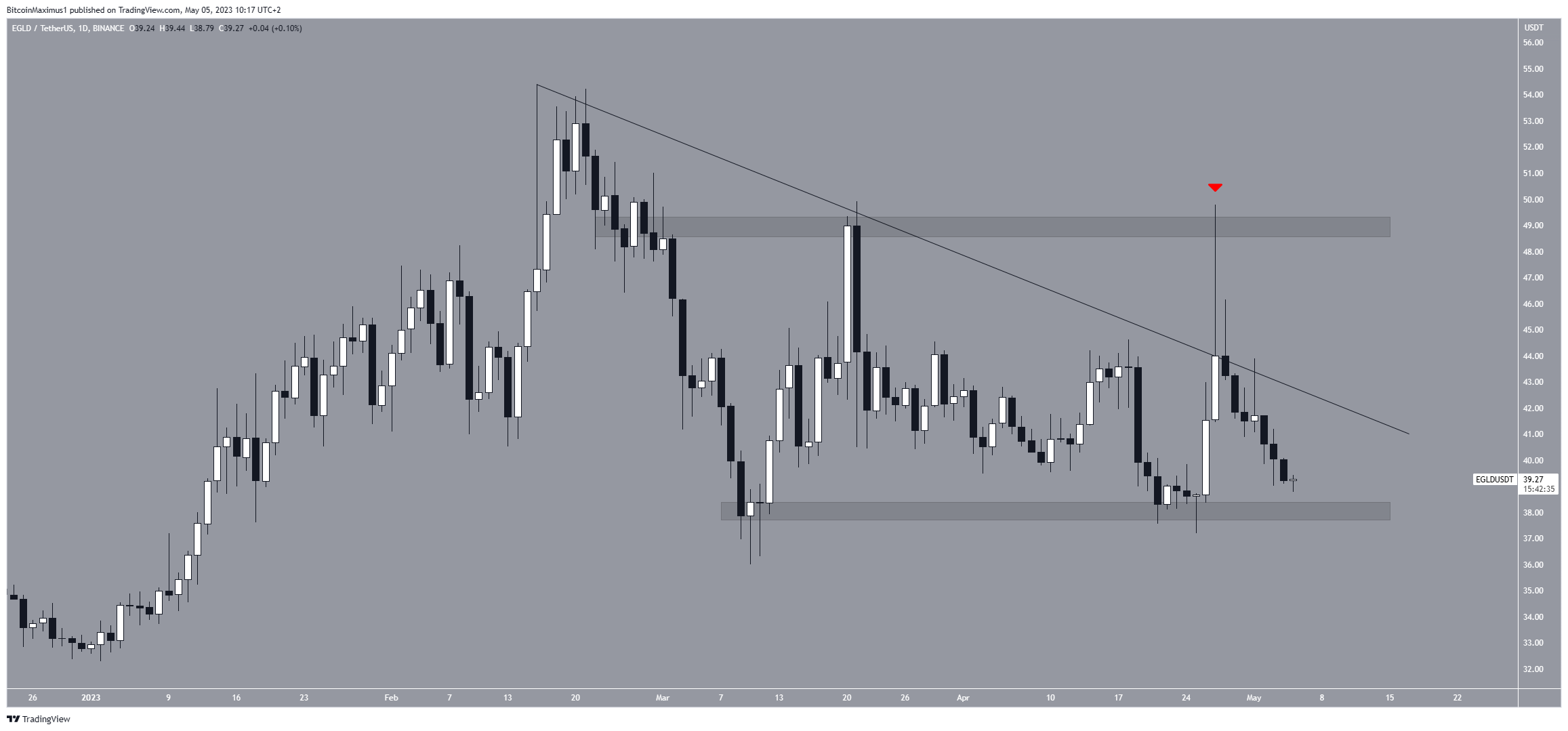

MultiversX (EGLD) Price Risks Breakdown

The final crypto loser is EGLD. The EGLD price has decreased under a descending resistance line since February. More recently, the line caused a rejection on April 27.

Now, the price is trading close to the $38 horizontal support area. When combined with the line, they create a descending triangle, which is considered a bearish pattern.

If the price breaks down, it can reach the $32 yearly low. However, if EGLD invalidates the bearish pattern and moves above the resistance line, an increase to $48 can occur.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.