In this article, BeInCrypto looks at the seven altcoins that increased the most over the past seven days (April 2 – April 9).

These altcoins are:

- Bitcoin Gold (BTG) – 155%

- Kucoin Token (KCS) – 146%

- XRP (XRP) – 70%

- Celsius (CEL) – 60%

- Stacks (STX) – 57%

- BitTorrent (BTT) – 55%

- Qtum (QTUM) – 53%

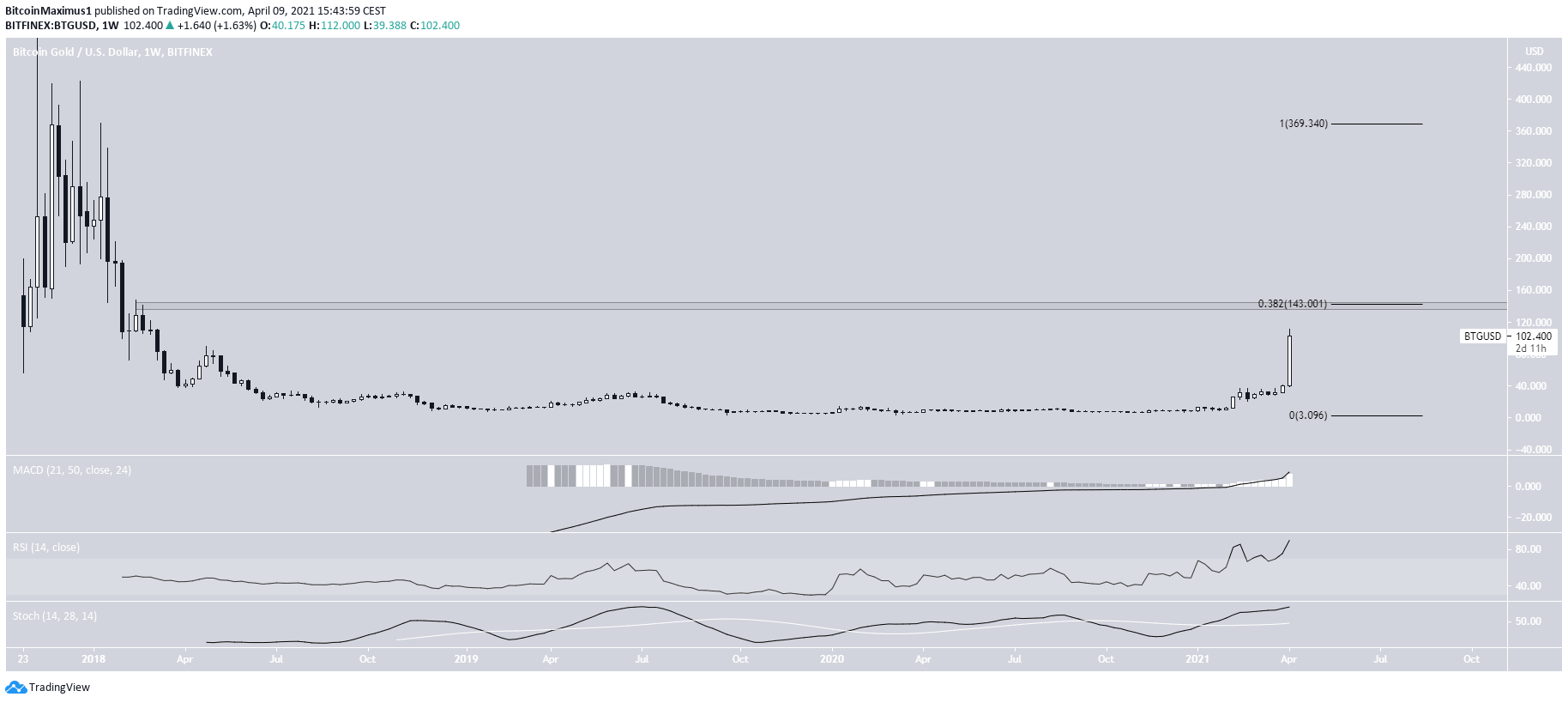

BTG

BTG has been increasing almost parabolically since April 3, when it was trading at a low of $40. Despite being overbought, technical indicators are still bullish.

The next closest resistance area is found at $143. This is both a horizontal resistance and the 0.382 Fib retracement level of the previous downward movement.

Some retracement is expected once BTG gets there, especially since the current upward movement is parabolic.

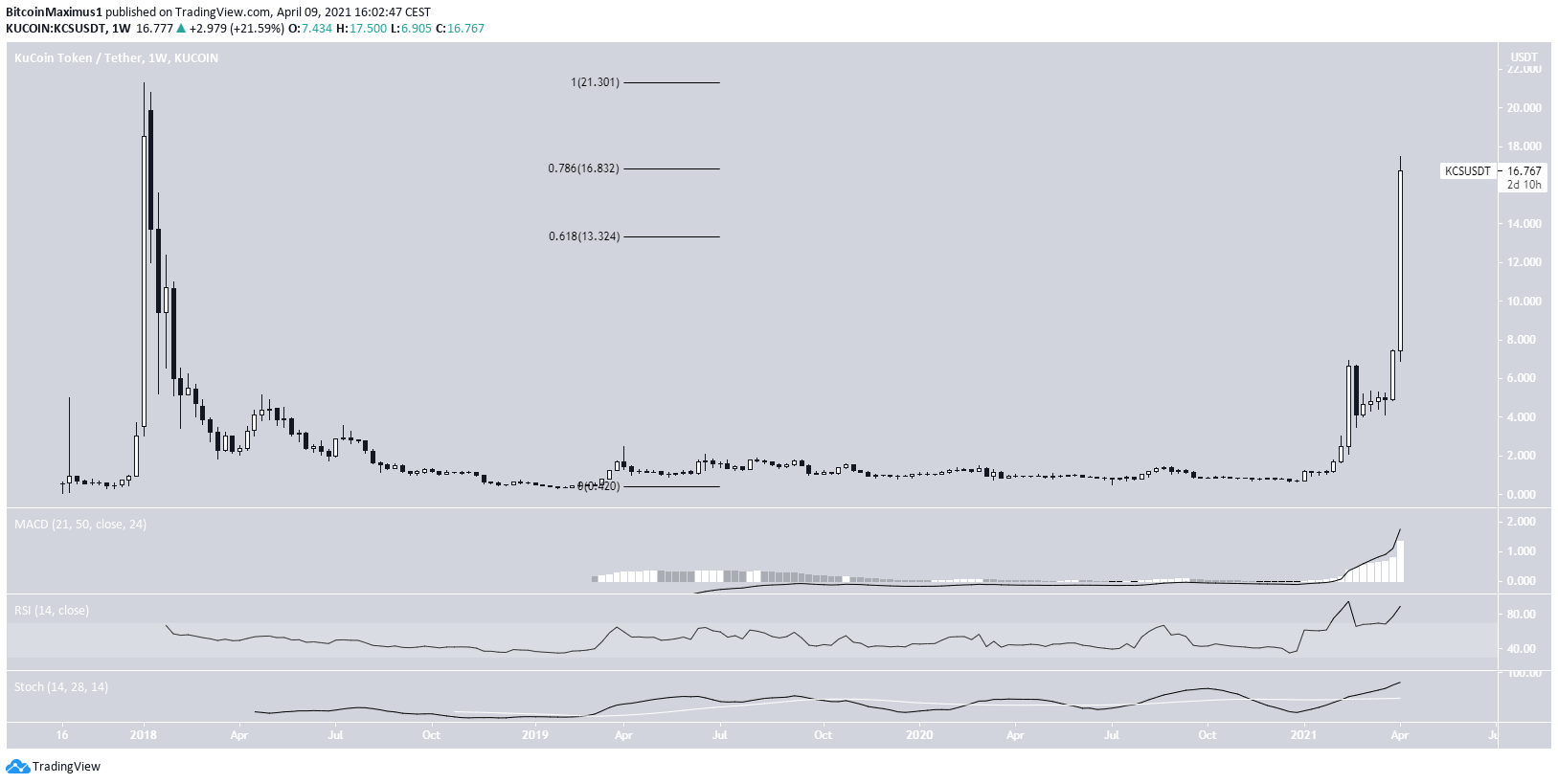

KCS

KCS has also been moving upwards for the past two weeks. The increase has been especially significant over the past two days, with KCS moving upwards by nearly 60%.

Technical indicators do not yet show any weakness.

However, it has just reached the 0.786 Fib retracement level at $16.83. Since KCS has not retraced since it was trading below $6, some retracement is expected.

The 0.618 Fib retracement level at $13.30 could act as support and create some sort of range.

XRP

XRP increased considerably last week and managed to move above the $0.90 resistance area. This might have been aided by an update to their sustainability efforts on April 5.

Technical indicators are bullish. This is especially evident by the bullish cross in the Stochastic oscillator, and the RSI crosses above 50.

The next significant resistance area is found at $1.41.

CEL

CEL had been trading inside a symmetrical triangle since Jan. 3, when it reached a high of $7.12.

The consolidation continued until the token finally managed to break out on April 5.

The breakout took it to a new all-time high price of $8.36 on April 7.

Currently, it is attempting to validate the previous resistance of $7.12 as support.

Technical indicators are bullish, and if successful, CEL would be expected to increase towards the next resistance at $9.30.

The soft launch of the Webapp was done on April 5, right around the time of the breakout.

STX

STX was subject to a rapid upward movement on April 5, increasing by 150%.

However, it has been on a downward trend since.

Despite the drop, STX managed to reclaim the $1.77 support area.

Now, it seems to be consolidating in a range between $1.75-$2.25.

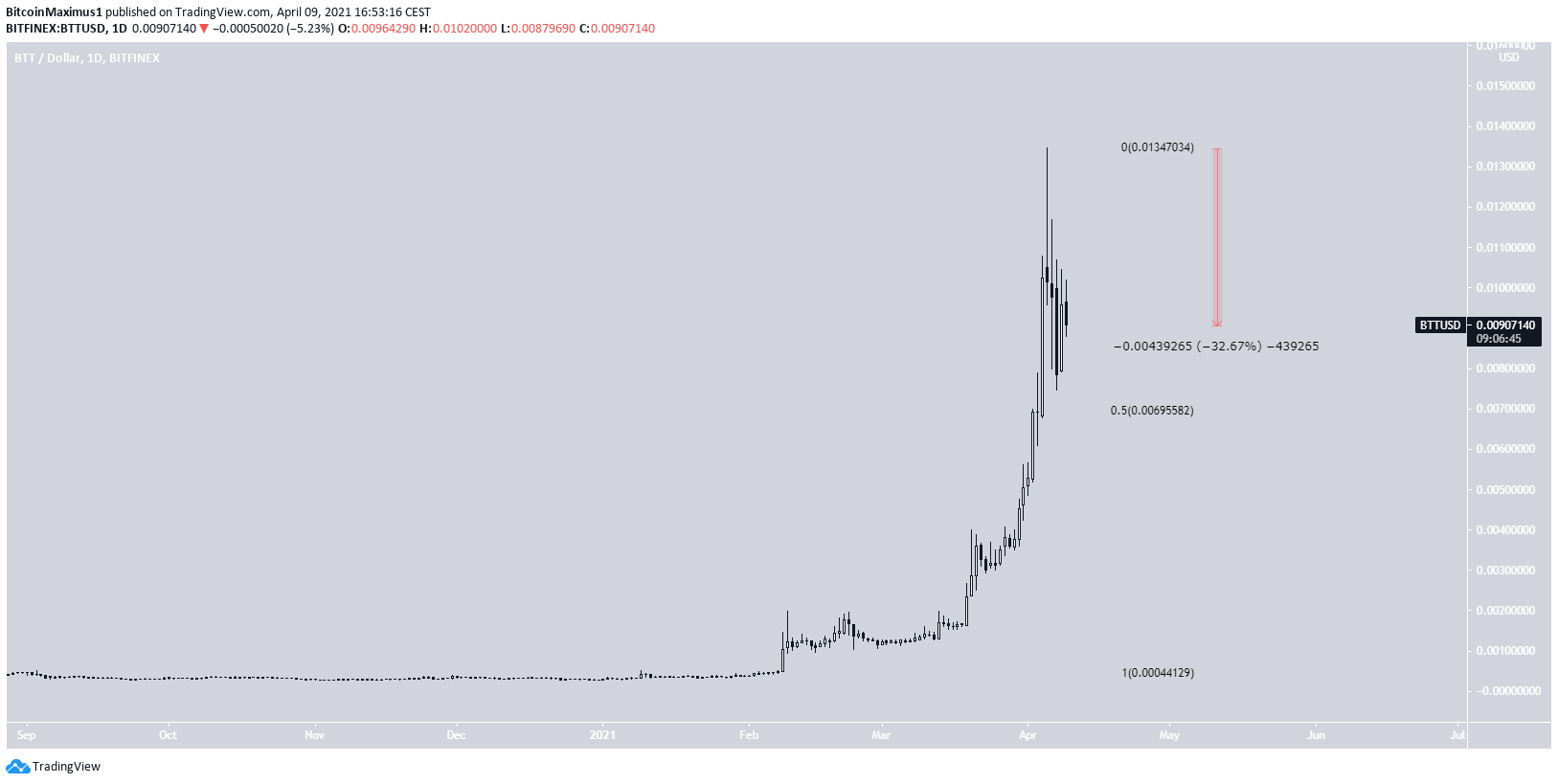

BTT

On April 5, BTT reached a high of $0.0134 and created a shooting star candlestick. This is considered a bearish reversal sign.

It has been moving downwards since, so far decreasing by 32%.

The upward move for BTT is completely parabolic. Thus when combined with the shooting star, BTT may continue to correct.

If so, the next closest support area would be found at $0.069.

QTUM

On April 3, QTUM released the update for the preceding month. The next day, it began a significant upward movement that led to a high of $17.98 on April 7.

QTUM has decreased slightly since and seems to be in some wave four, after which the token would expect another upward movement.

The main support levels are found at $12.70 and $11.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.