The Graph (GRT) price is recovering from multi-week lows, trading at $0.20, but this might be the extent of the recovery.

As GRT holders move to sell their holdings, the price will likely take a hit, resulting in the altcoin losing the recent gains.

The Graph Investors Like Their Profits

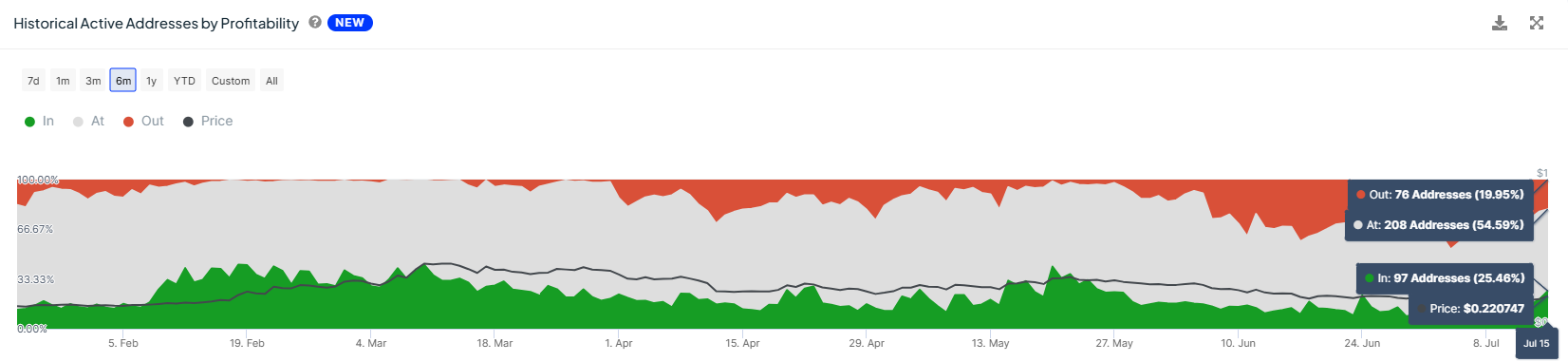

The rise in GRT price invoked investors’ interest in making money, resulting in the altcoin taking a hit. Signs of the same are visible upon observing the active addresses by profitability. The investors sitting in profit made up 26% of all participating investors.

Generally, these investors tend to be active only when they are seeking to book profits. Their dominance exceeding 25% is a bearish sign as it negatively impacts the price, resulting in a decline in profits or extending losses.

This is the case with The Graph as well.

Further substantiating this bearishness is the actions of the large wallet holders. The top wallet holders, excluding exchanges, have sold a substantial amount of tokens in the past two weeks.

About 70 million GRT, worth $14 million, have been sold by The Graph investors as the price rose. This profit-taking continues even as the GRT price struggles to close above $0.20.

Consequently, the altcoin could continue to hover around this support level, potentially even losing it amid the bearishness.

GRT Price Prediction: Aiming at Recovery

The GRT price is currently hovering at $0.20, attempting to flip the resistance level into support. Given that this level has been tested in the past, there is a fair chance that it could trigger a cooldown and further recovery.

On the other hand, if the selling continues, it is possible that this support could be lost. Consequently, the altcoin could slip to $0.16, wiping out all the gains noted in the last few days.

Read More: The Graph (GRT) Price Prediction 2024/2025/2030

But if the bounce off the support is successful, a rally to $0.26 is likely. This level marks the 23.6% Fibonacci Retracement line, and flipping it into support would invalidate the bearish thesis.