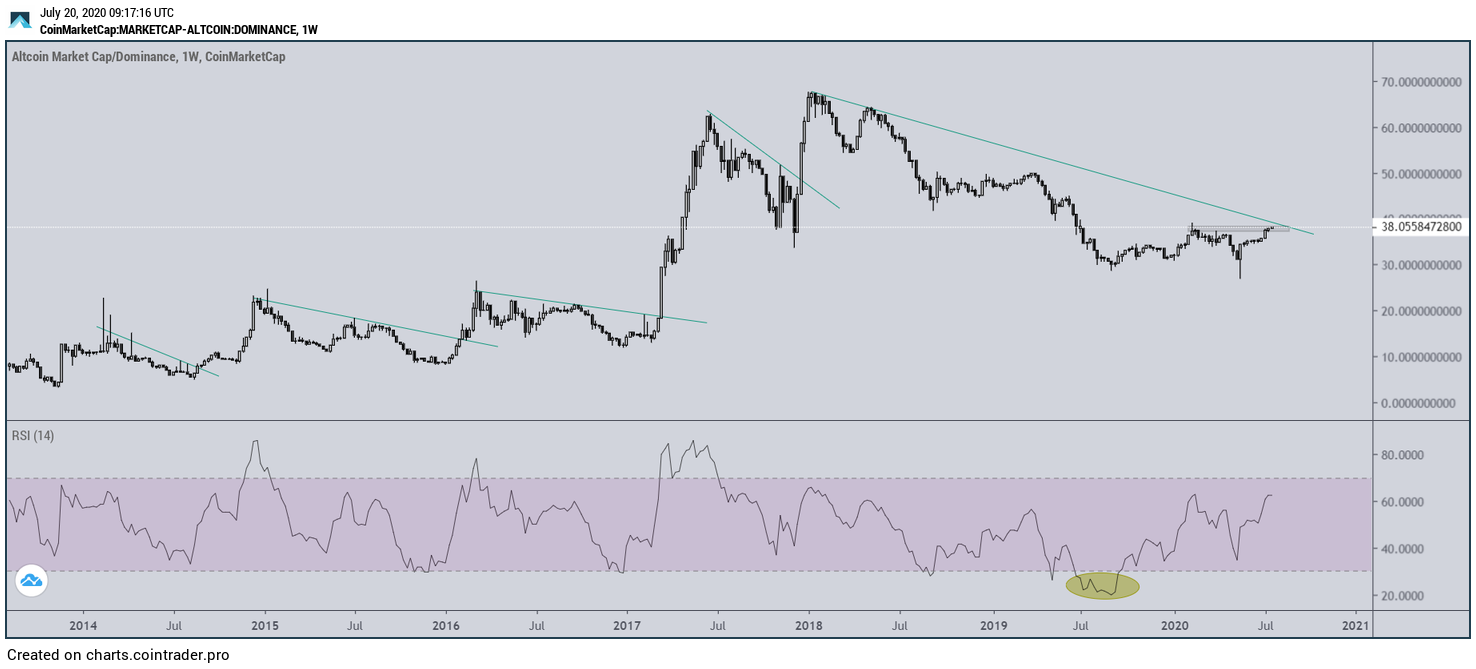

The Altcoin market cap (ALTCAP) is trading at a long-term descending resistance line, a breakout above which could trigger an impulsive bullish move.

Altcoin Market Cap

Cryptocurrency trader believes that the altcoin market cap (ALTCAP) will soon spike. He provided a chart to support this theory:

Until now, the altcoin market cap has had five similar spikes, which occurred on:

- July 2014

- August 2015

- February 2016

- March 2017 and

- February 2018

All of them began after the ALTCAP broke out from a descending resistance line that had been present since the previous high.

At the time of writing, the ALTCAP market cap was trading right at the latest descending resistance line, present since December 2017, and the 38% resistance area. Until it breaks out above both these levels, we cannot state with certainty that a bullish altcoin season has begun.

The weekly RSI reading in July 2019 was the lowest it has ever been, and the ALTCAP has been increasing since. While there is no bullish divergence yet, such extreme readings often signal a trend reversal.

Bitcoin Dominance Rate

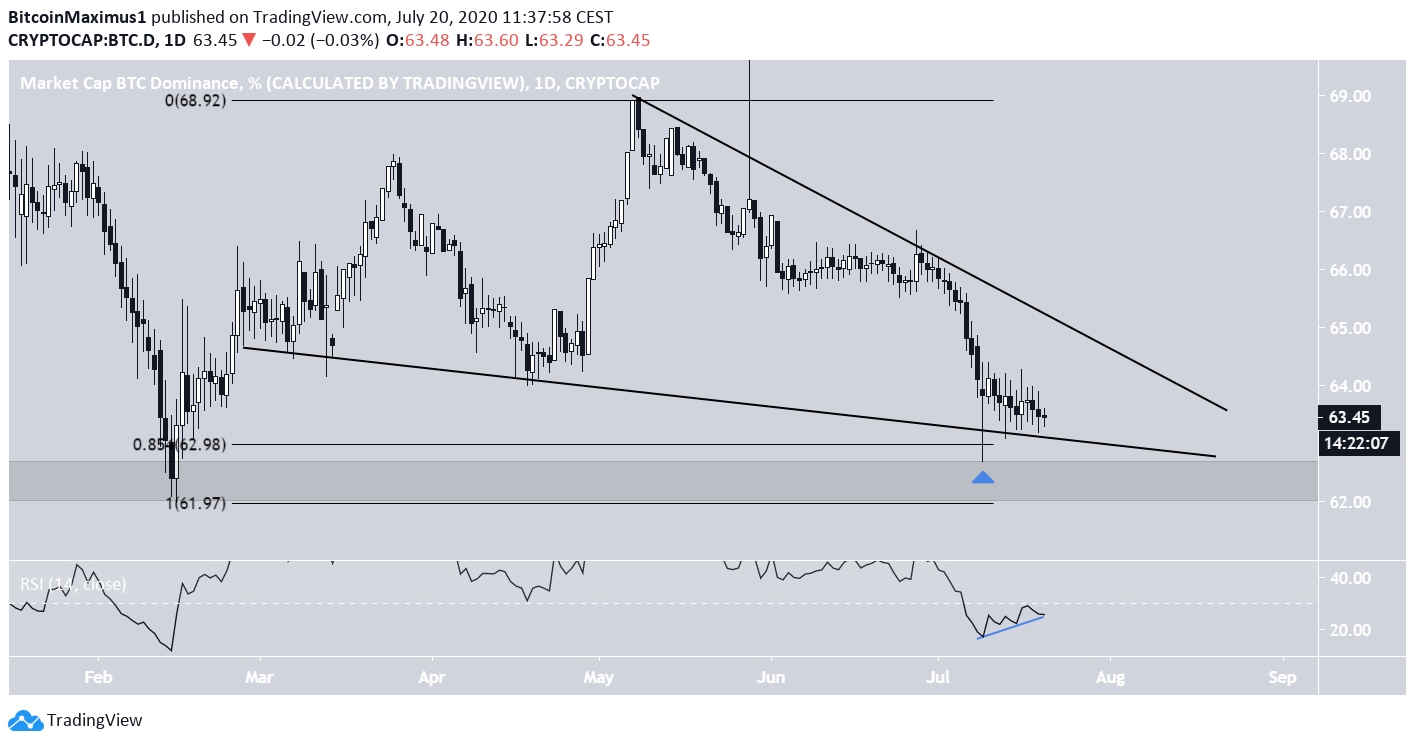

Since the Bitcoin dominance rate trades in the opposite direction, it also makes sense to look at its movement. Cryptocurrency trader @Incomesharks outlined a BTC dominance chart, stating that he expects another decline towards the 62% area, thus allowing altcoins to outperform.

The Bitcoin dominance rate has been declining since May, following a descending resistance line. In addition, it is possibly trading inside a descending wedge, which is known as a bullish reversal pattern.

The rate has also created a long lower wick right at the support area and has formed significant bullish divergence on the daily RSI. This suggests that the rate will increase in the short term, at least towards the resistance line of this wedge.

In the long-term, the rate is following a long-term descending resistance line from August 2019. In addition, there is a very strong support area at 61%.

The trend is clearly down and BTCD has been making successive lower highs and lower lows. However, until the rate either breaks out above this descending resistance line or breaks down from the support area, the long-term direction of the trend remains unclear.

At the time of writing, a short-term bounce seems more likely.