Thailand, a country that has previously touted itself as crypto-friendly, is planning to tax foreign income from crypto traders. The newly appointed government is scrambling to find ways to pay for its planned economic stimulus measures, including a nationwide airdrop.

On September 19, the Bangkok Post reported that the Thai Revenue Department is targeting overseas income, specifically mentioning cryptocurrency traders.

Traders Targeted by Thailand Crypto Tax

The proposed new tax would target Thais and foreign nationals living in the Kingdom for more than 180 days per year, it reported.

According to the new ruling, those who earn overseas income from work or assets will be subject to personal income tax.

The report revealed that legal experts said the new policy appears to have specific targets. These included “residents trading in foreign stock markets through foreign brokerages and cryptocurrency traders.”

A Finance Ministry source told the outlet:

“The principle of tax is that you must pay tax on income you earn from abroad no matter how you earn it and regardless of the tax year in which the money is earned.”

Local expat forums were flooded with comments and concerns from retired expats living in Thailand with pension income from abroad. However, it is unclear whether they are included in the new ruling or how the tax on crypto trading overseas will be collected.

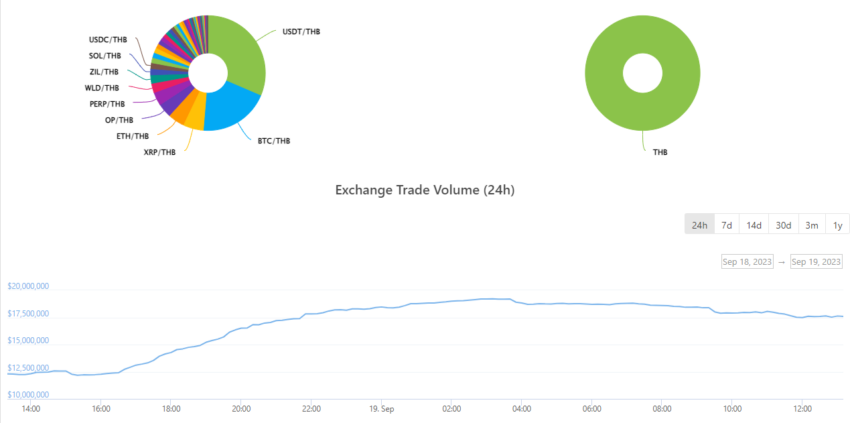

Thailand’s primary crypto platform, Bitkub, has a daily trading volume of $17.6 million.

However, this is a tiny fraction of that on Binance, the world’s largest exchange with over $4 billion in daily volume. Bitkub only offers 95 coins, whereas Binance has 362, so it is likely that many in Thailand could also be using overseas exchanges.

Financial experts also voiced caution stating that the new tax policy may alienate private bankers and financial institutions.

Thailand flip-flopped on a 15% crypto tax proposal in February 2022 following pushback from industry and the public.

Economic Stimulus Drive

Thailand’s newly appointed government has pledged a raft of economic reforms following a decade of stagnation under military rule.

One of its bold plans is a 10,000 THB (around $280) airdrop to eligible citizens using blockchain digital wallets.

The digital currency handout policy will cost an estimated 2 trillion baht (around $56 billion), which may explain the latest tax hunt.

In related news, the Thai government has just appointed a new Securities and Exchange Commission secretary-general. However, her stance on crypto is unclear.

Moreover, Thailand’s benchmark SET Index has dropped more than 8% this year, making it one of the worst performers in Asia. Foreign investors have pulled around $4.3 billion out of the Thai bourse, according to Bloomberg.

Therefore, the latest tax ruling could result in less money coming into the country rather than more if the trend continues.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.