The Texas-based cryptocurrency firm Lejilex, together with the Crypto Freedom Alliance of Texas (CFAT), has filed a lawsuit against the US Securities and Exchange Commission (SEC). They argue the SEC has overstepped its bounds by classifying certain digital assets as securities.

This case arises amidst regulatory tensions, with the SEC facing criticism for its approach to digital asset oversight.

Why Lejilex Dragged the SEC to Court

Lejilex wants to launch Legit.Exchange, a platform for trading cryptocurrencies. However, the SEC’s stance casts a shadow over their plans. The agency has labeled some of the digital assets Lejilex intends to list as securities.

This classification is based on ongoing legal battles with major exchanges like Coinbase and Binance. Consequently, there’s a growing debate within the crypto community about the nature and regulation of digital assets.

Moreover, Lejilex and CFAT challenge the notion that digital assets meet the criteria of “investment contracts” and thus should be regulated as securities. They believe this interpretation lacks legal clarity and imposes unnecessary regulatory burdens. Their argument hinges on the “major questions” doctrine.

This principle suggests that significant regulatory actions require explicit authorization from Congress. Yet, this argument has found limited support in recent legal precedents involving crypto companies.

“We wish we were launching our business instead of filing a lawsuit, but here we are,” Lejilex co-founder Mike Wawszczak said.

Choosing to file the lawsuit in Fort Worth is strategic. The region falls under the 5th US Circuit Court of Appeals, known for its conservative leanings. This decision underscores the crypto firm’s tactical approach to seeking a favorable legal environment. It highlights the growing trend of crypto entities challenging SEC regulations in court.

SEC Turns Crypto Into a Battleground

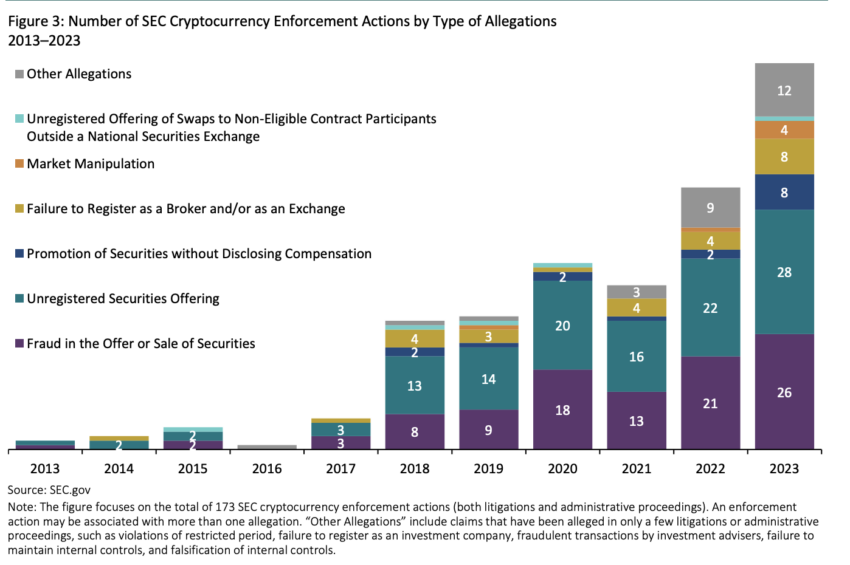

The backdrop of this legal challenge is a year marked by heightened SEC enforcement within the crypto sector.

Under Chairman Gary Gensler’s leadership, the SEC has intensified its scrutiny, leading to a record number of enforcement actions. This aggressive regulatory posture has stirred unease across the crypto industry.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

As Texas becomes a focal point for crypto, especially with its crypto mining operations, the state is also wrestling with related environmental and noise pollution issues.

These challenges add another layer to the complex interplay between the crypto industry and regulatory bodies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.