Tether, the world’s leading stablecoin issuer, has significantly bolstered its reserves by acquiring 8,889 Bitcoin (BTC).

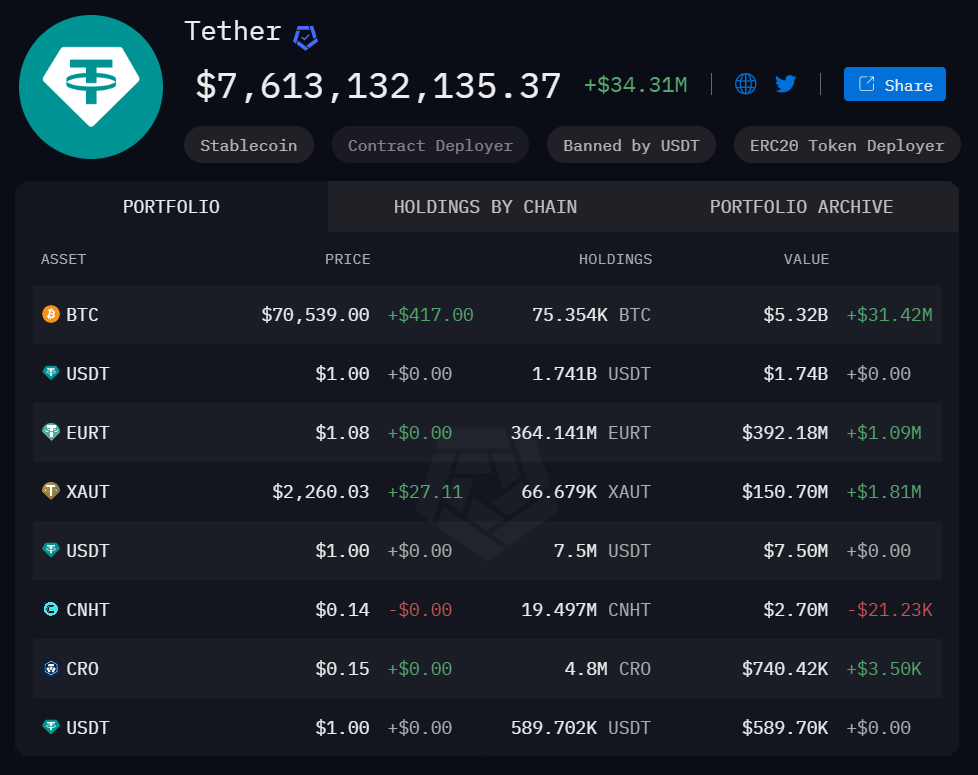

Tether’s most recent purchase brought its total Bitcoin reserves to over 75,000 BTC, with a combined value exceeding $5.3 billion.

Tether’s Growing Embrace of Bitcoin

The on-chain data reveals that Tether received the Bitcoin from Bitfinex’s hot wallet on March 31, 2024, at 17.21 UTC. At the time of the transaction, those Bitcoins were worth approximately $627 million.

Over the past year, Tether has demonstrably increased its Bitcoin holdings. Tether first disclosed its Bitcoin holdings in the first quarter of 2023. At the time, they also claimed to regularly invest up to 15% in Bitcoin from ‘corporate profits’ earned from ‘excess Tether stablecoin reserves.’

“The decision to invest in Bitcoin, the world’s first and largest cryptocurrency, is underpinned by its strength and potential as an investment asset,” said Paolo Ardoino, CEO of Tether.

Read more: Who Owns the Most Bitcoin in 2024?

Tether’s latest attestation report for Q4 2023 provided further insights into the financial impact of these investments. According to the report, Bitcoin contributed $2.8 billion to the company’s consolidated reserves. Such financial maneuvers underscore Tether’s commitment to leveraging cryptocurrency market dynamics to bolster its economic standing and operational resilience.

Beyond its investments in digital assets, Tether is broadening its horizons to encompass key technological and infrastructural domains. The company has ventured into different areas, including Bitcoin mining and artificial intelligence (AI) technology.

Consequently, this strategic action signals its ambition to become a multifaceted investor and infrastructure developer within the digital asset industry.

“While Tether is mostly known for one product (USDt), the Company is becoming an investor and infrastructure builder in many strategical sectors, spacing from AI to P2P telecommunications, from Bitcoin mining to renewable energy production,” Ardoino wrote.

The expansion of Tether data’s AI focus will focus on several key areas, including developing open-source, multimodal AI models to set new industry standards and driving innovation and accessibility within AI technology.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

Tether’s augmented Bitcoin reserves and practice expansion into new technological realms indeed reflect a strategic pivot towards diversification and innovation.