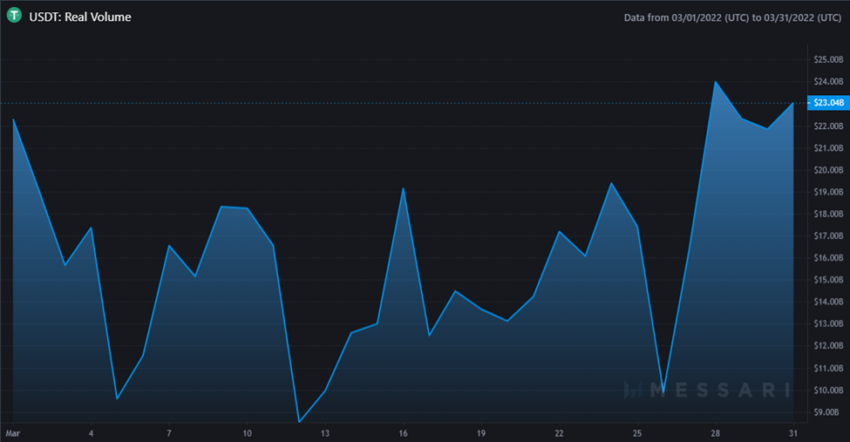

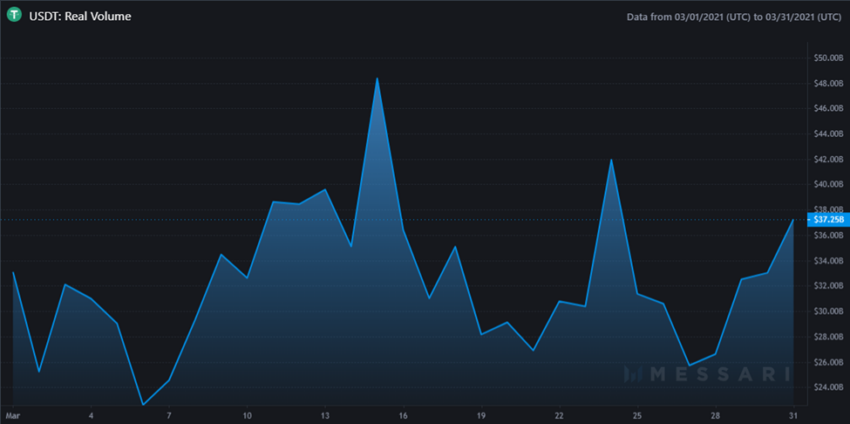

Tether (USDT) experienced a slight increase in real trading volume during the month of March, but plummeted by more than $500 billion since 2021.

Indeed, March proved to be a difficult month for the crypto community, leaving stablecoins more vulnerable than ever. Based on Be[In]Crypto research, stablecoins continued to trade below some of the highs it experienced last year.

As USDT remains to be the largest stablecoin by market cap, up by at least 1% since February of this year. By early March, the stablecoin was trading at around $443 billion.

USDT real volume fell to a yearly low

The slight increase in yearly volume could have a detrimental effect on the token’s future usage, given it competes against BUSD, USDC, and TUSD, among others.

Last month, USDT experienced a 50 percent decrease in real volume year-over-year, sitting around $1 trillion, according to Be[In]Crypto research.

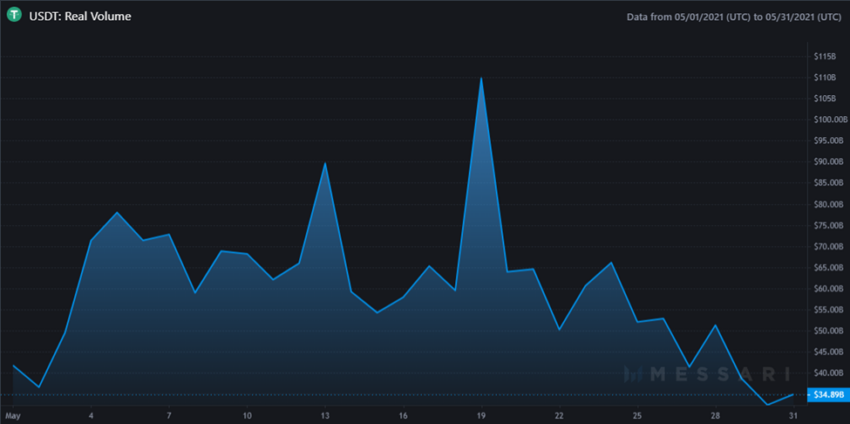

The first two weeks of May 2021 saw an increase in investor demand for digital assets, subsequently leading to new price milestones for several coins. The last two weeks of the month also witnessed a bearish engulfing which also led to a plunge in the price of tokens, leaving USDT with a real volume of $1.84 trillion.

In bearish markets, the demand for stablecoins increases as millions of traders use these coins to prevent large percentage losses. Fast forward to last month’s end, USDT experienced a 72% decrease in real volume, compared to May of last year.

Why the decline?

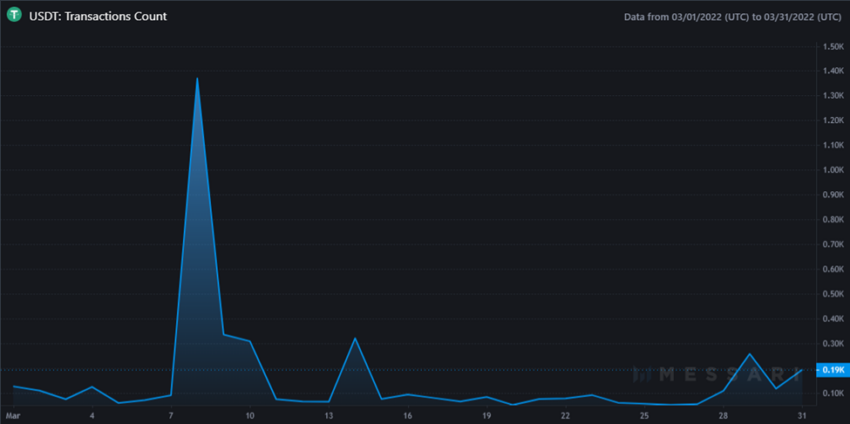

One of the primary factors that can be attributed to Tether’s decline in real trading volume is the dwindling in transaction counts.

Looking at both March and May 2021, the total transaction counts were around 20 million and 28 million, respectively. In contrast, however, February and March 2022 witnessed 4,266 and 4,806 total transaction counts, respectively.

At March’s conclusion, the total transaction count was 99.976% below the total transaction count for March 2021.

USDT/BTC volume was down in March

Last month, the yearly real volume decline was reflected in the USDT/BTC trading volume, which sat around $45 million, compared to March 2021, which rested comfortably at $50 million.

Despite the decreasing real volume from the highs of 2021, USDT remains the most popular and used stablecoin by traders and investors.

What do you think about this subject? Write to us and tell us!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.