Tether has announced plans to launch a stablecoin pegged to the United Arab Emirates Dirham (AED). The token will be fully backed by liquid reserves based in the UAE, ensuring stability for users.

Stablecoins have become a key sector in the crypto space, with Tether’s USDT leading in revenue generation, earning $93.75 million.

Tether to Launch AED-Backed Stablecoin

Tether has partnered with Phoenix Group PLC, a UAE-based multi-billion dollar technology conglomerate, along with support from Green Acorn Investments Ltd., to launch a stablecoin pegged to the UAE Dirham (AED). The new token will join Tether’s existing stablecoin offerings, including USDT, EURT, CNHT, MXNT, XAUT, and aUSDT.

“Tether’s Dirham-pegged stablecoin will provide users with a seamless and cost-effective means of accessing the benefits of the AED. The digital asset will streamline international trade and remittances, reduce transaction fees, and provide a hedge against currency fluctuations. Thus, it will play a crucial role in the financial ecosystem of the UAE and beyond,” the announcement read.

Tether’s move is aimed at boosting liquidity in crypto market and offering more choices for traders. This development could positively impact the broader cryptocurrency ecosystem by attracting more regional investors and businesses. Additionally, given Bitcoin’s historical positive correlation with USDT’s market cap, this expansion could potentially drive Bitcoin’s price as well.

Read more: 9 Best Crypto Wallets to Store Tether (USDT)

Tether’s interest in the UAE aligns with the region’s supportive stance on cryptocurrency and blockchain technology. The UAE has been proactive in establishing regulatory frameworks to oversee the use of digital assets.

“Very excited for the UAE Dirham-Pegged stablecoin. The opportunity is immense,” Ardoino wrote.

The UAE has solidified its reputation as a crypto-friendly destination, attracting a growing number of businesses involved in this space. Dubai, in particular, has become a key hub for blockchain activities, hosting conferences and promoting crypto innovation.

“I think Dubai is already a crypto hub. When I first got to Dubai, only a handful of crypto companies existed. Today there are probably a couple of thousand. On top of that, thousands of businesses are in the application process for registration, licensing, etc. There’s a crypto event in Dubai almost every night – dinners, seminars, etc. I’m invited to multiple events every night,” Binance ex-CEO Changpeng Zhao highlighted in a mid-2023 AMA.

UAE Solidifies its Global Crypto Hub Reputation

Additionally, the Dubai Financial Services Authority (DFSA) and the Abu Dhabi Global Market (ADGM) have implemented regulations to license and supervise digital asset businesses within their jurisdictions, including monitoring crypto exchanges.

In June, the UAE Central Bank introduced the Payment Token Services Regulation, recognizing digital money services as financial activities requiring Central Bank licensing and oversight. If the UAE-pegged stablecoin launches, it will likely pave the way for other stablecoins to seek licensing under this new regulatory framework.

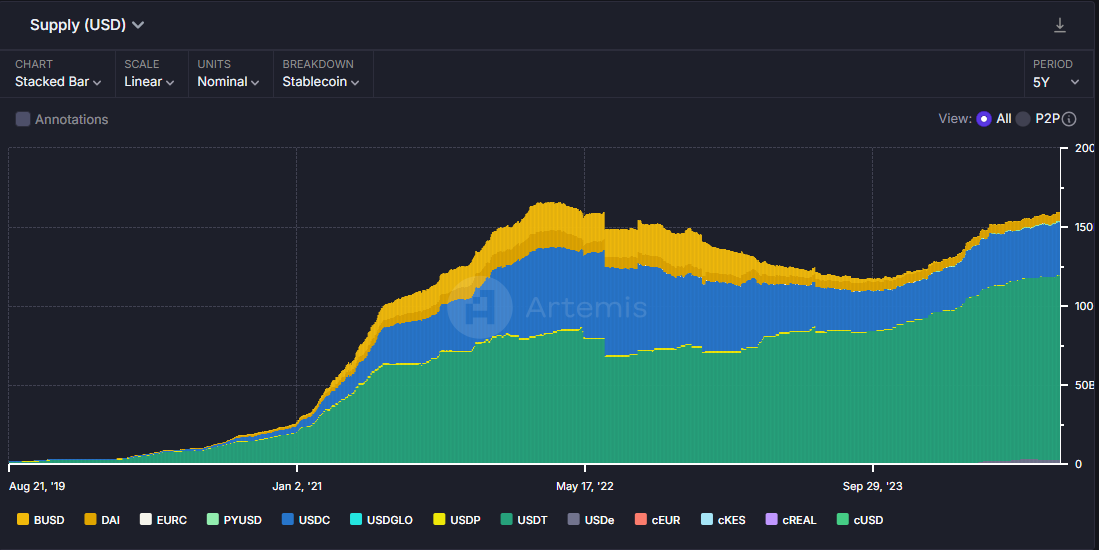

Meanwhile, the stablecoin industry has become increasingly lucrative, with the total supply surpassing $160 billion for the first time in over two years, nearing all-time highs. Tether’s USDT dominates the market, generating revenues of $93.75 million. Circle’s USDC follows with $28.89 million.

Read more: A Guide to the Best Stablecoins in 2024

The growing supply of stablecoins reflects their rising adoption and deeper integration within the crypto ecosystem, signaling increased trust and reliance on these assets for trading, payments, and financial services.