Be[in]Crypto takes a look at the price movement of seven different cryptocurrencies, including Terra (LUNA), which has increased by 20% since April 18.

BTC

Bitcoin (BTC) has been increasing alongside an ascending support line since Jan 24. Throughout the upward movement, there have been three distinct bullish candlesticks with very long lower wicks (green icons). These wicks are considered signs of buying pressure.

The previous two led to significant upward movement. If the current one does the same, BTC could increase all the way to $45,000, reaching a descending resistance line (dashed).

ETH

Ethereum (ETH) had been decreasing alongside a descending resistance line since April 4. The downward movement led to a low of $2,883 on April 18.

However, ETH bounced afterward and broke out from the descending resistance line on April 18.

If the upward movement continues, the next closest resistance would be between $3,150 and $3,235. The resistance is created by the 0.382 – 0.5 Fib retracement resistance level.

XRP

Similar to ETH, XRP had been decreasing alongside a descending resistance line since March 28. This line led to a low of $0.68 on April 11.

Afterward, the price bounced and broke out from the resistance line on April 15. It returned to validate it as support three days later.

So far, XRP has failed to move above the 0.5 Fib retracement resistance level at $0.80.

If it is successful in moving above it, there would be strong resistance at $0.835. This is the 0.618 Fib retracement resistance level and a horizontal resistance area.

VET

VeChain (VET) had been decreasing alongside a descending resistance line since March 31. the decrease led to a double bottom pattern from April 11 to 18. After generating multiple bullish divergences in the RSI and MACD, VET broke out from the resistance line on April 19.

If the upward movement continues, the next closest resistance area would be between $0.072 and $0.076. This is the 0.5 – 0.618 Fib retracement resistance area.

ZIL

Zilliqa (ZIL) has been falling since reaching a high of $0.23 on April 1. The downward movement led to the creation of a double bottom pattern from April 13 to 18.

Besides being a bullish pattern, the double bottom was combined with bullish divergences in both the RSI and MACD.

If the upward movement continues, the closest resistance area would be at $0.15. This is the 0.382 Fib retracement resistance level when measuring the most recent portion of the drop.

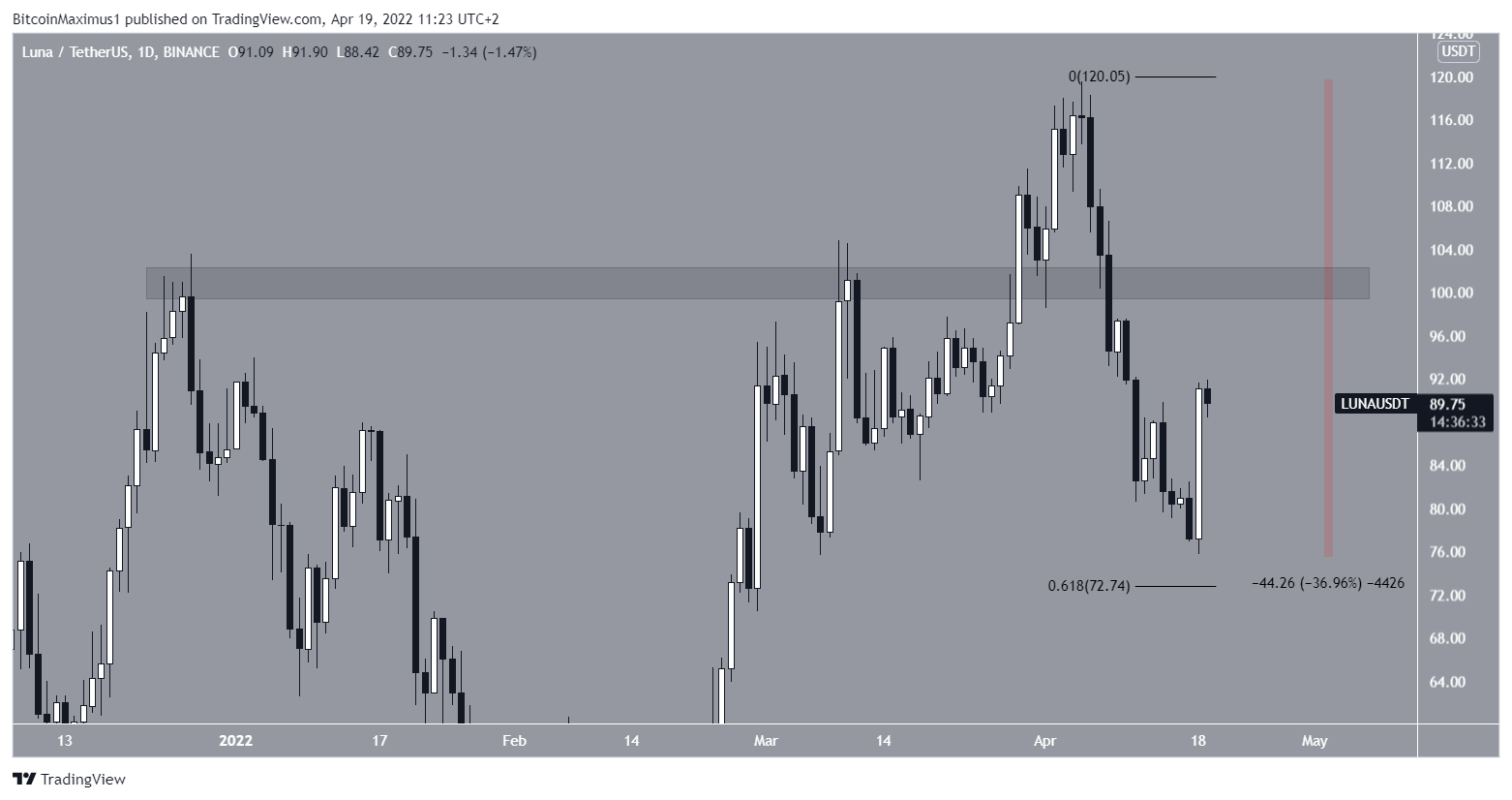

LUNA

Terra (LUNA) has been falling since reaching an all-time high of $119.55 on April 5. It reached a low of $75.67 on April 18, which amounted to a fall of 37% since the high.

LUNA bounced considerably on April 18, increasing by 30% in a day. However, despite the bounce, the trend cannot be considered bullish until the $101 area is reclaimed.

OGN

Origin Protocol (OGN) broke out from a descending resistance line on April 15. It continued to increase until it reached a high of $0.723 on April 18.

However, the price created a long upper wick once it was rejected by the 0.618 Fib retracement resistance level.

If a downward movement occurs, as a result, the closest support area would be at $0.57. This is a horizontal area that previously acted as resistance.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here