PAAL AI (PAAL), the Telegram coin developed on the Ethereum blockchain, has seen its price drop by 10% in 24 hours. At press time, it trades at $0.19.

The price represents a 77.50% decrease from its all-time high in March. This on-chain analysis examines the factors responsible for the recent drawdown and its likely next movement.

Crypto Whales Ditch PAAL AI

BeInCrypto’s findings reveal that PAAL suffered from notable selling pressure due to the decision of one of its notable stakeholders. The investors involved in this decline are whales, a key cohort whose action and inaction can greatly influence prices.

According to IntoTheBlock, PAAL AI’s large holders’ netflow dropped by 72% in the last seven days and has remained this way for the last 30 to 90 days. Large Holders’ netflow is the difference between their Inflow and Outflow.

When this difference increases, it means that whales are accumulating more coins than they are distributing. In most cases, this rise in coins purchased foreshadows a price increase.

However, a net negative in this regard suggests that distribution is higher. As this is the case with PAAL, the price extended its losses.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

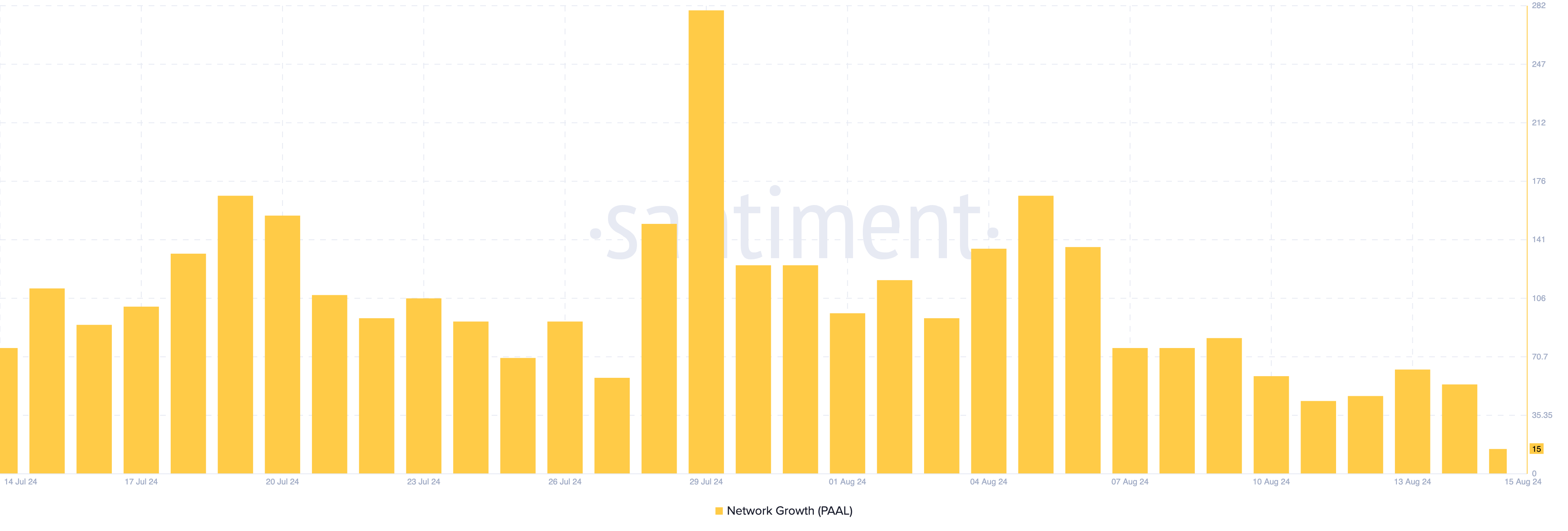

If crypto whales keep on liquidating their PAAL holdings, the price may continue to decline. Beyond this selling pressure, on-chain data from Santiment shows a significant drop in the project’s network growth.

Network growth measures the number of new addresses interacting with a cryptocurrency for the first time.

When this number increases, it implies an influx of new participants making their first successful transaction. However, a decrease suggests a drop point to a dearth in traction and lack of adoption.

For PAAL AI, the recent decrease infers that crypto currently faces a shortfall in the required demand to help the price recover. If sustained, the price of PAAL may decrease again, as mentioned earlier.

PAAL Price Prediction: The Coin Struggles Continue

Based on the daily chart, PAAL has formed a rounding top pattern. Also known as an inverted rounding bottom, this pattern is characterized by an initial uptrend, after which the rally loses steam and the price declines.

Oftentimes, bearish confirmation occurs when the price slips below the neckline shown on the chart. From the chart below, PAAL’s neckline is at $0.1965. However, the price has dropped below the region, suggesting that a bearish continuation could be next.

This bias is further reinforced by the Bull Bear Power (BBP), an indicator used to measure the strength of buyers relative to sellers. Usually, if the BBP is positive, bulls are in control, and prices can increase.

However, the indicator’s reading for PAAL is negative, suggesting that bears may continue to push the price further down. In this case, PAAL’s price may drop to $0.1724, but if bulls fail to defend this region, it can slip toward $0.1499.

Read more: Top 7 Telegram Tap-to-Earn Games to Play in 2024

On the contrary, the cryptocurrency’s price may reverse to the upside if whale accumulation and buying volume in the spot market increase. Should this be the case, PAAL may retest $0.2037. If sustained, the price can extend to $0.2462.