Anti-money laundering (AML) specialist VAF Compliance has launched a new Telegram bot enabling crypto firms to comply with AML and Know Your Customer rules as greater global licensing regulations take hold.

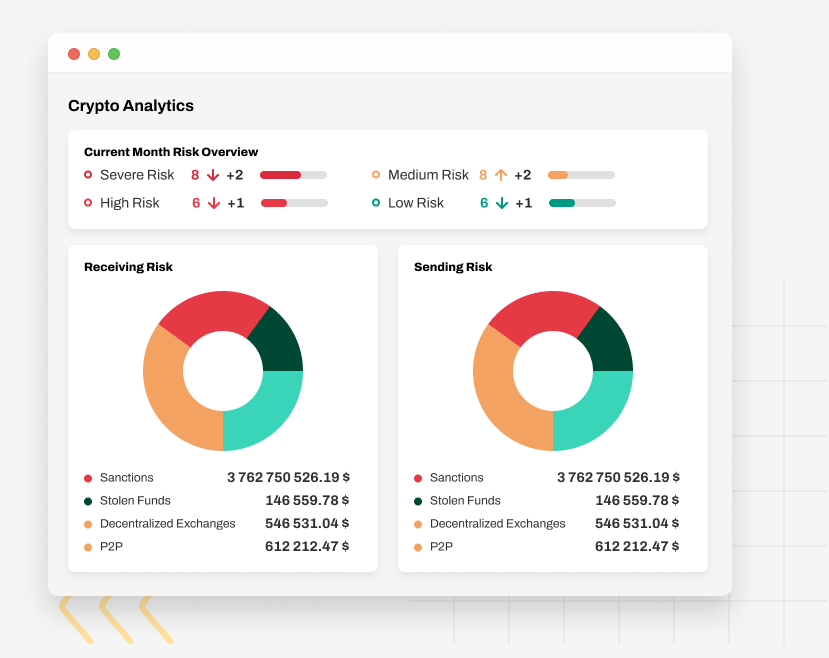

The service will judge the risks of businesses accepting tainted cryptocurrency funds using a growing list of sanctioned wallet addresses.

Bot Complements Existing Wallet AML Compliance Tools

The bot is compatible with multiple blockchains, offering assistance in both English and Chinese.

According to the Dubai-based firm, businesses can pay fees for reports on transactions across multiple blockchains.

VAF recently assigned crypto exchange Huobi a C-rating for transactions involving a cluster wallet linked to terrorism and child abuse. And U.S. senators last month accused Binance, the world’s largest crypto exchange, of being a “hotbed of illegal activity.”

AML tools like VAF’s bot can help crypto companies in the European Union and Hong Kong comply with forthcoming legislation.

Notabene, a company that helps crypto wallet companies comply with the Financial Action Task Force’s Travel Rule, which in 2019 grew to include crypto transactions, favored the approach European lawmakers took when applying the Travel Rule to crypto in their upcoming Markets in Crypto-Assets bill.

“They were open and moved quickly,” Lana Schwartzman recently told BeInCrypto.

According to Schwartzman, Notabene’s regulatory and compliance chief, the new rules give the industry a grace period to comply. MiCA’S Transfer of Funds rule subset requires identity checks at both ends of a crypto transfer.

According to Notabene’s COO Alice Nawfal, the U.S. could use MiCA’s strategy and develop compliance around money laundering through meeting with the industry.

The MiCA bill, agreed upon by European lawmakers in October 2022, will be voted on by the EU Council later this month.

Hong Kong’s New Rules to Intensify Exchange Registration Requirements

Arguably the next major global crypto hub, Hong Kong’s recent crypto consultation paper raised eyebrows for its requirement that all crypto firms register with the Securities and Futures Commission.

The registration ensures that firms comply with the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance 2022. Submissions for the consultation paper closed on March 31. The paper will inform a licensing regime that will go into effect from June 1.

ZA, Hong Kong’s largest virtual bank, conducts AML checks for local Web3 firms wishing to open accounts by confirming their information in the city’s company registry. The firm’s CEO has confirmed that none of its clients have broken the city’s current rules.

Under current licensing regulations, HashKey and OSL are the only two registered exchanges.

Like the recently-liquidated Silvergate Bank, ZA offers crypto firms fiat-to-crypto conversion rails.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.