Swipe (SXP) has been increasing since Feb 24 and has shown numerous signs that it has initiated a bullish trend reversal.

SXP had been falling since reaching an all-time high price of $5.80 on May 3. On Aug 25, it created a lower high (red icon) and resumed its descent.

So far, it reached a low of $1.04 on Feb 24. The price has been moving upwards since.

On March 16, SXP broke out from a descending resistance line that had been in place since the all-time high price.

If the upward movement continues, the two closest resistances are at $2.90 and $4.05. Besides being horizontal resistance areas, they are the 0.382 and 0.618 fib retracement resistance levels, respectively.

Future SXP movement

Technical indicators in the daily time-frame support the continuation of the upward movement.

Firstly, the MACD has been increasing after generating a strong bullish divergence (green line). It is now in positive territory, which is considered a sign of a bullish trend.

Secondly, the RSI is also increasing after generating bullish divergence and is now above 50. This is also considered a sign of bullish trends.

Therefore, daily time-frame readings support the continuation of the upward movement towards at least $2.90.

The two-hour chart shows that SXP has broken out from an ascending parallel channel and validated it as support afterwards (green icon).

Therefore, it is in alignment with the daily time-frame in supporting the continuation of the upward movement.

Wave count analysis

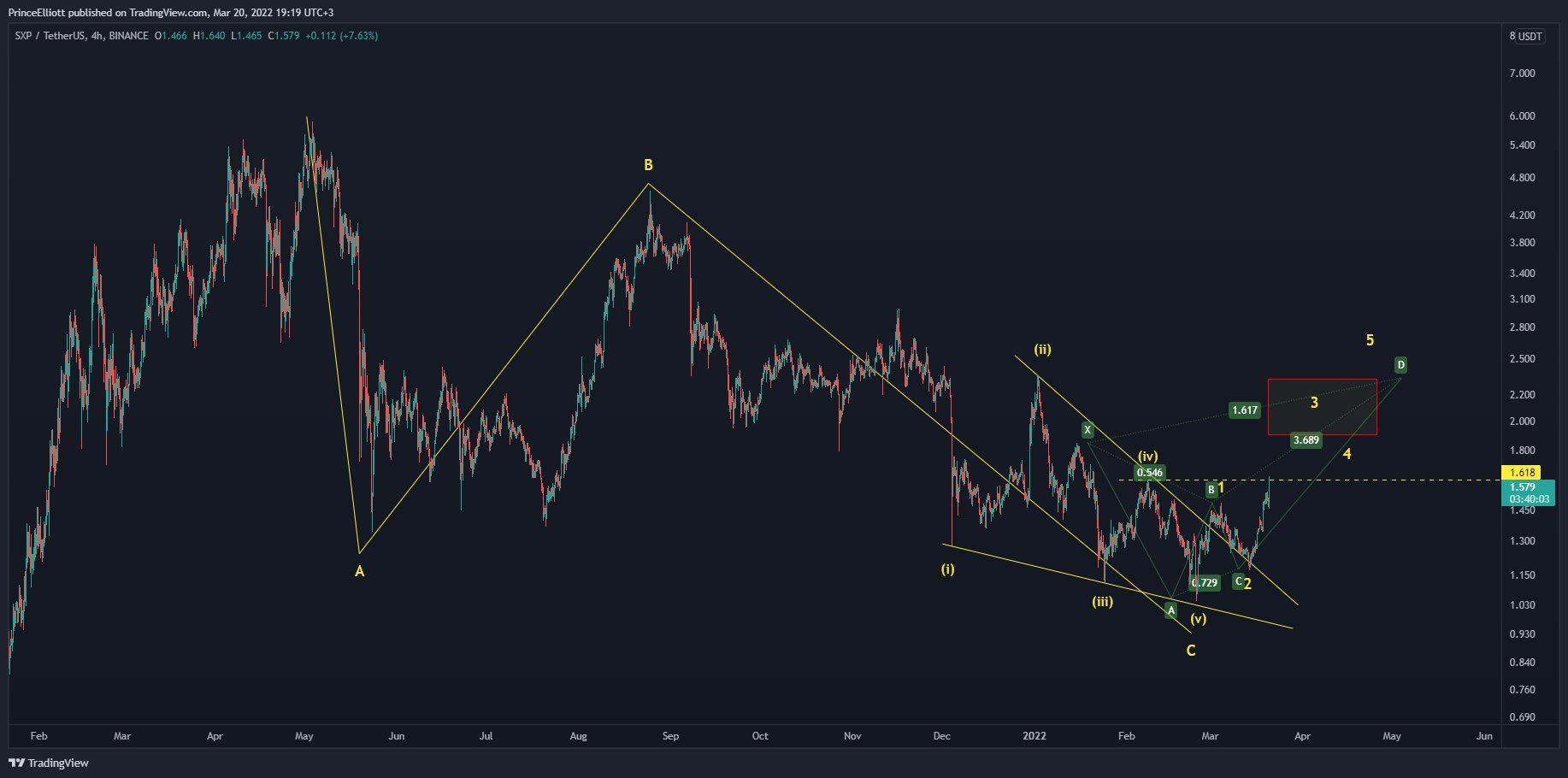

Cryptocurrency trader @PrinceofElliott tweeted a chart of SXP, stating that the price has completed an A-B-C corrective structure.

The most likely wave count does suggest that SXP has completed an A-B-C corrective structure (black) when measuring from the all-time high.

Wave C developed into an ending diagonal, as evident by the wedge shape. Such structures are usually retraced swiftly. The sub-wave count is given in white.

Therefore, the wave count is also in alignment with the bullish readings from the daily and two-hour time-frames.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here