SUI price has struggled recently to secure $2.00 as a support level, drifting further away from this mark as enthusiasm wanes among traders.

The altcoin’s recent downward trend reflects the market’s cautious sentiment, as SUI faces challenges in stabilizing and rallying towards a new all-time high (ATH).

SUI Needs a Push

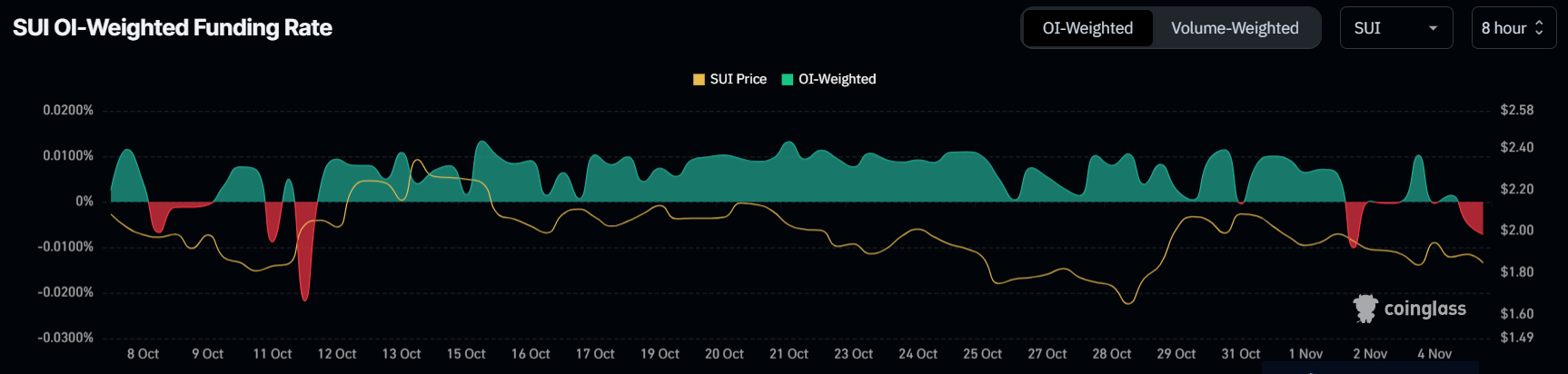

SUI’s market sentiment remains mixed, as evidenced by fluctuating funding rates that have alternated between positive and negative. This inconsistency indicates uncertainty among traders, who appear split on SUI’s short-term trajectory.

Such back-and-forth sentiment often leads to increased volatility and can weigh on the altcoin’s price. Many SUI traders are currently placing short contracts, aiming to profit from expected declines, which has added downward pressure.

This short-selling trend signals that traders are wary of SUI’s immediate prospects, with many anticipating further dips. As long as this sentiment holds, SUI may struggle to gain upward momentum. Such expectations can create a self-fulfilling cycle, where lower prices reinforce bearish sentiment, leading more traders to take short positions.

Read More: Everything You Need to Know About the Sui Blockchain

SUI’s macro momentum also points to a cooling trend, particularly as the Relative Strength Index (RSI) has been declining since mid-October. Previously, in the overbought zone, the RSI had fallen steadily and now hovered just above the neutral level of 50.0. This decline suggests waning bullish momentum, and if the RSI dips below 50.0, it could signal stronger bearish conditions for SUI.

When the RSI remains above 50, it often indicates a chance for price stabilization. However, with the indicator on a consistent downward path, the likelihood of an imminent reversal grows weaker.

SUI Price Prediction: Recovering Losses

Currently, SUI is trading at $1.92, below the $2.03 resistance level. For SUI to make any headway toward reaching its previous ATH of $2.36, it must first flip $2.03 into a solid support level. Doing so would signal renewed bullish interest and could attract further buying momentum.

If SUI fails to break through the $2.03 barrier, the altcoin will likely continue consolidating above its $1.69 support. Prolonged consolidation could contribute to market uncertainty as traders remain hesitant to commit fully to SUI. This lack of a clear trend keeps the price in a holding pattern, delaying any significant moves toward a new ATH.

Read More: A Guide to the 10 Best Sui (SUI) Wallets in 2024

The bearish-neutral outlook for SUI will be invalidated if it manages to turn $2.03 into support while broader market conditions turn bullish. Such a shift would boost confidence in SUI’s trajectory, potentially reigniting its rally ambitions and setting the stage for a new all-time high.