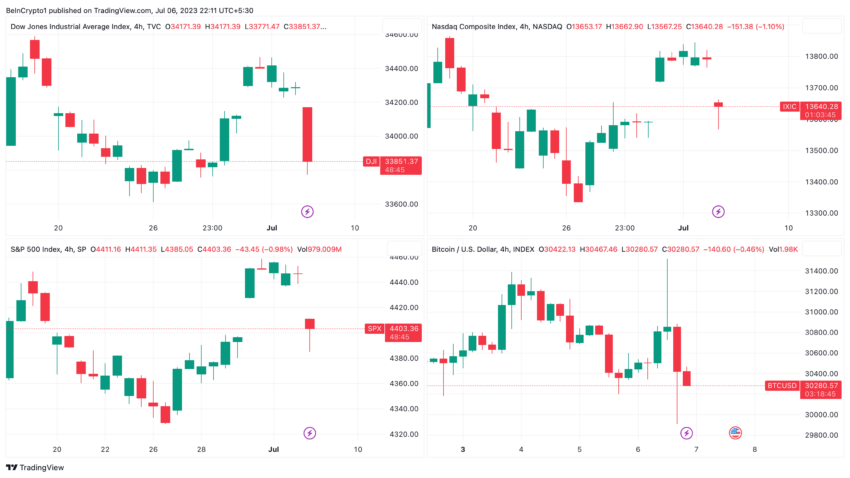

Wall Street reeled on Thursday. Stock markets and cryptos faced severe drops as concerns over impending rate hikes set in.

The Dow Jones Industrial Average nosedived by 506 points, an alarming 1.5% decline, while Bitcoin stumbled to $30,600. Both reflecting the jittery reaction to robust labor market data and anticipations of the United States Federal Reserve’s monetary tightening.

Stock Markets and Cryptos React to Potential Rate Hikes

The Dow’s tumble to 33,782 was mirrored by a 1.6% drop in the Nasdaq and a 1.4% dip in the S&P 500. Simultaneously, the crypto market showed signs of weakening. Bitcoin retreated from a 13-month high, further magnifying the effects of an overall market slump.

Fears were largely spurred by robust labor market data, revealed in the ADP National Employment report.

According to the report, private payrolls increased more than expected in June. This is an indicator of the labor market’s resilience even amid looming recession risks from higher interest rates.

The strong jobs data, coupled with the hawkish minutes of the Federal Reserve’s June meeting, stoked fears of rate hikes that could potentially stifle the market’s growth.

Despite growing risks, the Federal Reserve seems keen on further policy tightening.

“Since the ADP number was almost twice of what was expected, it generally implies there’s potential for more rate hikes going forward,” said Randy Frederick, Managing Director at Charles Schwab.

Indeed, the market now predicts a near 92.4% chance of a quarter-point hike at the Fed’s next meeting on July 26. This is a jump from 90.5% earlier in the day, as calculated by CME’s Fedwatch tool.

Moreover, Dallas Fed President Lorie Logan endorsed the potential for rate hikes. He stated it would have been “entirely appropriate” to raise rates at the June policy meeting because it is consistent the “Fed’s dual-mandate goals.”

These rate hike predictions have far-reaching implications, touching not only the traditional markets but the crypto market as well. Traders are now factoring in a 75% chance of three additional rate hikes by year’s end.

This expectation extends the tightening cycle and suggests the Fed’s monetary policy could remain a driving factor in the coming months for the stocks market and cryptos.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.