STFIL, a major Filecoin (FIL) staking platform, has revealed that members of its core technical team are under investigation by Chinese police. The company announced this information on its official X (formerly Twitter) account on April 9, 2024, at 04.53 UTC.

STFIL claimed that they have engaged legal counsel to assess the situation and offer support to those detained.

Millions in Filecoin Moved as STFIL Team Faces Investigation

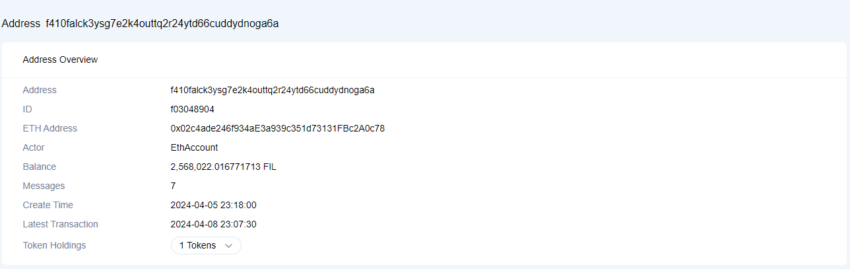

The announcement comes after unexplained protocol upgrades and a large transfer of FIL tokens from the STFIL platform to an unknown address. Currently, that address holds approximately 2,568,022 FIL, worth an estimated $23.09 million.

Read more: Filecoin Staking: How To Get Started

STFIL encouraged the community to monitor the address. Additionally, they invited participation in discussions focused on protecting stakeholder interests.

Community reactions to the news have been mixed. Some expressed confusion and sympathy, while others, like crypto analyst Niraj Singh, allege foul play. He highlighted his significant investment of $80,000 in FIL and his dedication to the long-term success of the Filecoin community, which collectively holds 5.2 million tokens, as a basis for his concern.

Singh claims a contract alteration allowed for a targeted withdrawal of funds, branding the incident a “rug pull.”

“Project owner altered the contract to permit only one designated address for fund withdrawals. Funds were then withdrawn from the contract,” Singh stated.

Additionally, Singh has openly requested the Filecoin Foundation to freeze the address and assist affected FIL holders.

Read more: Filecoin (FIL) Price Prediction 2024/2025/2030

STFIL ranks as the second-largest liquid staking protocol within the Filecoin ecosystem. Data from DeFiLlama places its current total value locked (TVL) at $39.08 million. Its TVL is behind GLIF, which has a value of $324.2 million.

Following the incident, STFIL’s official website indicates the protocol’s available liquidity of only 2,141 FIL (approximately $19,226).

However, this news does not severely affect FIL’s price. Despite the slight dip to $8.85, $FIL is now trading at $9, representing a 1.4% decrease in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.