Imagine you have additional storage on your computer that you aren’t planning to use anytime soon. Well, if you were clued up on Filecoin — a decentralized storage ecosystem — you could sell that storage space for FIL tokens. But is purchasing FIL tokens a good investment decision? This Filecoin price prediction piece aims to find out.

Here, we discuss Filecoin’s project fundamentals, tokenomics, and any red flags before conducting a data-backed technical analysis. Let’s take a closer look at this innovative ecosystem and its native token.

NOTE: This article contains out of date figures and information. It will be updated with fresh analysis for 2025 and beyond in the New Year. In the meantime, please see our Filecoin Price Prediction tool for the most recent, data-informed projections.

- Filecoin predictions and the role of fundamental analysis

- Filecoin and the associated tokenomics

- The state of Filecoin: predictions and performance analysis (Q3, 2022 data)

- Filecoin (FIL) price predictions and relevant metrics (2022-23 data)

- Filecoin price prediction using technical analysis

- Filecoin (FIL) price prediction 2023

- Filecoin (FIL) price prediction 2024

- Filecoin (FIL) price prediction 2025

- Filecoin (FIL) price prediction 2030

- Filecoin (FIL’s) long-term price prediction (up to 2035)

- Is the Filecoin price prediction model reliable enough?

- Frequently asked questions

Want to get FIL price prediction weekly? Join BeInCrypto Trading Community on Telegram: read FIL price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

Filecoin predictions and the role of fundamental analysis

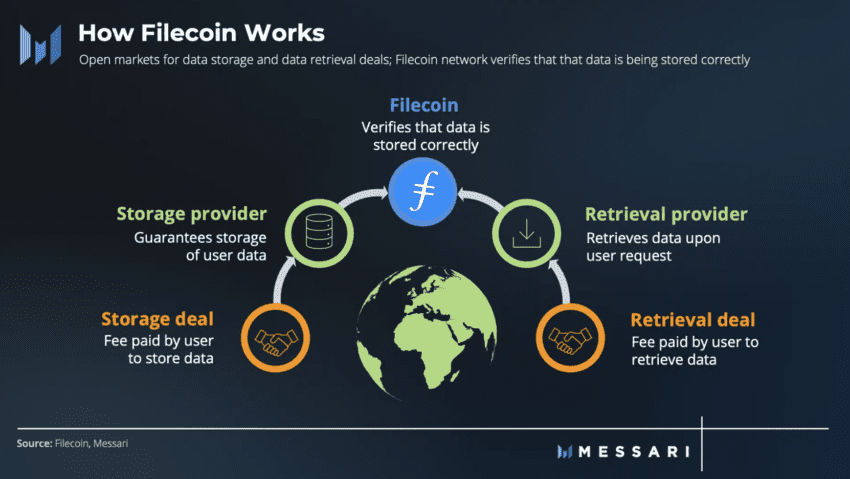

Filecoin serves as an online storage solution. Its decentralized nature distinguishes it from Google Drive or other digital storage providers. In simple terms, Filecoin delivers storage for users by the users. IPFS — or the InterPlanetary File System — is the underlying protocol. Filecoin rests on top as the security and incentive layer.

All of the above contributes to the utility of Filecoin as a project. But that’s just the primer. There is a lot more that’s fit deep inside the project. Let us try and make sense of the same:

- Filecoin manages consensus via a novel form of PoW — PoRep (proof-of-replication) and proof-of-spacetime (PoSt).

- The project aims to improve the overall efficiency of storage systems, increase storage permanence, and lower the lags associated with traditional storage systems.

- The ecosystem supports Ethereum integration — allowing devs to access datasets and work with smart contracts relevant to the Ethereum ecosystem.

- Pantera Capital and Winklevoss Capital Management are two major Filecoin investors.

- Juan Benet — founder of IPFS — is the project founder.

Did you know? Filecoin Virtual Machine was launched on March 14, 2023, bringing smart contract support and programmability to the ecosystem.

The illustration below explains how Filecoin operates behind the scenes:

The fundamentals are on point. Filecoin — the network — solves pressing issues of slowness and inefficiency associated with centralized storage providers. This makes us optimistic about future Filecoin price predictions.

Filecoin and the associated tokenomics

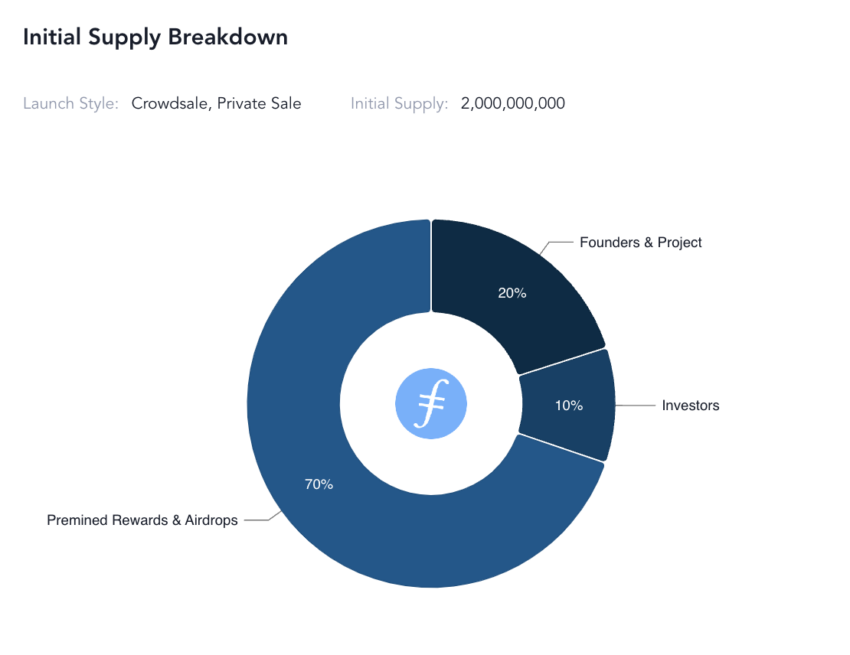

Protocol Labs, the founding body behind Filecoin, doesn’t have a clear supply cap. As of Jan. 4, 2023, the circulating supply of FIL stood at 359+ million. However, 2 billion tokens were announced during the launch, with only 30% released to the crowd.

Moving to the project’s use case, FIL aims to incentivize users that offer storage space. Network participants that use the space pay miners and storage suppliers in FIL. Plus, storage providers need to provide FIL as collateral to guarantee service quality. Slashing penalties secure the network further and keeps the token circulation in check.

Now that we know a bit about the use cases relevant to the FIL token, here are the important insights about the token economics model that might determine the nature of the future Filecoin price predictions:

70% of the FIL supply is expected to be released over time, catering to the miners and storage providers. 10% of the max supply initially went to the investors. 20% of the 2 billion supply cap went to the project, and founders with 5% of the same have a 6-year vesting period.

The token economics model looks transparent and depends on network growth and the popularity of Filecoin as an ecosystem. So, more tokens entering circulation shouldn’t be a problem if your focus is on the long-term price of FIL.

The state of Filecoin: predictions and performance analysis (Q3, 2022 data)

If you are bullish on Filecoin as a project and even as an investment option, you first need to see how the network’s Q3 performance was. Once we identify the nature of the Q3 metrics, it will be easier to see the growth and price changes compared to Q2.

Report-specific data

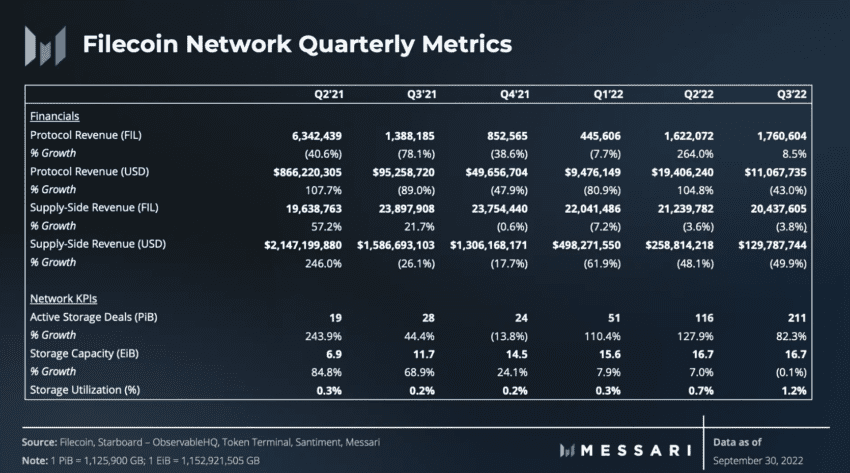

Here is the snapshot of the quarterly metrics compared QoQ:

Do notice that protocol revenue shot up by 8.5% in FIL terms (number of native units). The drop in USD terms is due to the overall nature of the crypto market and shouldn’t be read into that deeply.

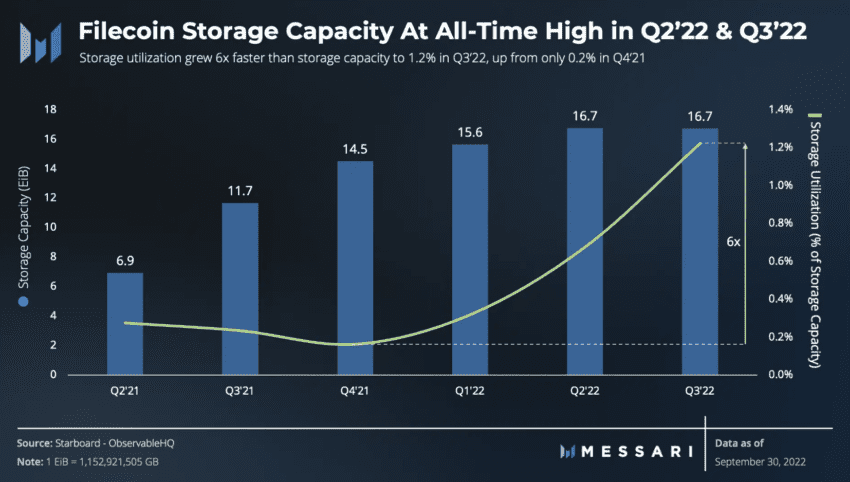

Another interesting observation is that storage capacity peaked in Q3, whereas storage utilization grew six times QoQ.

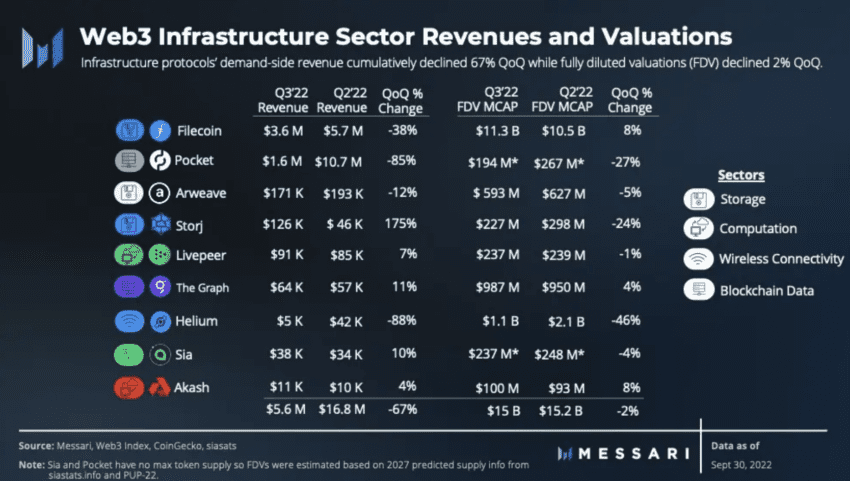

Filecoin is one of the key building blocks of the web3 infrastructure. If we compare it with other protocols like Storj and even The Graph, Filecoin seems to have done better in Q3. This is regarding FDV, or Fully Diluted Valuations, to a tune of 8%.

The only disconcerting point is that protocols like Storj witnessed a 175% growth in revenue during the same period. Whereas, Filecoin went down 38%. Again, this drop is in dollar terms and hence might not show the bigger picture.

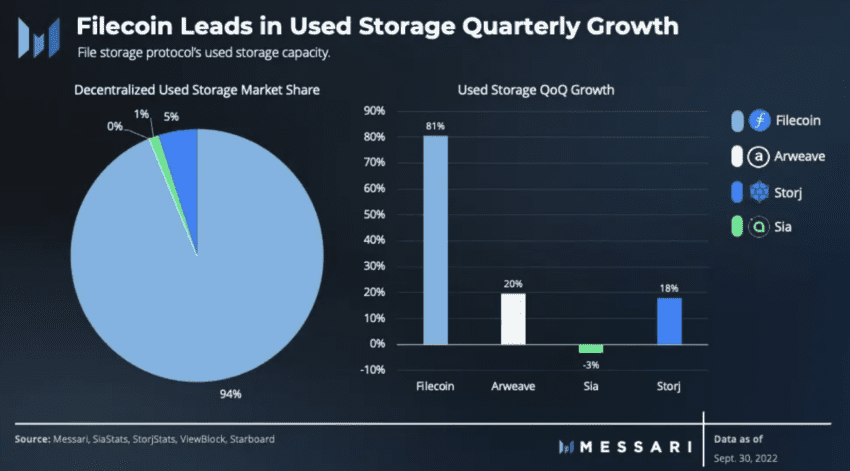

In terms of storage growth share among decentralized protocols, Filecoin still maintains the lead — accounting for 81% of the overall market share in Q3.

And finally, the big thing. Projects choosing to build on Filecoin grew 12% in Q3 2022, which will likely push the price of FIL upwards in quarters to come. We cover more about the price growth expectations in our segment on technical analysis.

Filecoin (FIL) price predictions and relevant metrics (2022-23 data)

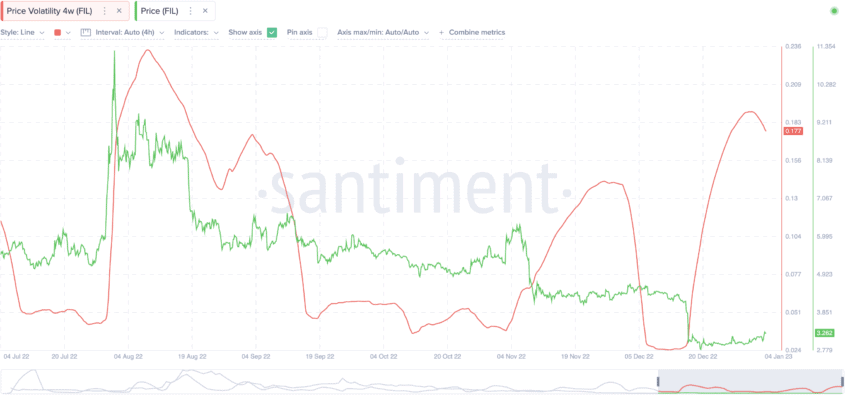

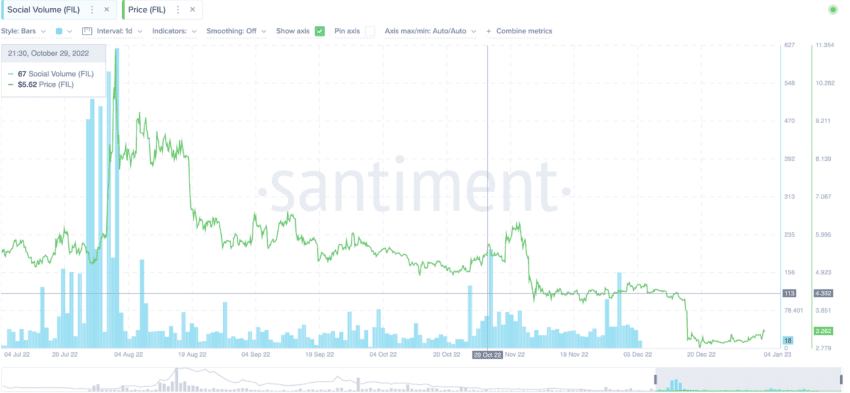

Anybody looking to predict the future maximum price of FIL should consider the social and volatility metrics of the project.

For starters, the volatility of FIL peaked in early August 2022, after which we saw a price drop. After that, prices dropped every time the volatility indicator made a lower high.

The social volume was quite high in August 2022. The prices responded similarly. Since then, FIL hasn’t been able to maintain social chatter. Notice that the social volume peaked a little towards the end of October. Even the prices showed some strength at that time. Hence, it is clear that social metrics do play a role in determining the price of FIL.

Filecoin price prediction using technical analysis

Technical analysis will help us identify key trends and locate any distinguishable patterns.

Before we proceed with a broader picture, it is time to understand a few things about the price movements of Filecoin.

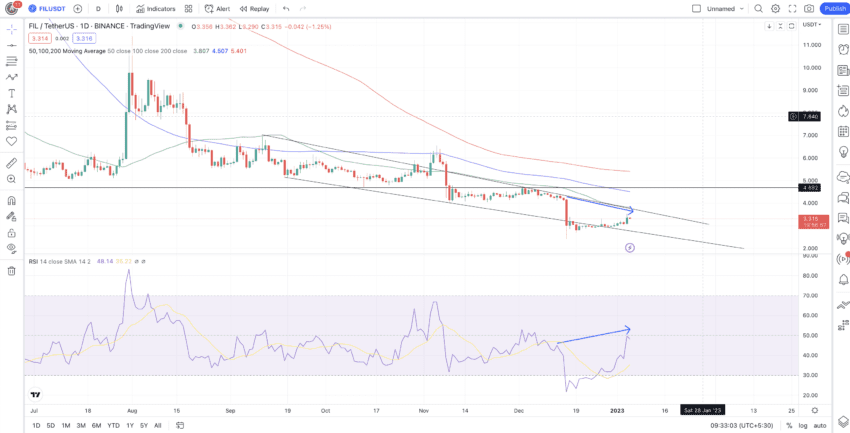

Short-term price action

The short-term price action of FIL, per early 2023 data, shows a bullish formation at FIL’s counter. Notice how FIL trades inside a falling wedge pattern and slowly moves closer to the upper trendline. Any breakout above the upper trendline can start a short-term rally of sorts. If the trendline is breached, the short-term maximum price prediction could be $4.692 — a strong resistance level.

Even the RSI is supportive, courtesy of the bullish divergence on display. While the price action is making a lower high, RSI is clearly on a higher-high path, indicating a possible short-term upmove. However, just for the sake of confirmation, it is advisable to keep an eye on the green, blue, and red lines — 50, 100, and 200-day moving averages.

If any smaller period moving average crosses above a higher period moving average line — termed a golden crossover — we can expect a relatively confirmed price surge. At present, the green line is moving in parallel to the blue line, hinting at some range-bound price action.

With the short-term price development possibilities taken care of, let us now shift focus to identifying a pattern, if any.

Pattern identification

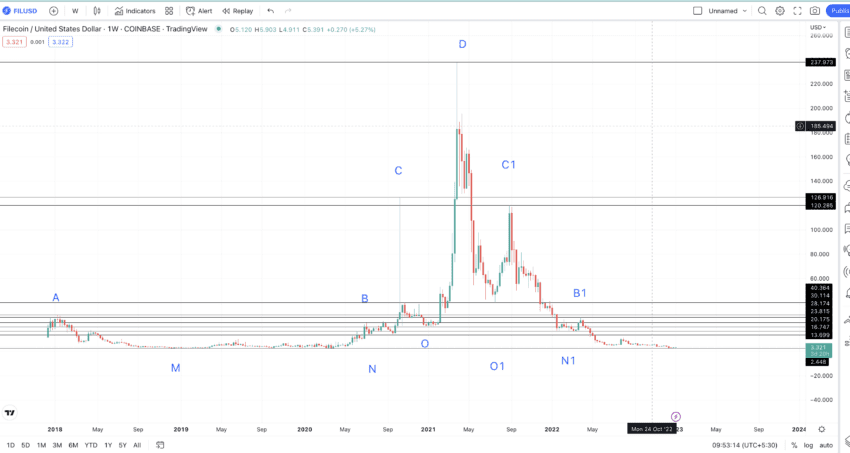

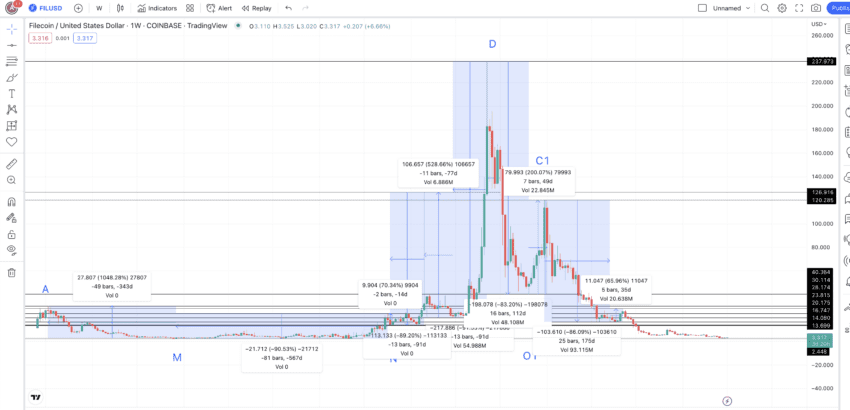

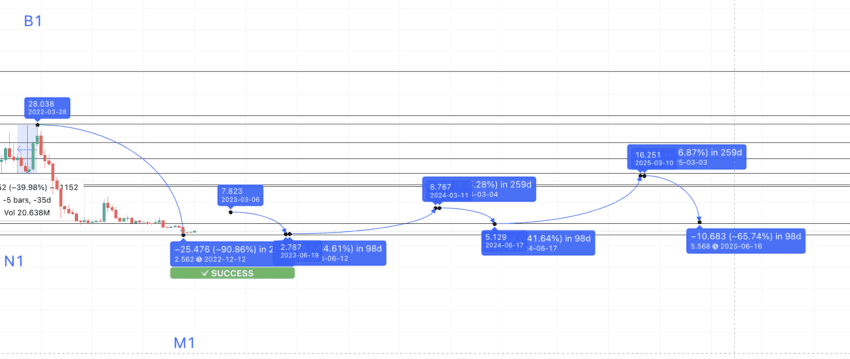

While the short-term price forecast model discussed the daily chart, here is the weekly chart of FIL with a relatively clear pattern.

Notice how the price of FIL made three highs (not higher highs) after starting to trade before peaking at $237.24. Once there, the prices started dropping whilst making lower highs compared to the peak. Hence, the prices follow a symmetrical pattern, with the left side of the chart mirroring the right.

Here is the chart with all the highs and lows marked clearly. Throughout this article, we shall use the distance between these points to make Filecoin price predictions. Each point is associated with a strong support/resistance level depending on the then price movement of FIL.

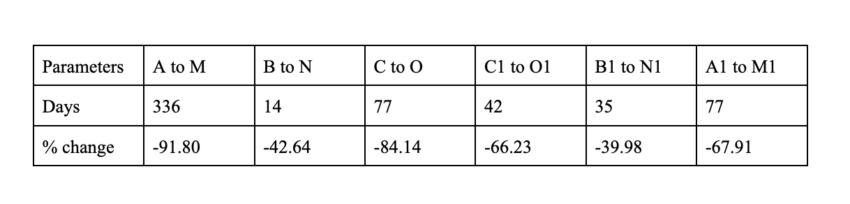

Our first target is to find the next low after B1. We can mark that as M1. Once we have M1, we can extrapolate to locate the next high or A1.

Price changes

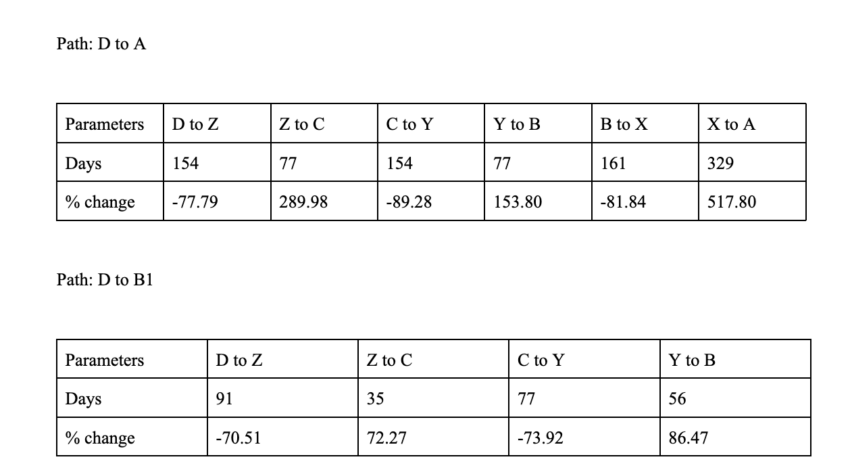

Let us now trace the path (distance and price changes from D to A and then from D to B1, including the highs to lows and the lows to highs)

We can start our calculations now that we have all the data points available. On the right side, we only have data available till B1. Therefore, for Path 1 or Table 1, we shall use the data till B to keep the averages fair.

Filecoin (FIL) price prediction 2023

We predicted a high of $7.70 for FIL in 2023, and FIL managed to reach $7.6, validating our analysis. Here is what we inferred a year back:

The average of high to lows (negative percentage change) comes to be: 117 days and 87.50%.

Therefore, the next low or M1 could be in 117 days and at a drop of 87.50%. Let us see if the price of FIL ever touched that level on drawing a forecast line from B1. The lowest drop didn’t come that quickly, and it took 259 days for the price of Filecoin to drop to 90.86%.

This shows our price prediction calculation for FIL is going in the right direction.

Calculations

Now let us calculate the low-to-high average using the positive percentage values on the table. This average comes to be: 44 days and 216.25%.

As it is a bear market, the timeline can vary as it did in the case of B1 to M1. Therefore, we expect A1 to surface at $7.70 by late February, per our FIL price prediction 2023 model.

By A1, the price of FIL would have completed the existing pattern. Now, we can create another table to find the price drop and distance between the lower highs and the lows — path from A to D and A1 to D. This will help us locate the next point from A1 and prepare the minimum price prediction for 2023.

Therefore, the average from the left side to the next low would be 97 days and 65.45%

The low from A1 would, therefore, surface at $2.768, given the forecast line.

Filecoin (FIL) price prediction 2024

Outlook: Moderately bullish

to-high moves, using the earlier tables, come to be 44 days and 216.25%.

Therefore, we can trace the path from the minimum price of FIL in 2023 to locate the next high. The average distance puts the high in 2023 itself. Hpwever, we can safely say that the current condition of the crypto market might push the maximum price to 2024. We expect this to be 259 days — the time taken from B1 to M1 per the earlier pattern.

Therefore, the Filecoin price prediction for 2024 puts the maximum price of FIL at $8.79.

Calculations

Additionally, the abovementioned table puts the high-to-low average at 97 days and 65.45%. However, there is strong support at $5.129 — where the minimum price prediction value for 2024 should surface. The timeframe can still be 97 days.

Projected ROI from the current level: 10%

Filecoin (FIL) price prediction 2025

Outlook: Moderately bullish

Now that we have the low in 2023, it’s time to identify the Filecoin price prediction for 2025. Also, we know that the average low-

Using the average price of Filecoin in 2024, we can prepare a Filecoin price prediction model for 2025. The timeframe can vary from 44 days to 259 days, but we can put the peak percentage gain at $216.25%.

The highest Filecoin price prediction for 2025 arrives at $16.251. The low can follow the (97 days and 65.45%) average, putting the minimum price in 2025 at $5.57.

Projected ROI from the current level: 103%

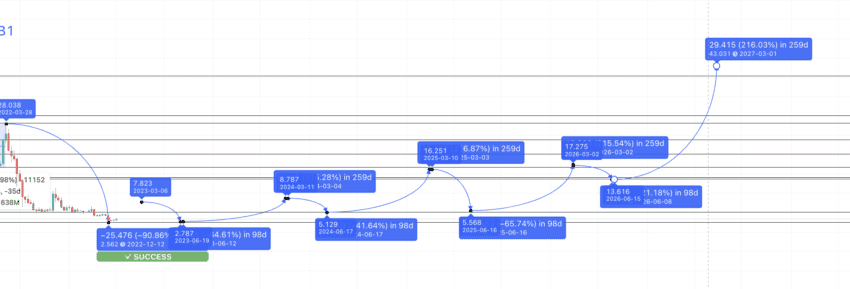

Filecoin (FIL) price prediction 2030

Outlook: Bullish

We now have the highs and lows for 2025. We can use the minimum price to project further and locate the Filecoin price prediction level for 2026. The distance can be 259 days (as used earlier), whereas the percentage change can be 216.25%.

The high for 2026, therefore, might surface at $17.57 — showing tepid growth from 2025. However, by this time the price of FIL will assumably stop dropping as low as previously, especially with the bull market settling in.

Therefore, the drop from the expected high in 2026 can be up to $13.699, which is a strong support level. The distance might vary, but we shall take the average as 97 days — according to the table-specific data.

Calculations

Now, from this level, we can expect a major surge in 2027 — courtesy of the average price rise figure of 216.25%. Therefore, the FIL price prediction for 2027 might show a maximum price level of $43.031.

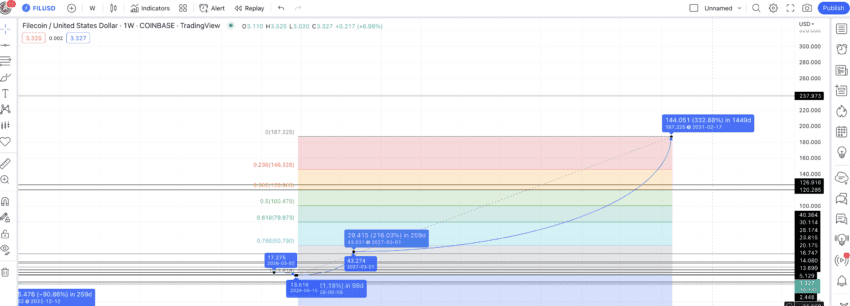

If we draw the Fib levels using the high for 2027 and the low for 2026, we can extrapolate the average price of Filecoin to 2030.

If the same growth path is followed, the Fib indicator puts the price of Filecoin at $187.325 in 2030. This time, Filecoin will still be shy of its all-time high of $237.24.

Projected ROI from the current level: 2241%

Filecoin (FIL’s) long-term price prediction (up to 2035)

Outlook: Very bullish

When will Filecoin make a new ATH? What does our price prediction model for FIL say? To answer these questions, we need to trace the path of Filecoin to 2035 — something the table below can help with.

You can easily convert your FIL to USD

| Year | | Maximum price of FIL | | Minimum price of FIL |

| 2024 | $8.79 | $5.129 |

| 2025 | $16.251 | $5.57 |

| 2026 | $17.57 | $13.699 |

| 2027 | $43.031 | $26.68 |

| 2028 | $53.78 | $41.95 |

| 2029 | $80.68 | $62.93 |

| 2030 | $187.325 | $93.66 |

| 2031 | $224.79 | $175.33 |

| 2032 | $337.18 | $263.00 |

| 2033 | $404.62 | $315.60 |

| 2034 | $536.00 | $332.32 |

| 2035 | $657.51 | $407.65 |

Do note that the yearly Filecoin predictions might not be completely accurate. Instead, potential FIL investors should identify the average price of FIL annually, then tally the same with our maximum and minimum price predictions to assess the deviation.

Is the Filecoin price prediction model reliable enough?

Our Filecoin price prediction model considers but is not limited to, technical analysis, performance analysis via market cap comparisons, and tokenomics. Plus, both the short-term and long-term technical analysis offer several data points to account for accuracy. Therefore, this FIL price prediction piece is as realistic and practical as possible, considering the general volatility of the crypto market.

Frequently asked questions

Does Filecoin have a future?

How high can Filecoin get?

Is Filecoin a good crypto?

Will Filecoin explode in 2025?

Is Filecoin limited in supply?

Why is Filecoin so important?

Is Filecoin a stablecoin?

Who is invested in Filecoin?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.