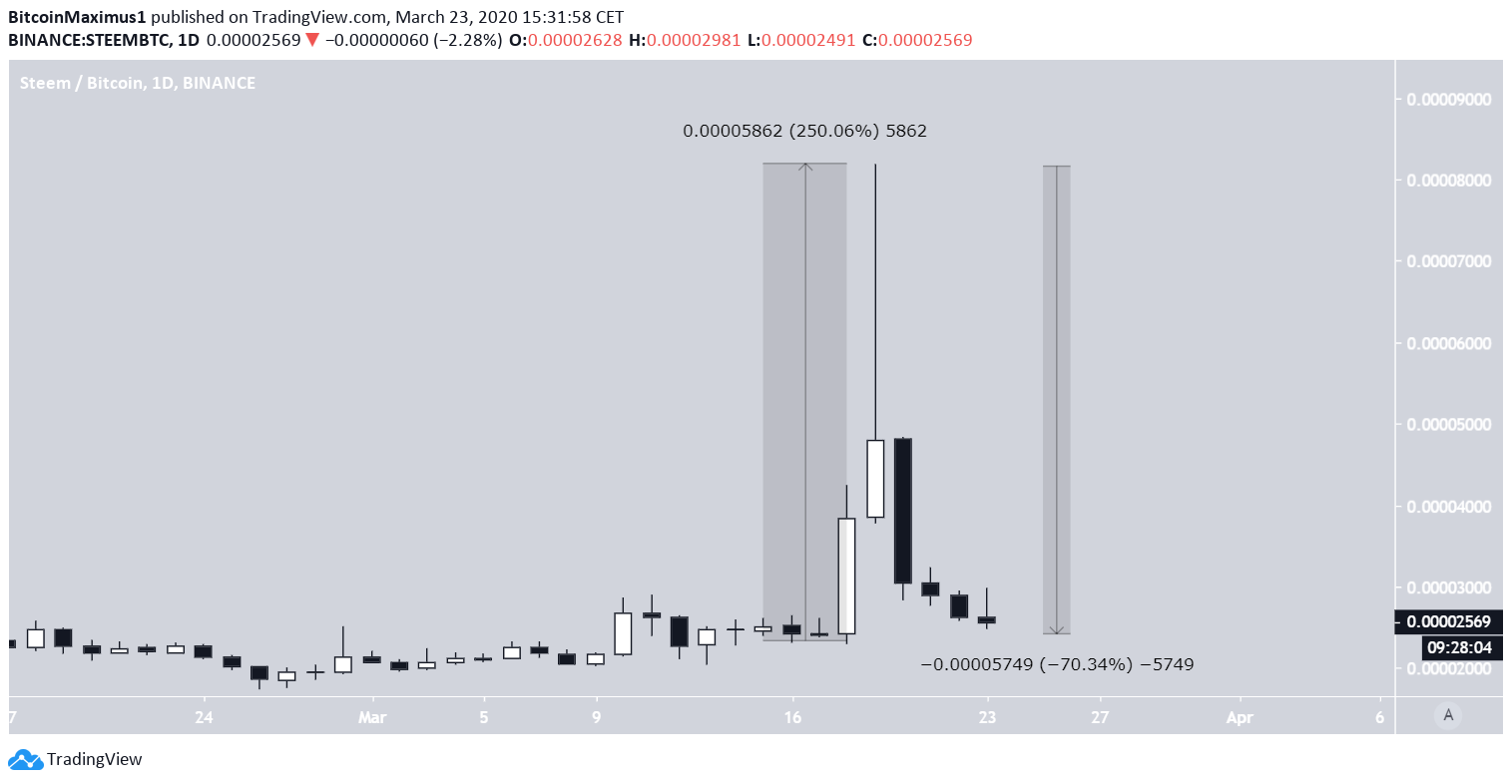

Beginning on March 18, the STEEM price initiated a very rapid upward move, which culminated the next day with a high of 8,187 satoshis. However, the increase was short-lived, considering the price has decreased by 70% since.

Well-known trader @CryptoNTez tweeted a STEEM chart that shows both last week’s massive price increase and the ensuing movement that has caused the price to retrace and give back the majority of its gains. Since the high reached on March 19, the price has decreased by an enormous 70%.

Last week, we posted an article looking at the prices of both STEEM and DASH, stating that the increases do not seem natural, especially in the case of STEEM. Let’s revisit STEEM to see how it’s fared since.$STEEM

— Nico (@CryptoNTez) March 22, 2020

Up 200%, down 70% in a week#STEEM pic.twitter.com/xe3MPFLsXt

STEEM

On March 18, the STEEM price initiated one of its most volatile movements to date. It increased by a massive 250% in two days, reaching a high of 8,187 satoshis. However, what followed has been a similarly paced price decrease. STEEM has decreased by 70% since the high, returning to its more regular 2,500 satoshi price level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored