What if Ethereum blockchain transactions could be frozen or even reversed? These are the questions being posed by Stanford researchers in a recent paper on reversible transactions.

Stanford researchers Kaili Wang, Qinchen Wang, and Dan Boneh have proposed new Ethereum token standards called ERC-20R and ERC-721R. They have been designed as prototype opt-in token standards that support reversing transactions when the situation and evidence warrant it.

The paper released on Sept. 9 and detailed on Sept. 24 calls for a blockchain ‘back button’ or ‘undo button’ in the case of a hack or theft. It cites the recent BAYC phishing attacks, Poly Network attack, Harmony Bridge compromise, and Ronin theft as reasons why a reversible transaction would be needed.

Blockchain back button

There is the argument that reversible transactions defeat the purpose of a blockchain but the proposed standards are not meant to replace ERC-20 tokens or make Ethereum transactions reversible, Wang stated. They “simply allow short time windows post-transaction for thefts to be contested and possibly restored,” she confirmed.

Reversible tokens could be swapped, however swapping them for non-reversible tokens would only be finalized after the time window for transaction reversing has closed, making them irreversible again.

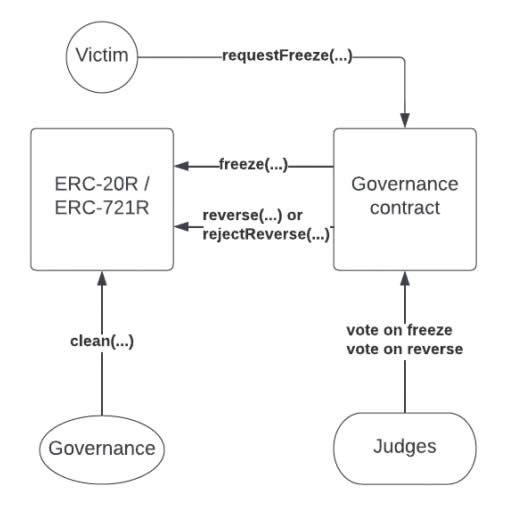

In the hypothetical event of a reverse request, the victim of the hack or theft would first request a freeze to the governance contract on the stolen funds. A decentralized quorum of judges would then vote to freeze the assets or not. If accepted the freeze would be initiated and evidence must be supplied to the judges in a ‘trial’ to initiate the reversal.

In the case that an attacker anticipates a freeze on the transactions, the researchers proposed conducting the entire freeze on-chain in one single transaction, “so that the attacker can’t “outrun” the freeze.”

They did acknowledge that the most ambiguous part of the system would be determining the panel of judges responsible for making decisions on the proposed ERC-20R and ERC-721R tokens.

$14 billion stolen in 2021

The paper details and discusses more in-depth details, such as how to decrease the risk of judge dishonesty. It also tackles implications for exchanges and mixers, and explanations of the algorithm and implementation.

According to Chainalysis, there was $14 billion stolen in crypto in 2021 so a viable solution for fund recovery is definitely needed even if it does undermine the current irreversible state of blockchain networks.