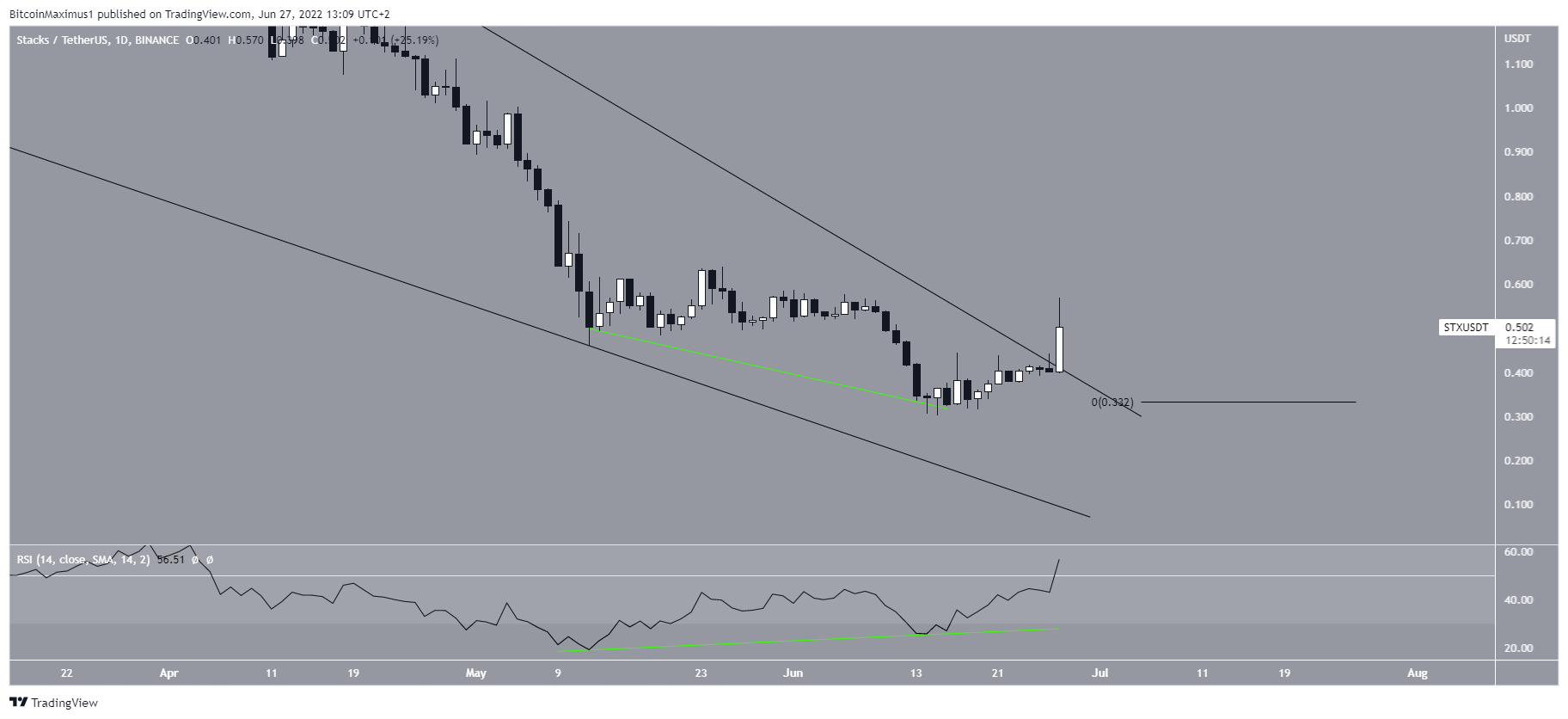

Stacks (STX) has broken out from a bullish long-term pattern after the RSI generated significant bullish divergence.

STX has been falling since reaching an all-time high price of $3.25 in Dec. 2021. The downward movement has so far led to a low of $0.30 on June 15, 2022. The price has been moving upwards since.

An interesting development is a fact that the price has already broken out from along-term descending wedge, which has been in place since the aforementioned all-time high price. The wedge is considered a bullish pattern, meaning that it leads to breakouts the majority of the time.

Prior to the breakout, the wedge had been in place for 221 days.

If the upward movement continues, the closest resistance area would be at $1.45. This is the 0.382 Fib retracement resistance level and a horizontal resistance area.

Divergence leads to a breakout

A closer look at the daily chart shows that the breakout was preceded by a very significant bullish divergence in the daily RSI. Such divergences often lead to bullish trend reversals.

Furthermore, the RSI has moved above the high between the divergences and above 50, increasing its legitimacy. Both of these readings are considered signs of a bullish trend.

So, the RSI supports the continuation of the upward movement towards the previously outlined resistance area.

STX wave count analysis

Since the aforementioned all-time high, STX seems to have completed a five-wave downward movement (black), which took the shape of an ending diagonal. In it, wave five ended at exactly the 1.61 external retracements of wave four (white). Therefore, a significant bounce is now expected.

If this count is correct, the upward movement could continue until the 0.382 Fib retracement resistance level at $1.46.

For Be[in]Crypto’s latest bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.