The exponential rise of stablecoins, marketed as a stable form of crypto, has sent ripples through the financial world. Touted for their potential to facilitate faster and cheaper transactions, stablecoins have gained popularity among traders and investors.

However, it is becoming increasingly apparent that stablecoins might not be as stable as they purport to be. This could potentially impact individual investors and the broader financial market.

Stablecoins Not As Stable as Promised

Unlike other cryptocurrencies, stablecoins are tied, or “pegged,” to an asset, often the US dollar. By linking their value to a less volatile asset, stablecoins seek to offer the best of both worlds: the speed and privacy of cryptocurrencies without the price swings.

Nonetheless, cracks in this model are beginning to show, causing significant investor uncertainty and market disruptions.

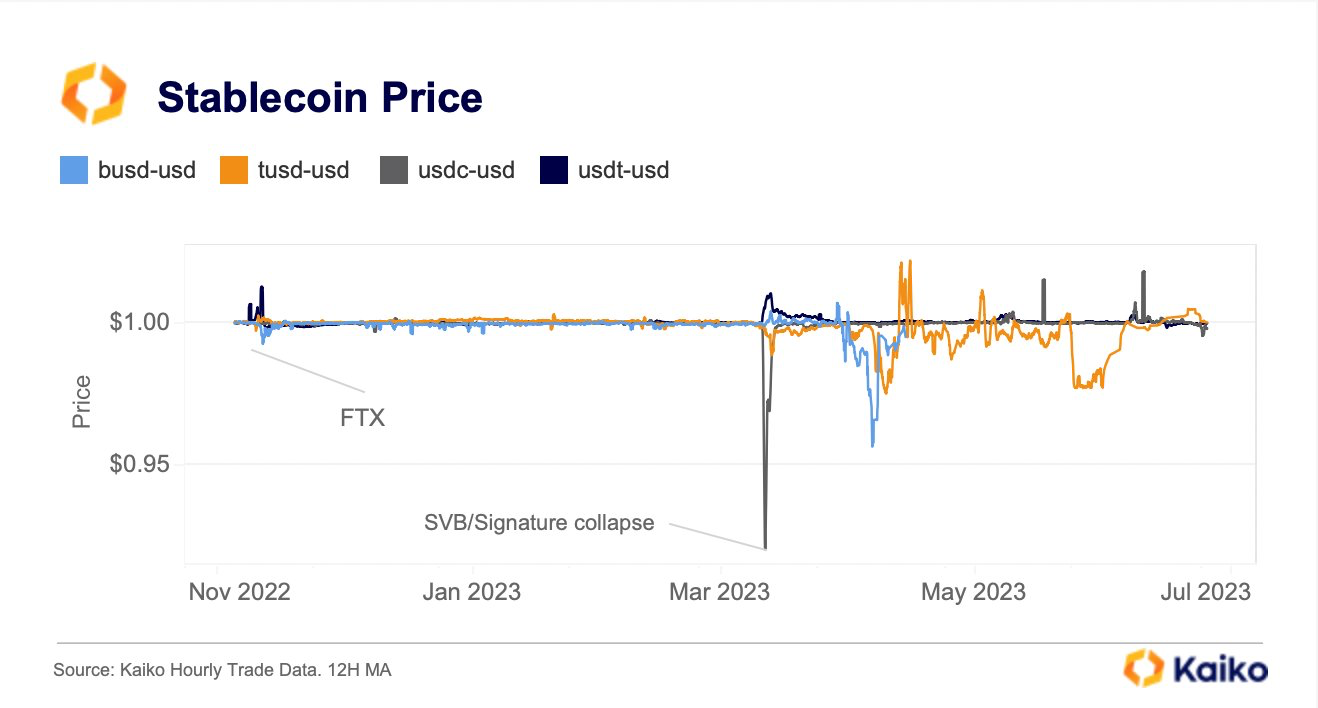

“We find strong evidence of instability of stablecoins, although these deviations from the $1 mark are gradually corrected at different speeds for all stablecoins. [At times,] the deviations do not converge even in the long-run due to non-stationarity of the differentiated series between its price and the $1 mark,” concluded Kun Duan, researcher at Huazhong University of Science and Technology.

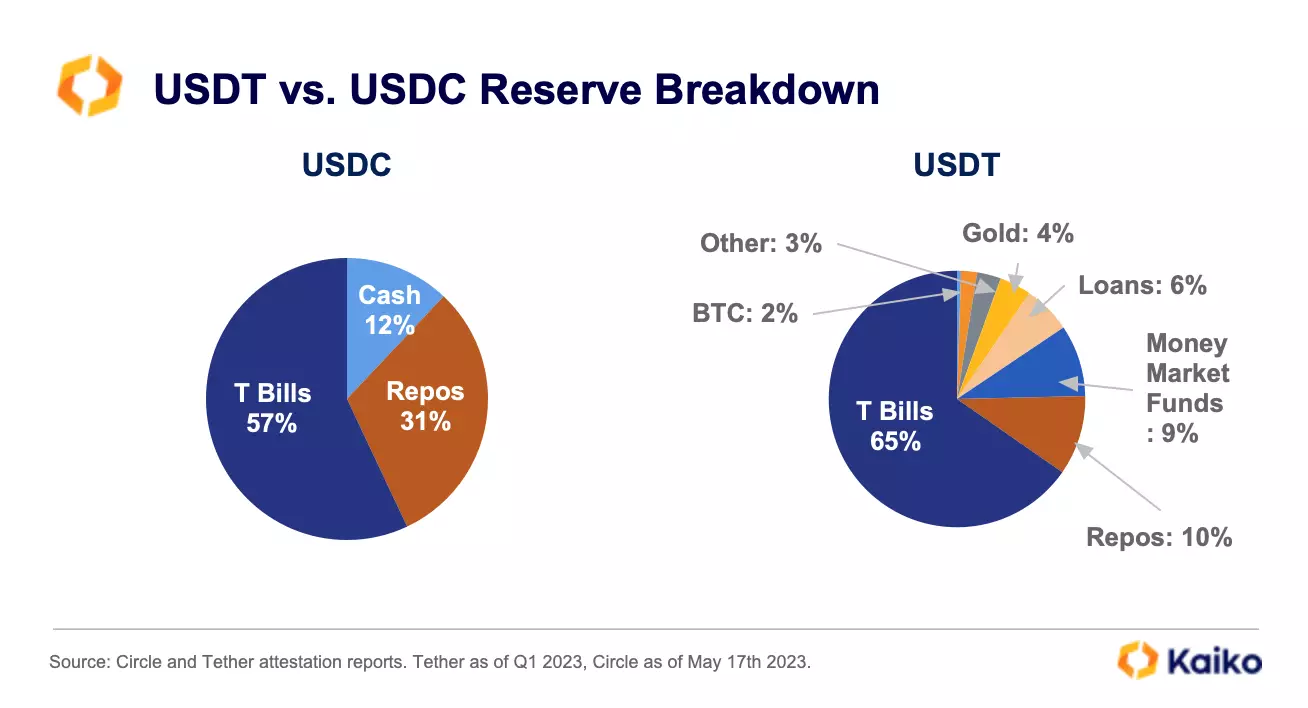

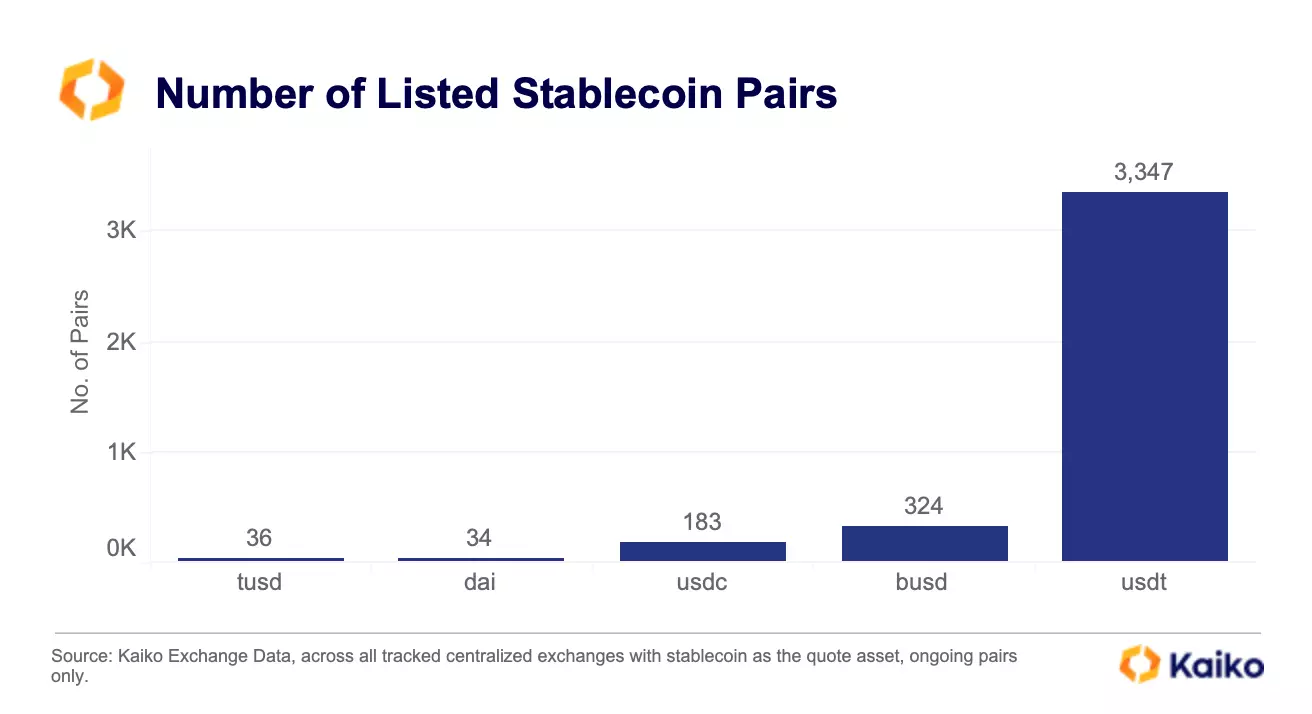

Stablecoins have largely been used to enable speculative trading in other crypto-assets. Tether and USD Coin, the two largest stablecoins on the market, claim to be fully backed by assets.

However, the transparency and oversight of the ability of issuers to meet redemption requests have come under scrutiny.

Some Top Stablecoins Lose US Dollar Peg

In some cases, regulators have raised concerns about the liquidity, quality, and valuation of the reserve assets held by stablecoin issuers.

For instance, Tether, once considered a paragon of stability, faced a loss of investor confidence. Subsequently causing USDT to temporarily lose its peg to the US dollar on June 15.

“Markets are edgy in these days, so it is easy for attackers to capitalize on this general sentiment. But at Tether we are ready as always. Let them come. We are ready to redeem any amount,” said Paolo Ardoino, CTO at Tether.

Similarly, TerraUSD, one of the largest algorithmic stablecoins, collapsed when it failed to maintain its peg. This led to significant investor withdrawals and disruption of its stabilization mechanism.

These disruptions are not mere blips. They demonstrate an inherent vulnerability in the design of stablecoins. Particularly those that are not fully backed by high-quality liquid assets.

“We have got a lot of casinos here in the Wild West, and the poker chip is these stablecoins at the casino gaming tables,” said Gary Gensler, Chair at the US Securities and Exchange Commission.

The risk of “runs,” or rapid withdrawal of funds, can compromise the ability of issuers to redeem the full amount due to the illiquidity of assets. This risk is similar to those faced by other financial investment products.

Read more: What Are Algorithmic Stablecoins?

However, it is magnified for stablecoins due to the opaque and unregulated nature of the crypto ecosystem.

Tether, for instance, has faced regulatory fines over claims of its stablecoin being “fully backed by US dollars.” It was found to be investing part of its reserves in risky and illiquid assets with only a slim capital buffer.

Other large stablecoin issuers have imposed restrictions on redemptions, further eroding investor confidence.

How Stablecoins Instability Impacts Investors

For the individual investor, these revelations highlight that while stablecoins promise stability, they are far from risk-free.

Investment in stablecoins carries both market and liquidity and operational risks, including fraud and cyber risks. Investors have little recourse for lost or stolen crypto assets in the current regulatory environment.

The potential impact extends beyond individual investors. As stablecoins become more integrated into the banking sector, they could pose broader financial stability risks. For instance, a run on a stablecoin could result in sudden deposit outflows from banks or disruptions to funding markets.

Regulatory bodies have begun to recognize these risks. Regulators are developing proposals to address the risks arising from stablecoin activity. However, as these regulatory frameworks evolve, investors must tread carefully.

The lesson from recent events is clear. Stablecoins, akin to other cryptocurrencies, do not always guarantee a safe bet. Investors should approach them with caution, considering not just their potential rewards but also the significant risks they carry.

Meanwhile, regulators must redouble their efforts to bring transparency and oversight to this rapidly growing corner of the financial market.