Speculation and rumors are swirling as highly anticipated regulations for stablecoins in the United States reportedly draw nearer than ever.

Social media reports are fueling speculation that these regulations could lead to further developments in national regulatory frameworks.

Stablecoin Regulations Are Nearing

According to a recent report, Congresswoman Maxine Waters has declared that stablecoin regulations are getting close to becoming signed off in the United States:

“NEW: Maxine Waters says a deal on stablecoins is “very, very close”

While overall, the crypto industry is still wondering when regulations will come for the broader industry, there is much more confidence that stablecoins will see some clarity.

On January 16, BeInCrypto reported that Circle CEO Jeremy Allaire said there was a “very good chance” that stablecoin regulations would be passed in the US in 2024.

Read more: A Guide to the Best Stablecoins in 2024

Stablecoins offer benefits such as faster and cheaper payments compared to traditional banks. However, regulations aim to level the playing field for both money services and customers. Stablecoins must maintain a 1:1 backing with their fiat counterparts and undergo regulation as assets storing value.

Furthermore, stablecoin issuers must be categorized as money services businesses and comply with the relevant tax laws applicable to such entities.

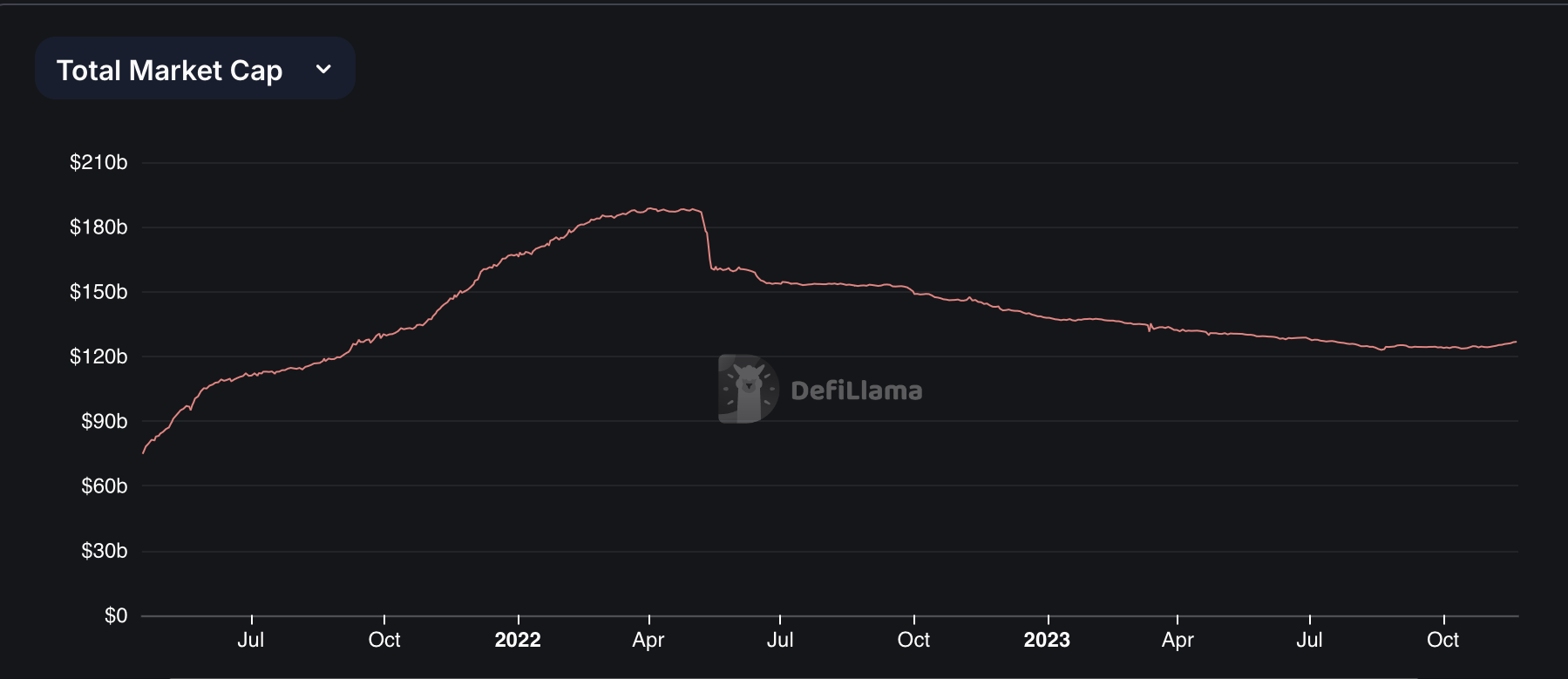

Stablecoin Market Capitalization

Recent regulatory uncertainty reportedly hindered the stablecoin market, leading to an 18-month decline. In October 2023, BeInCrypto reported that since May 2022, stablecoins’ market cap has dropped by 35%.

Recent data from DeFiLlama indicates that the total market capitalization for stablecoins is $135.94 billion.

According to CoinMarketCap, Tether (USDT) remains the largest stablecoin by market capitalization.

Read more: What Is a Stablecoin? A Beginner’s Guide

At the time of publication, Tether’s market cap is $96.13 billion. It holds approximately 70% of the entire stablecoin market cap.

Meanwhile, USDC maintains a market cap of roughly $27.5 billion, while DAI trails closely behind with an approximate market cap of $5.3 billion.