Coinbase is expanding its services across 20 African nations in partnership with Yellow Card. This initiative promises to introduce USDC, a stablecoin, across emerging economies, revolutionizing remittance and savings practices in regions plagued by economic volatility.

The Coinbase team noted, “In regions where instability and inflation are prevalent, Coinbase’s introduction of USDC provides a stable alternative to traditional banking systems.”

Coinbase Goes ‘Broad and Deep’ Into Africa

This sentiment reflects the profound need for innovative financial solutions in these economies. The collaboration aims to mitigate the challenges in accessing and transferring funds, particularly in high-inflation and remittance-dependent countries.

Coinbase Wallet users will soon experience the benefits of this expansion. Starting in February, they can purchase USDC directly within the app.

Moreover, the partnership with Yellow Card ensures easy access to one of the main US dollar stablecoin offerings, enhancing transactional efficiency.

The significance of this venture is best encapsulated in Coinbase’s “Go Broad, Go Deep” strategy, which focuses on compliant international expansion.

This strategic approach aims to build a foundation of clear rules and partnerships, facilitating innovation and integrating a substantial portion of the global population into the crypto economy.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

CBDC Wave and the Obstacles It Presents

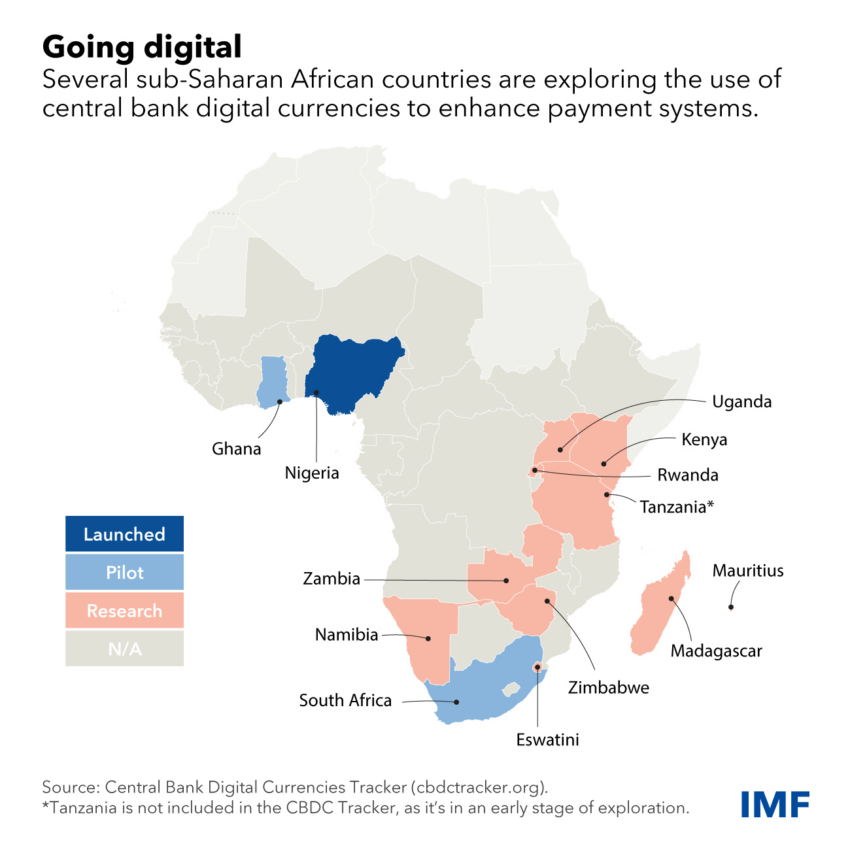

Concurrently, many African nations are at the forefront of embracing Central Bank Digital Currencies (CBDCs). This shift underscores the continent’s commitment to modernizing its financial systems.

However, the path to widespread adoption of digital currencies like USDC and CBDCs is laden with challenges. Infrastructure requirements, digital literacy, and trust in centralized systems are significant obstacles.

Africa Blockchain Association member Daniel Arok reiterated this point, stating:

“A lot of scams have been done in the name of crypto in Africa – people have therefore been sceptical of crypto in Africa, and this was heightened by the controversies.”

Additionally, these digital ventures could disrupt existing monetary frameworks, necessitating responsive and adaptive regulatory measures.

Overall, Coinbase’s expansion into Africa, alongside the continent’s exploration of CBDCs, heralds a new era of financial inclusion and economic empowerment. This move is both an expansion of services and a commitment to reshaping economic landscapes.

As these digital financial systems evolve, they promise potential economic opportunities for improved financial access and autonomy across Africa.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.