The stablecoin market has reached a new milestone, with total market capitalization setting a new all-time high record.

This achievement is driven by a combination of technological innovation, regulatory clarity, and increased institutional adoption.

USDT and USDC Reign Supreme Amidst Emerging Stablecoin Competitors

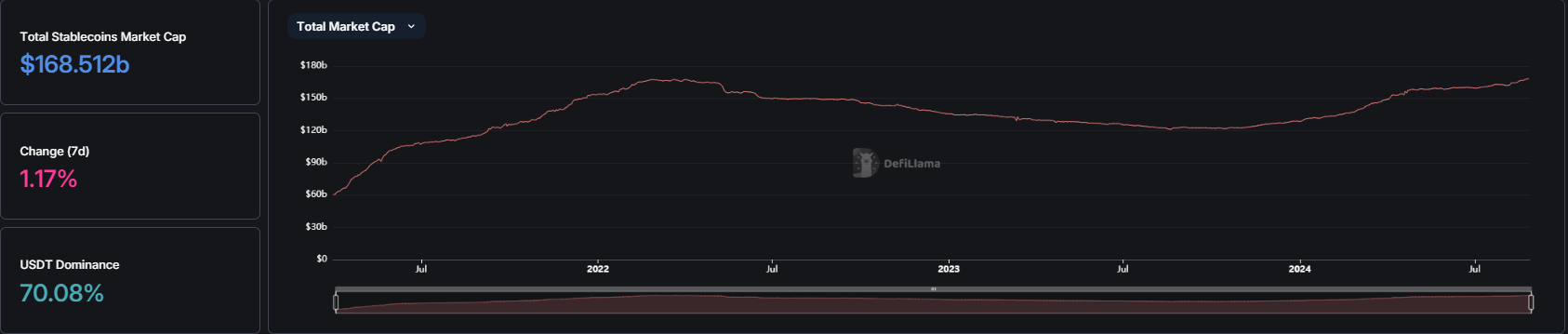

DefiLlama data shows that, as of August 26, stablecoin market capitalization (excluding algorithmic) has reached an unprecedented $168.51 billion. Tether’s USDT dominates the market, as evidenced by its market cap of over $117 billion. This accounts for nearly 70% of the total market cap.

Circle’s USDC has also seen steady growth. While still below its peak in 2022, USDC reached over $34 billion in market capitalization in August 2024. Together, these two stablecoins account for the lion’s market share, reflecting their critical role in the broader crypto ecosystem.

“These days with the availability of stablecoins, it is becoming not only a method of settlements for crypto-whales to transfer liquidity between the exchanges but an effective payment collection method that is cost efficient and quickly integrated. With the rise of crypto-checkout services and the fact that sometimes companies prefer to settle their international payment via crypto, the peak of market cap is not a surprise,” Keabank CEO Mark Berkovich told BeInCrypto.

Read more: What Is a Stablecoin? A Beginner’s Guide

Although USDT and USDC remain the dominant forces, new entrants like PayPal’s PYUSD and First Digital USD (FDUSD) are also gaining traction. BeInCrypto reported that PYUSD’s market capitalization had surpassed the $1 billion mark last weekend. This milestone is particularly noteworthy, given that PayPal launched PYUSD one year ago.

One of the key drivers behind this surge is its integration with the Solana blockchain in May 2024. This move opened new opportunities for users in Solana-based DeFi protocols, which offer attractive incentives, such as 20% annual returns for PYUSD deposits.

Meanwhile, FDUSD has witnessed remarkable growth in Binance — the largest global crypto exchange by trading volume. Launched in June 2023, FDUSD’s market share on Binance reached an all-time high of 39% by the end of July 2024.

According to a recent report by research firm Kaiko, this surge was fueled by Binance’s strategic reintroduction of zero-taker fees for the FDUSD trading pair. Consequently, this move significantly boosted its daily trade volume to an average of $6.5 billion.

“However, FDUSD’s success is heavily reliant on Binance, as it is solely traded on the platform and closely tied to its fee policies,” analysts at Kaiko cautioned.

Read more: Stablecoin Regulations Around the World

Favorable regulatory developments also pushed the growth of the stablecoin market. For instance, in the European Union (EU), the introduction of the Markets in Crypto-Assets (MiCA) framework in June 2024 provided much-needed clarity for stablecoin issuers.

This regulatory clarity has encouraged more institutional participation, with major players like Circle obtaining necessary licenses to operate within the EU. Additionally, traditional financial institutions, such as Deutsche Bank’s DWS, have announced plans to launch regulated stablecoins, further legitimizing the market.

“This year we see that stablecoin’s future is not only USD-pegged – there are now MICA-compliant EUR stables plus the UAE announced Dirham-pegged stable. This actually makes crypto an extremely effective local payout solution with even more predictable costs, as now merchants working with stablecoins would not necessarily need to have USD to local currency exposure,” Berkovich added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.