Solana (SOL) attracted attention from a whale address early Tuesday morning, with the large holder purchasing 34,807 coins valued at over $4 million in a single transaction.

This transaction triggered a 4.26% spike in SOL’s price and a 41% surge in trading volume over the past 24 hours.

Solana Whales Adopt Different Strategies

Earlier today, a Solana whale purchased 34,807 SOL tokens valued at $4.52 million as part of an ongoing accumulation strategy. Since February, the whale has withdrawn approximately 207,000 SOL, worth over $29 million, into self-custody. Following Tuesday’s acquisition, they staked 115,135 SOL tokens, totaling $15.3 million.

Meanwhile, another whale has taken a more bearish approach. On-chain sleuth Lookonchain, via a series of posts on X, tracked this whale’s consistent selling habits.

On Tuesday, the address sold 20,000 SOL tokens, valued at $2.66 million. Since the beginning of the year, this whale has sold 715,000 SOL, worth about $102 million. Despite these sales, the whale still holds a significant stake of 1.84 million SOL, valued at roughly $246 million.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

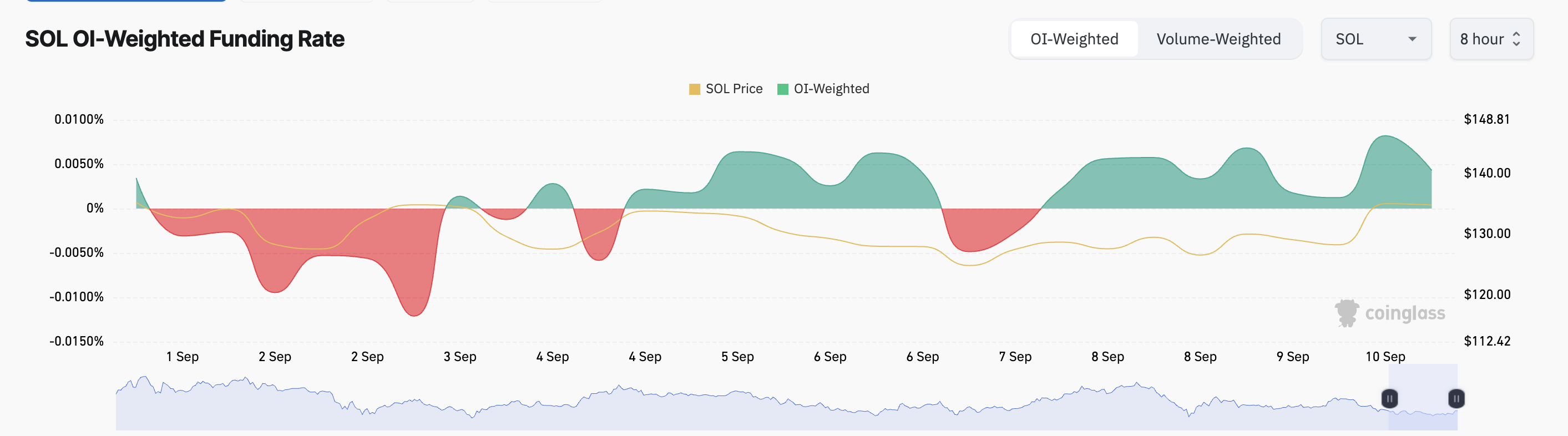

Amid these contrasting whale activities, SOL’s value has risen by 5% over the past 24 hours, reflecting increased market activity. In the derivatives market, trading volume surged by 35% as participants took more long positions. According to Coinglass data, SOL’s funding rate across cryptocurrency exchanges has remained positive since the weekend, standing at 0.0043% at press time.

A positive funding rate, used in perpetual futures contracts to keep prices aligned with spot prices, indicates higher demand for long positions. This suggests that more traders are accumulating SOL in anticipation of a price rally than those betting on a decline.

SOL Price Prediction: Coin Eyes 17% Uptick

At its current price of $135.197, SOL sits slightly above its short-term term resistance at $133.37. Its rising Relative Strength Index (RSI) indicates a steady uptick in the demand for the altcoin.

If this demand persists, SOL’s rally will continue. The coin’s price may jump 17% to $159.90.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

However, if profit-taking intensifies, SOL may lose some of its recent gains, potentially dropping to $109.66. The last time SOL traded at this level was on August 5, when over $1 billion in liquidated positions exited the market.