After dipping to $125 over the weekend, Solana’s (SOL) price briefly reached $130 in early trading, fueling speculation that the altcoin might be heading back toward $200. However, SOL has since slipped to $129.02, raising doubts about the strength of the rally.

While some traders remain optimistic that this minor pullback is temporary, this analysis suggests otherwise, as several factors indicate that the rally may not sustain in the near term.

Solana Sees 100X Less Inflow

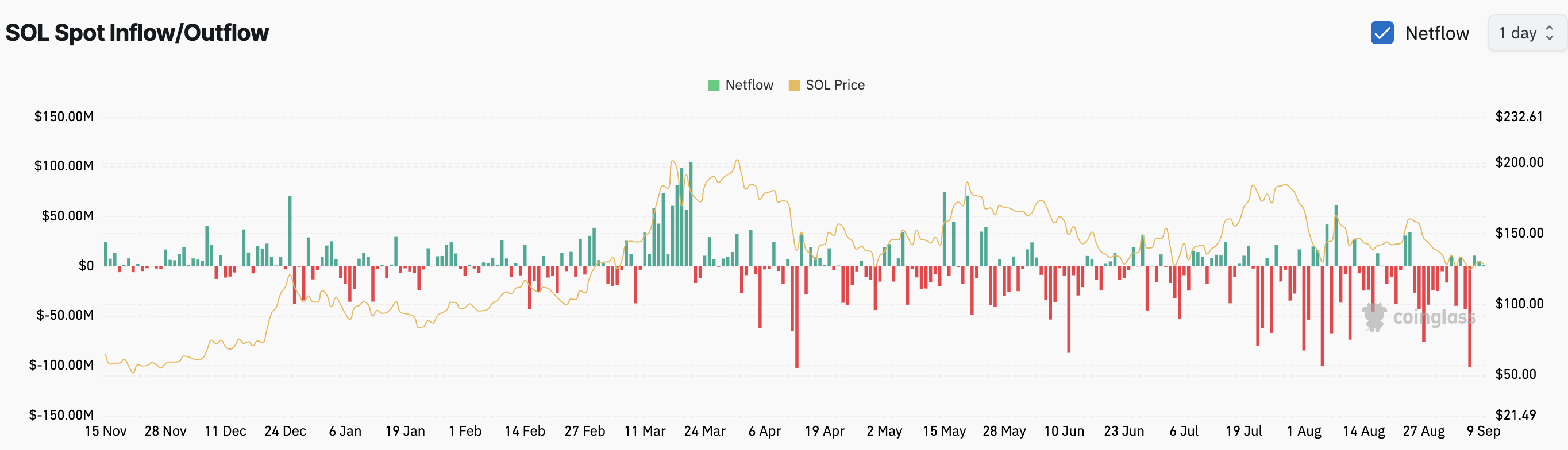

An assessment of Solana’s market condition reveals that the Spot Inflow/Outflow recorded an outflow of $100 million on September 6. This indicates significant distribution before the drop to $125 on Saturday.

However, at press time, SOL’s inflow had increased to $1 million, reflecting rising buying pressure. Despite this uptick, Solana is unlikely to reach $200 in the short term.

As seen in the image, the last time SOL surpassed $200 was in March, when the Spot Inflow/Outflow showed an inflow of $175 million, highlighting a much larger influx of capital at that time compared to current conditions.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

Thus, the current lackluster inflow into the spot market has likely diminished Solana’s chances of approaching the $200 zone. Additionally, BeInCrypto evaluated market sentiment, a key factor in forecasting price movements.

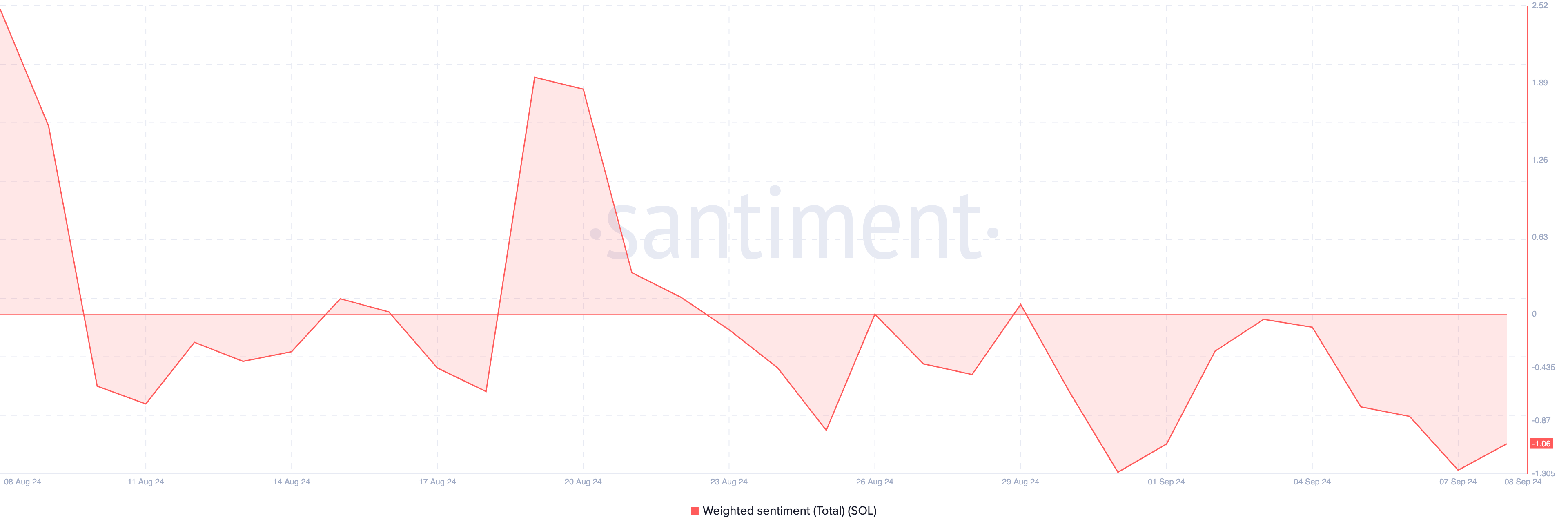

According to Santiment, Solana’s Weighted Sentiment is in the negative, indicating an increase in pessimistic commentary around the token. If this sentiment persists, demand for SOL may weaken further, potentially leading to another price decline.

SOL Price Prediction: No Clear Path for Uptrend

From a technical perspective, Solana is trading within a descending triangle, a bearish pattern. The upper trendline has been falling, with multiple fakeouts starting at $138.20, while a flatter trendline provides support around $126.88.

On the 4-hour chart, SOL might attempt to break through the $130 resistance. However, given the current low liquidity inflow, this breakout seems unlikely. Instead, Solana’s price could drop to $125.15, especially with additional resistance at $135.35.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

For SOL to invalidate this bearish outlook, significant capital inflow is needed. If that occurs, Solana could break out of the descending triangle and reverse the ongoing downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.